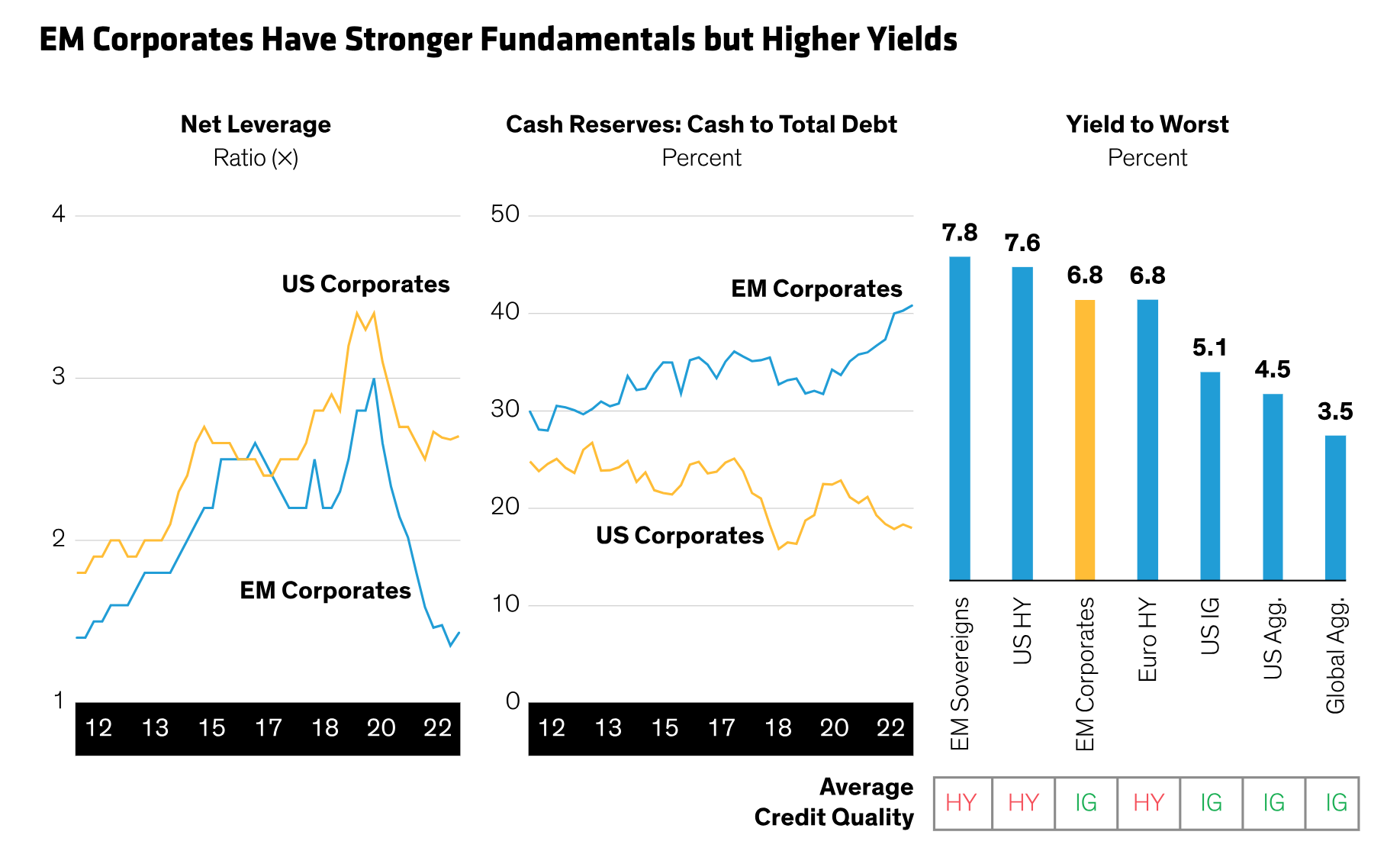

Emerging-market (EM) corporate bonds are too-often overlooked by investors who presume the asset class is too niche or too risky. But the aggregate fundamentals of EM corporates are stronger than those of their developed-market counterparts. For example, EM corporate net leverage ratios are significantly lower than those of US corporates, while cash reserves are much higher (Display).

The rating agencies have long acknowledged these comparatively strong fundamentals, which are reflected in average credit ratings. Moody’s rates investment-grade EM corporates and investment-grade US corporates comparably at A3, while rating high-yield EM corporates BB3, a full notch above high-yield US corporates at B1.

Yet, EM corporate bond yields are higher than those of most other markets. At 6.8%, the yield of the EM corporate market—with its average investment-grade rating—is on par with those of high-yield sectors, and nearly two percentage points higher than the yield of the investment-grade US corporate market.

To us, this disconnect between relative quality and relative yield represents an attractive opportunity. That’s why, in our view, investors should take a closer look at EM corporate debt.

Related: AI-Driven Spending Boom Is No Dot-Com Bust for Investors

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Historical analysis does not guarantee future results.

Left display as of June 30, 2023; middle display as of December 31, 2022; right display as of December 31, 2023

Average credit quality as of March 31, 2024; HY = high yield; IG = investment grade

Source: Bank of America, Bloomberg, J.P. Morgan and AllianceBernstein (AB)