Returns following money market asset peaks

What is this chart showing?

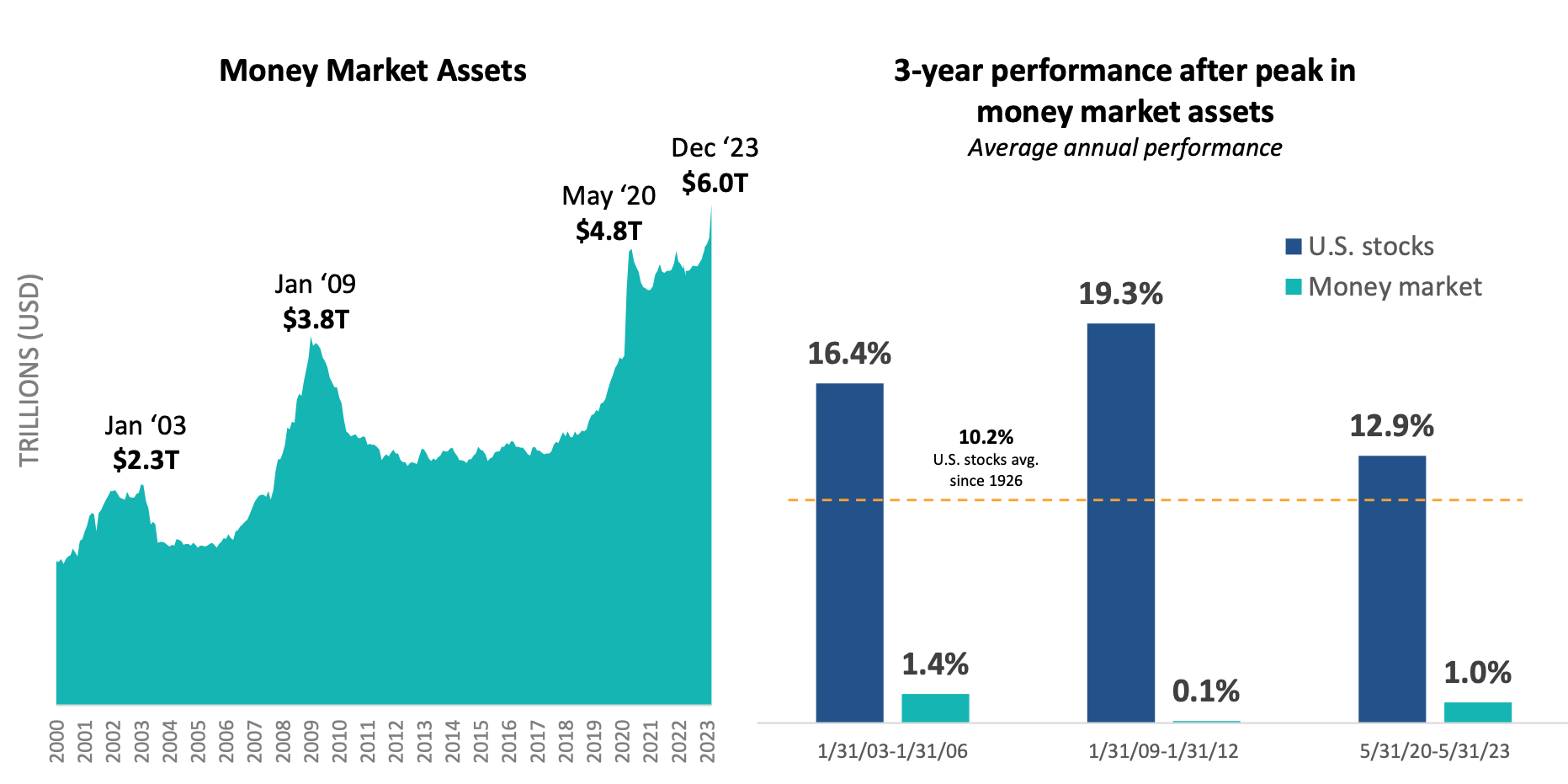

This chart shows the rise in money market assets over time, and how money markets and U.S. stocks performed over the 3-year period following peak money market assets.

Why is it important?

While it can be beneficial for investors to hold cash for preservation or liquidity purposes, holding too much can lead to suboptimal results.

Money market fund assets reached new all-time highs in 2023.

Historically, this has been a bullish sign for stocks as they have performed better than average following periods of peak money market assets.

Related: Stocks: More Ups than Downs in Historical Trends

Source: Chart (left): Morningstar. Data most recently available as of 1/31/24. Chart (right): Morningstar, BlackRock Student of the Markets, Lincoln Financial Group. Returns calculated from end of peak month listed. US Stocks = S&P 500 TR; Money Market = Morningstar taxable money market category average returns. Past performance does not guarantee or predict future performance.

LCN-6306131-013024