The emergence of environmental, social, and corporate governance investing (ESG) has created fantastic conversation around how investors can not only achieve investing return goals, but also make a societal impact with their investments. This is especially the case among high-net-worth individuals and family offices who have accumulated a great deal of net worth and now want to leave a legacy for society by investing in society. As with any investment idea hitting the spotlight, more and more investors want to know more about ESG and if it is right for them. As an advisor, it is important to know the basics of ESG investing to provide the utmost experience for your clients. Let’s discuss.

ESG Tip #1: ESG has no exact measurement

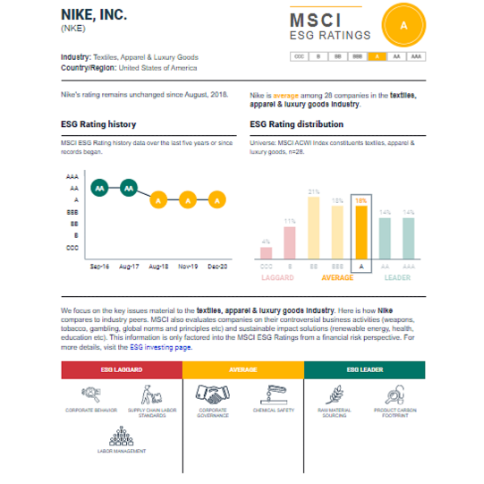

ESG metrics have been created as a way for investment firms to rate companies. Most of these ratings are based on broad analysis of where the company ranks compared to its competitors, and will analyze how a company treats its labor force, its sustainability, and its carbon footprint. These are great topics to analyze but ratings often fall short. Let’s analyze this. MSCI has a great tool, one that I prefer to use; there is a link to this here. While this tool is great to use and presents well, the ratings themselves may not represent individual investor sentiment. For example, here is the rating on NIKE:

Source: MSCI.com

ESG Tip #2: ESG means something different to each person

I chose to analyze NIKE simply because the company has a history of publicly debated labor issues. This is not a company many investors would associate with ESG nor want to see in their ESG portfolio, yet MSCI gives NIKE an “A” for ESG practices. The rating itself is trivial. What is not trivial is individual investor sentiment. Knowing what your investor wants will enhance the client experience, which takes us to tip #3.

ESG Tip #3: Provide an ESG questionnaire to each investor

Investors may have different opinions and values in relation to ESG. If you were to rank the importance of environmental, social, and corporate governance, your rankings would undoubtably be different than some others. That is only a high-level analysis of the topic; once you dive deeper, you will see each individual has a different viewpoint on each ESG topic. For example, there are individuals who are passionate about sustainability while others may be more passionate about minority representation on a board of directors. Each topic is compelling and moving society forward, but many companies fall short of exhibiting all ESG metrics. How do you find out what companies would be best suited for a client from an ESG perspective? Simple. Provide a questionnaire that allows the investor to rate personal importance on a variety of ESG topics. This allows you to build a portfolio around your client’s ESG goals, further enhancing the client experience and providing the utmost value as an advisor.

ESG Tip #4: Beware of the Snake Oil Salesmen

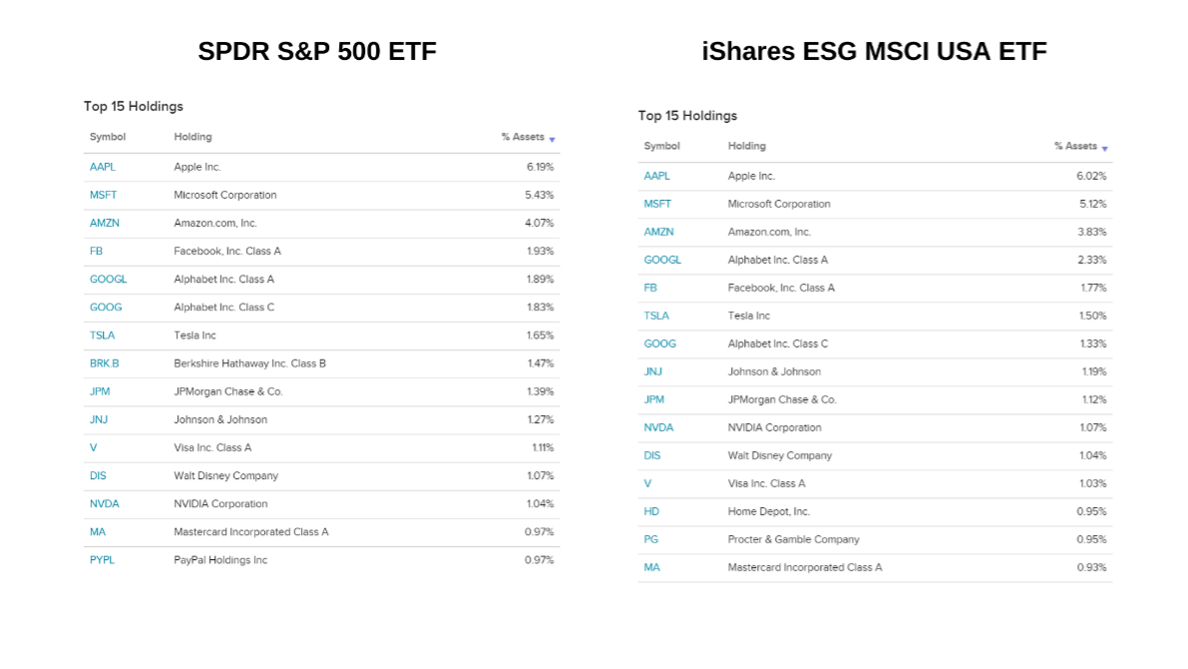

As with anything trendy, ESG has been used as a marketing ploy by some who see its ability to lure large investors. Unfortunately, it is my belief that this has become a mainstream issue that will only be addressed with enhanced investor and advisor education on the topic. For example, here is an article by Bloomberg published March 3rd on how the largest US ESG fund has no direct renewable holdings. In a time when most individuals are taking part in ESG investing through ETFs, how can you personally evaluate a security marketing itself as an ESG ETF? Well, here is a refresher on the importance of always checking under the hood and analyzing an ETF’s core holdings. Let’s take a look at the largest ESG ETF to see if it would align with your individual investor sentiment.

Source: etfdb.com

Hard to tell the difference between the SPDR S&P 500 ETF and the largest US ESG exchange traded fund, the iShares ESG MSCI USA ETF. What does this mean? Well, this knowledge could have a variety of implications, but the real question is what does this mean to you and your investors? Is this the ESG your investors are interested in? Or would a personal touch of identifying investor values for ESG and investing in tailoring a portfolio to said values be more impactful for your investor? These are questions for you to ask yourself and your clients. ESG investing can make a wonderful societal impact and help your clients achieve investing goals when done right. Just beware of the potential snake oil salesmen lurking behind the “ESG” name and always do your due diligence.

Related: ESG Adoption Barriers Are Declining. That's Good for Advisors