Written by: Charlie Choi and Samuel Wilamowsky

The US housing market continues to defy traditional notions about rising rates. Across much of the US, prices have been resilient, even as mortgage rates have climbed to 20-year highs. For those who expected home prices to retreat, the current market is somewhat of an enigma. We’ve had a more positive outlook—particularly given the chronic housing shortage. Over the coming months, we expect continued supply constraints and strong technical factors to modestly boost home prices.

Locked-In Homeowners Are Crimping Supply

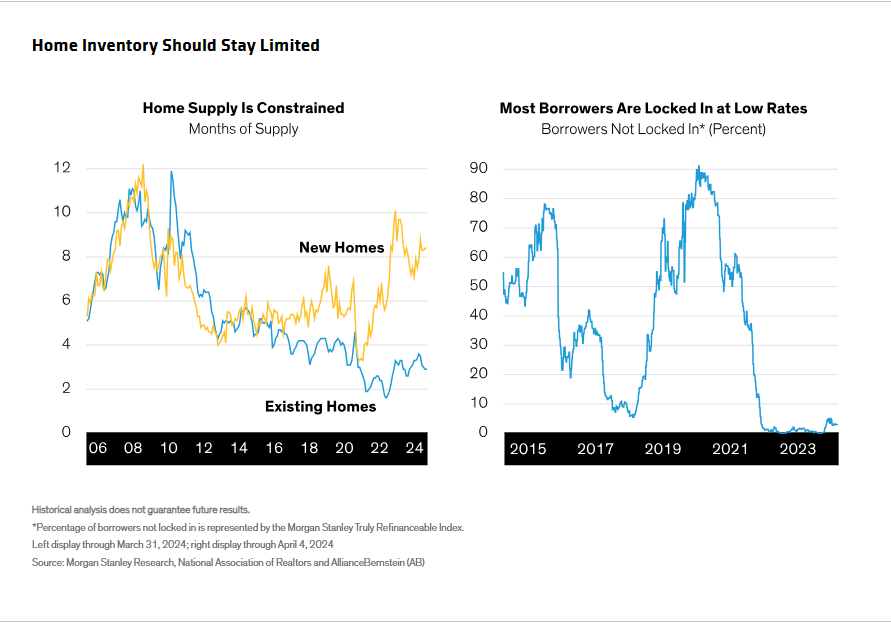

Over the past several years, homebuyers have competed for a shrinking supply of housing—particularly existing homes (Display, left). Existing homes comprise more than 70% of US residential listings and continue to run at only three months’ supply—a level historically associated with rising home prices.

And, unlike in many other countries, most US homes are financed at fixed rates. Homeowners who’ve secured mortgages at rock-bottom rates have no reason to move in today’s high-rate environment. We expect these homeowners locked in at low rates (Display, right) to largely stay where they are—exacerbating supply constraints and supporting home prices.

