What is this chart showing?

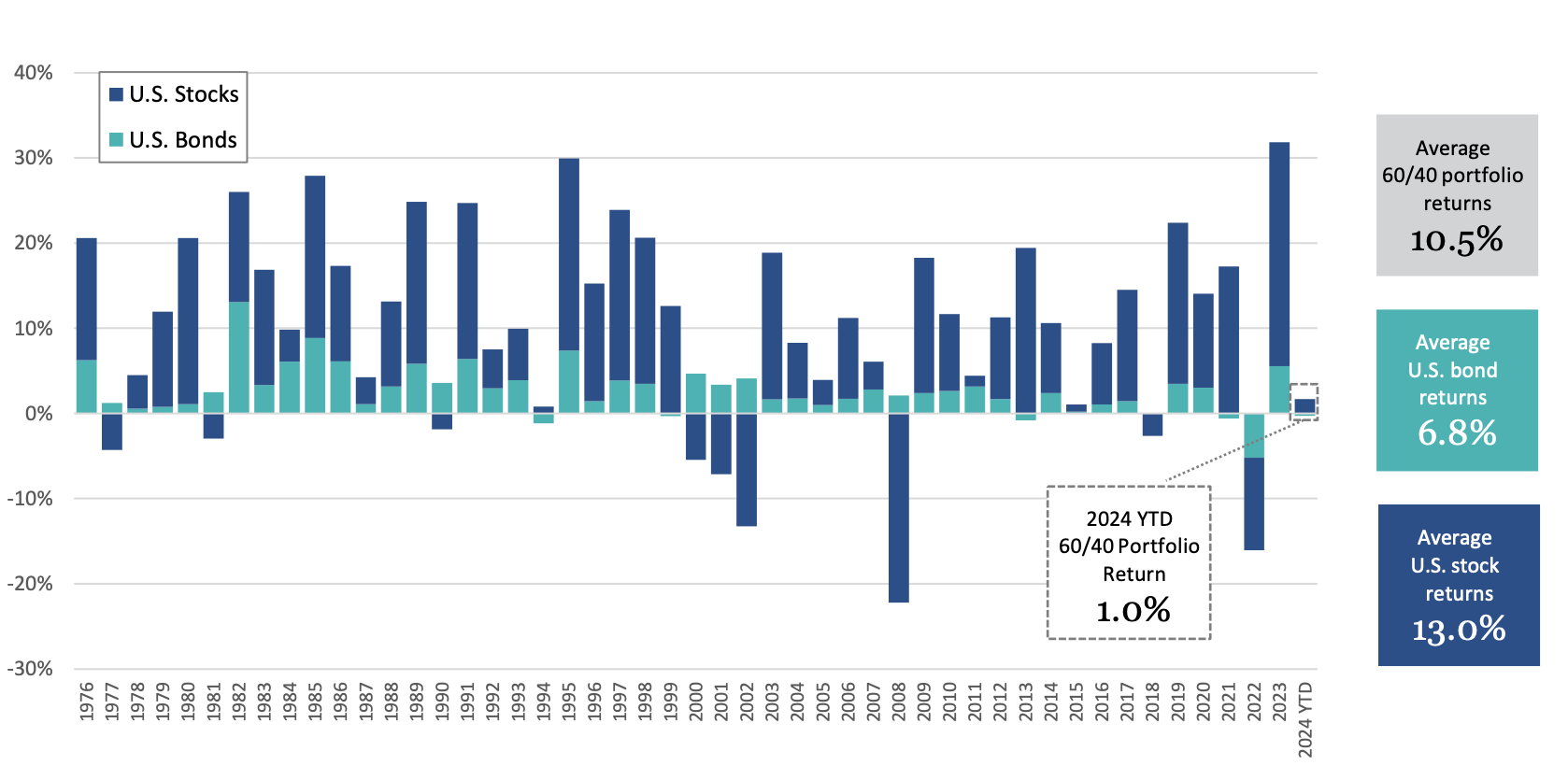

This chart shows both the annual and long- term average returns of a portfolio consisting of 60% U.S. stocks and 40% U.S. bonds.

Why is it important?

Investors can use this to compare the performance of a domestic 60/40 portfolio to other strategies, as well as view the respective contribution to total return from both stocks and bonds.

Related: Implications of the Initial Rate Cuts on Market Dynamics

Stocks are represented by the S&P 500 Index. Bonds are represented by the Bloomberg Barclays U.S. Aggregate Bond Index. You cannot invest directly in an index. All indices are unmanaged and do not include fees or expenses. Please see the back of this presentation for index definitions and disclosures.

Source: Data from Morningstar, Stocks = S&P 500 TR, Bonds = Barclays US Aggregate Bond Index, 1976 through January 31, 2024; 60/40 Portfolio = 60% S&P 500 TR + 40% Barclays US Aggregate Index. Arithmetic averages used. Past performance is not indicative of future returns. Asset allocation does not ensure a profit nor protect against loss.

LCN-6306131-013024