Paul Tudor Jones is super bullish on Bitcoin right now and may give the crypto the same 5% weighting as gold, commodities and cash.

Two years ago this month, the billionaire hedge fund manager said that gold was his favorite trade in the next 12 to 24 months due to geopolitical disruptions, among other factors. The yellow metal “has everything going for it,” he told Bloomberg.

It was a good call. Over the next 12 months, the gold price surged from around $1,330 an ounce to $1,730, and in August 2020 it eventually hit its all-time high of $2,073—a 55% increase from the day Jones announced his bullishness.

This week he made a similar call in response to runaway inflation, saying he’d go “all in” on not just gold but also crypto and commodities if the Federal Reserve refuses to step in and tame rising consumer prices. (For the record, the Fed did just that, leaving rates at historic lows for now.)

“If [the Fed governors] say, ‘We’re on the path, things are good,’ then I would just go all in on the inflation trades. I’d probably buy commodities, buy crypto, buy gold,” Jones told CNBC.

He added that he wanted “5% in gold, 5% in Bitcoin, 5% in cash, 5% in commodities.”

Jones’s comments come just a few weeks after fellow billionaire hedge fund guru Ray Dalio surprised investors by saying he’d rather own Bitcoin than government bonds. Investing in bonds has become “stupid,” he said, since yields are currently lower than the rate of inflation.

Like Jones, Dalio has traditionally been a fan of gold, and as of Bridgewater’s most recent filing, his fund had a $277 million position in SPDR Gold Shares (GLD) and a $143 million position in the iShares Gold Trust (IAU). The fund also held relatively small positions in a number of companies involved in precious metal mining, including Barrick Gold, Newmont, Agnico-Eagle Mines and Wheaton Precious Metals.

With Inflation on the Rise, Investors May Not Be Able to Afford Shunning Gold and Bitcoin

I think both Paul Tudor Jones and Ray Dalio are right to allocate funds to gold as well as its digital cousin Bitcoin. Some investors try to make it an either/or debate, but generally I believe there’s enough room in most portfolios for both assets, not to mention exposure to commodities.

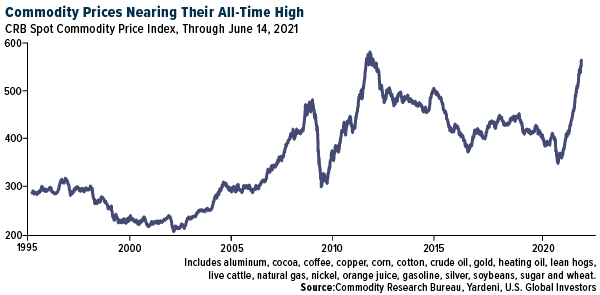

I’ll show you why in a moment, but for now, there shouldn’t be any question that inflation is here, transitory or not. A basket of commodities, including gold, is close to touching and exceeded its all-time high set in 2011 as shortages, labor scarcity and a mounting backlog of orders lift prices for everything from aluminum to wheat.

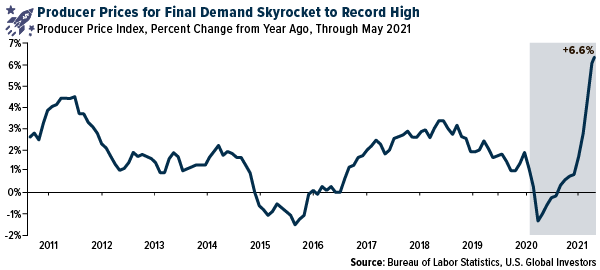

As a result, prices received by producers for finished goods and services rose at the fastest pace on record last month. The final demand index advanced 6.6% in May, the largest increase ever since 12-month data began to be collected in late 2010.

Seeking a haven, then, makes a lot of sense to me at this time. Stocks have so far shrugged off higher inflation, but it’s important to recognize that rising consumer prices are often a self-fulfilling prophecy, regardless of the Fed’s actions. Many investors may not be able to afford shunning gold and Bitcoin.

Gold and Crypto Beat Tech Stocks

Even if inflation weren’t such a concern, gold and Bitcoin have performed well enough in recent months to justify having them in your portfolio.

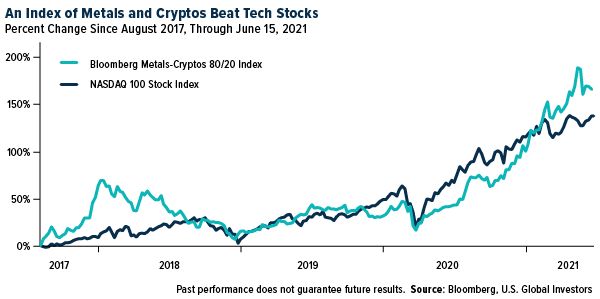

In fact, according to a recent report by Bloomberg commodity strategist Mike McGlone, a simple 80/20 index of metals and cryptos has beaten the tech-heavy Nasdaq-100 since August 2017, when the Bloomberg Galaxy Crypto Index was launched.

When combined at a 20% weight with the Bloomberg All Metals Index, Mike’s metals-cryptos 80/20 index has been very competitive against and ended the period higher than the Nasdaq-100. What’s more, it did that with lower volatility.

“Volatility is relative, and when combined with gold, Bitcoin has been less risky than the S&P 500, which should sustain the quasi-currency’s outperformance in 2021,” Mike writes.

That’s not to say that Bitcoin is risk-free. Far from it. But when used prudently with gold, it could help shield investors from potentially rocky market volatility triggered by higher-than-expected inflation.

Related: Why Other Countries May Follow El Salvador in Adopting Bitcoin