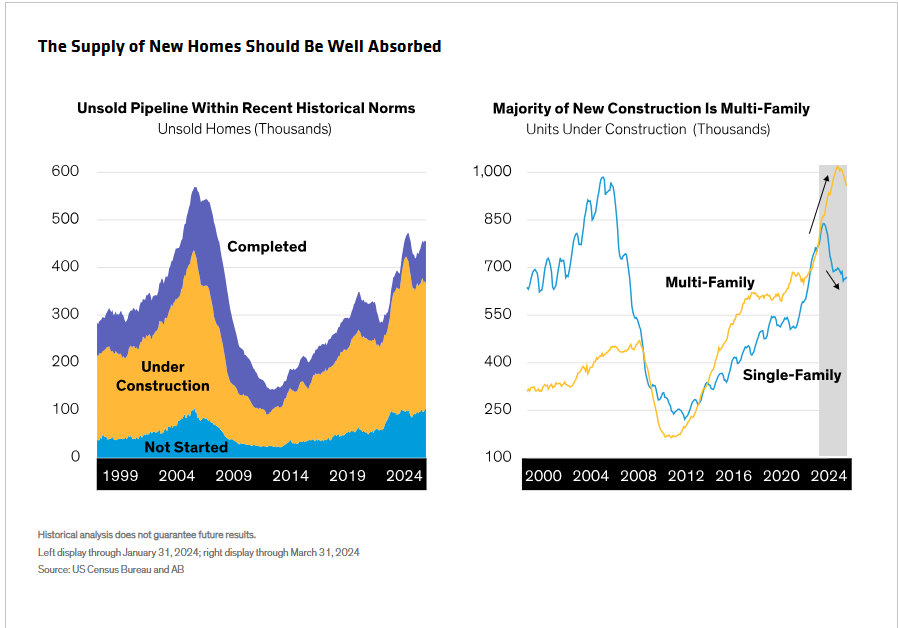

Home builders, recognizing a growing population’s need for more housing, are gradually ramping up construction—but new inventory is being quickly absorbed. The unsold pipeline of new homes is within recent historical norms (Display, left), but there’s still a shortage of single-family homes, which make up only a quarter of current inventory.

This is due in part to systemic underbuilding following the global financial crisis. After seeing home values plummet, a shrinking number of builders became wary of expanding the single-family pipeline too much. The result: most new construction consists of multi-family homes (Display, right), while a greater share of single-family homes is being built for rental—trends that position the US market to continue absorbing single-family supply.

Pockets of Demand Should Help Support Home Prices

The high cost of homeownership is creating a challenging backdrop for homebuyers. Elevated prices and high rates mean prospective homebuyers face monthly payments that are more than double those of just a few years ago (Display, left)—prompting many to put house hunting on hold. This is reflected in the declining traffic of prospective buyers, which is well below its long-term average. (Display, right).

Despite these headwinds, we see pockets of pent-up demand.

Housing costs have soared so much that in many parts of the country, renting has become more affordable than owning. Nonetheless, the overall percentage of US renters is declining. In our view, this is because most Americans prefer owning—and they fear missing out on home price appreciation. If these trends continue, a falling percentage of renters should ultimately support home prices.

In a similar vein, we expect increased future demand from millennials and first-time homebuyers. Many millennials are now in their 30s—prime homebuying age—but a good chunk of them are still renting or living at home, creating a potential source of pent-up demand. Over time, lower rates and the normal progression of life events, such as marriage and children, should pull millennials into the home market and contribute to years of structurally higher demand.

In a sense, we’re seeing a tug of war between limited inventory and moderating demand. When the dust settles, we expect supply constraints to win the day, leading to a modest uptick in home prices in 2024.

Sound Fundamentals Create Investment Opportunities

Despite affordability challenges, the current housing backdrop is creating meaningful opportunities for investors.

In particular, we believe credit risk-transfer securities (CRTs) could benefit from high homeowner equity, declining loan-to-value ratios and low mortgage delinquency rates. CRTs pool thousands of mortgages that conform to Freddie Mac and Fannie Mae standards into a single security. They’re not government guaranteed (despite, in most cases, being issued by Fannie Mae and Freddie Mac), so yields are competitive.

We also see opportunities in agency mortgage-backed securities (MBS).

MBS spreads have climbed to 20-year highs in recent years, owing to heightened market volatility and monetary-policy tightening. Relatively wide spreads and cheap valuations are a one-two punch that has historically generated competitive returns. Until interest rates retreat from their lofty heights, we don’t foresee MBS spreads narrowing dramatically, but we expect them to perform well if growth slows or market volatility subsides. Even with slowing demand for MBS on the part of banks and international investors, a relatively constrained supply should provide some buffer.

It’s been an interesting few years for the US housing market, which has defied the odds against a backdrop of rising rates. Until housing starts to keep pace with pent-up demand, we expect prices to remain elevated and homeowners to stay put.