Written by: Hamilton Lane

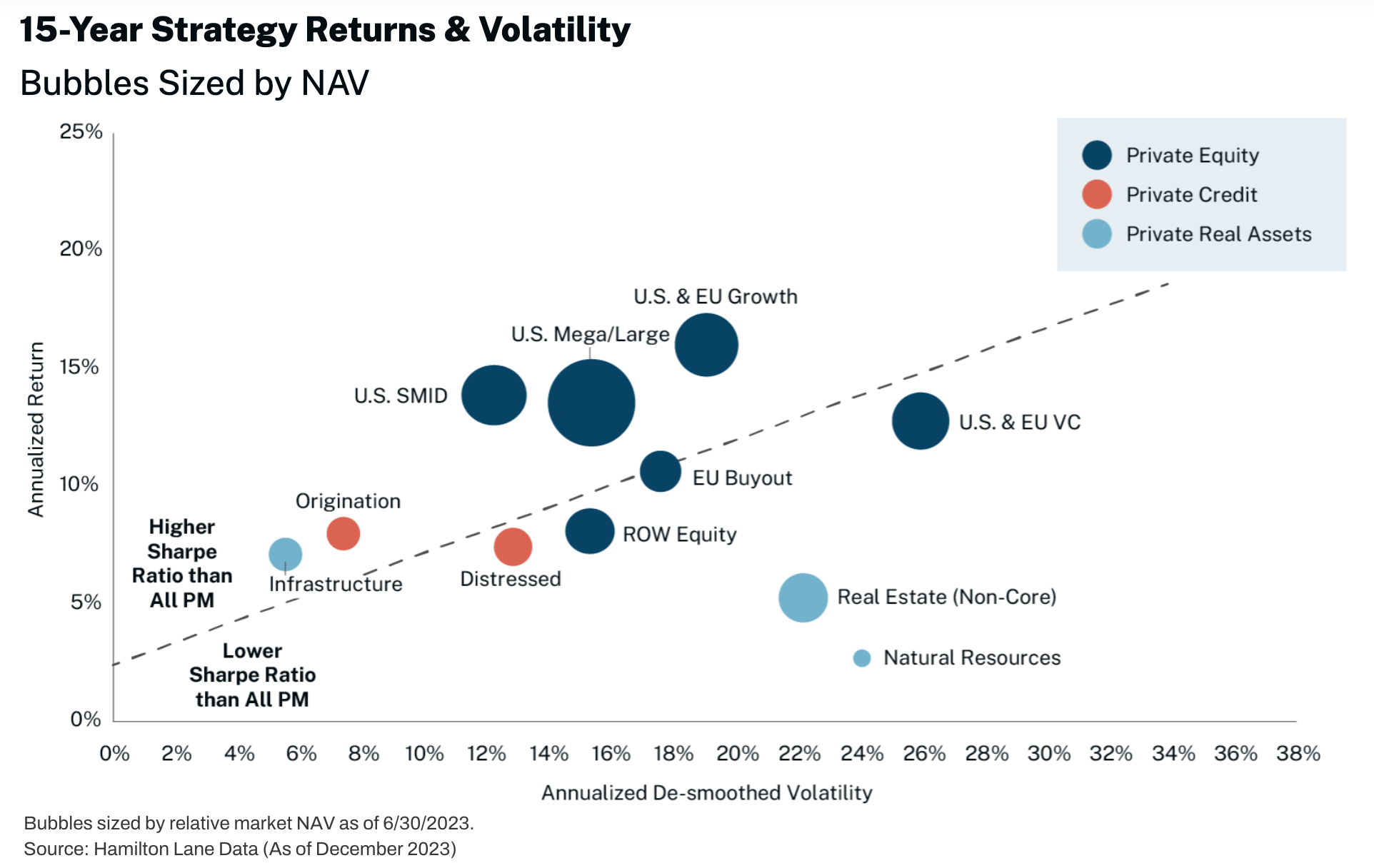

Risk versus return: a constant tradeoff that investors look to while determining allocation percents. Here we look at the 15-year annualized returns for various private markets assets classes compared to their annualized de-smoothed volatility (a better estimator of “true” risk). The bubbles are sized according to their total industry net asset value.

Over the last 15 years, equity strategies have offered more premium returns, with buyout lower on the risk spectrum than other equity strategies. Growth equity, however, can help offer higher returns with only slightly more risk than buyout offers. Credit exhibited the lower volatility expected of that strategy, though it did not yield returns as comparable to equity. Over this timeframe, real estate is heavily influenced by the GFC-era funds. We’d expect the real estate volatility measure to continue to come down as we shift further from that timeframe. Overall, it’s important for investors to understand the risk-return tradeoffs each strategy can have and use that information during portfolio allocations to layer multiple strategies to get the risk-return profile desired of the portfolio.

Related: Navigating Middle-Market Investments

DEFINITIONS

Credit – This strategy focuses on providing debt capital.

Distressed Debt – Includes any PM fund that primarily invests in the debt of distressed companies.

EU Buyout – Any buyout fund primarily investing in the European Union.

Growth Equity – Any PM fund that focuses on providing growth capital through an equity investment.

Infrastructure – An investment strategy that invests in physical systems involved in the distribution of people, goods, and resources.

Natural Resources – An investment strategy that invests in companies involved in the extraction, refinement, or distribution of natural resources.

Origination – Includes any PM fund that focuses primarily on providing debt capital directly to private companies, often using the company’s assets as collateral.

Private Equity – A broad term used to describe any fund that offers equity capital to private companies.

Real Assets – Real Assets includes any PM fund with a strategy of Infrastructure, Natural Resources, or Real Estate.

Real Estate – Any closed-end fund that primarily invests in non-core real estate, excluding separate accounts and joint ventures.

ROW Equity – Includes all buyout, growth, and venture capital-focused funds, with a geographic focus outside of North America and Western Europe.

U.S. Mega/Large – Any buyout fund larger than a certain fund size that depends on the vintage year and is primarily investing in the United States.

U.S. SMID – Any buyout fund smaller than a certain fund size that depends on the vintage year and is primarily investing in the United States.

Venture Capital – Venture Capital incudes any PM fund focused on any stages of venture capital investing, including seed, early-stage, mid-stage, and late-stage investments.