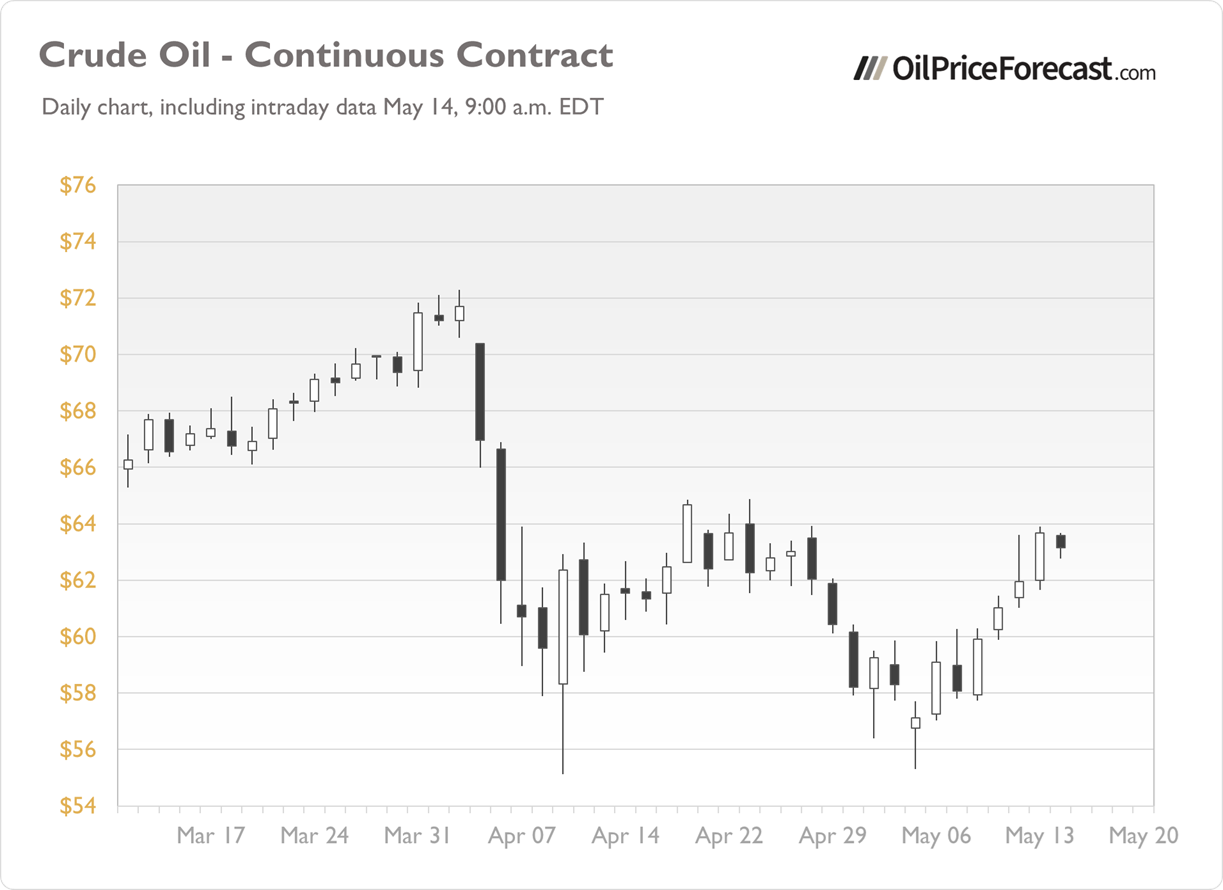

Will WTI crude resume its uptrend following yesterday's gains? Let's analyze.

Crude oil gained 2.78% on Tuesday as markets reacted to lower-than-expected CPI data and political developments. However, prices remain below the key medium- to long-term resistance level of $65–66. Today, crude oil is down 0.8%, as markets appear to be pausing following the recent rally.

For oil markets specifically, these developments are worth monitoring:

-

OPEC has trimmed its forecast for growth in oil supply from the United States and other producers outside the OPEC+ group this year, now expecting supply to rise by about 800,000 barrels per day in 2025, down from last month's forecast of 900,000 bpd.

-

API data showed U.S. crude stocks rose by 4.3 million barrels in the week ended May 9, while gasoline inventories fell by 1.4 million barrels and distillate stocks dropped by 3.7 million barrels.

-

The US-China trade tensions have eased with the announcement of a trade deal, which has stabilized market sentiment.

Conclusion

Crude oil is showing some consolidation following yesterday's gains, with prices remaining below mid-April highs. While the market reacted positively to lower-than-expected inflation data, today's retreat suggests caution among traders ahead of official inventory data from the EIA expected at 10:30 a.m.

For now, my short-term outlook is neutral.

No positions are currently justified from a risk/reward perspective.

Here’s the breakdown:

-

The market still appears to be in a consolidation phase rather than establishing a new sustained uptrend.

-

The large crude inventory build reported by API is offsetting some of the positive sentiment.

-

The key resistance zone around $65-66 remains an important technical barrier that may limit further gains