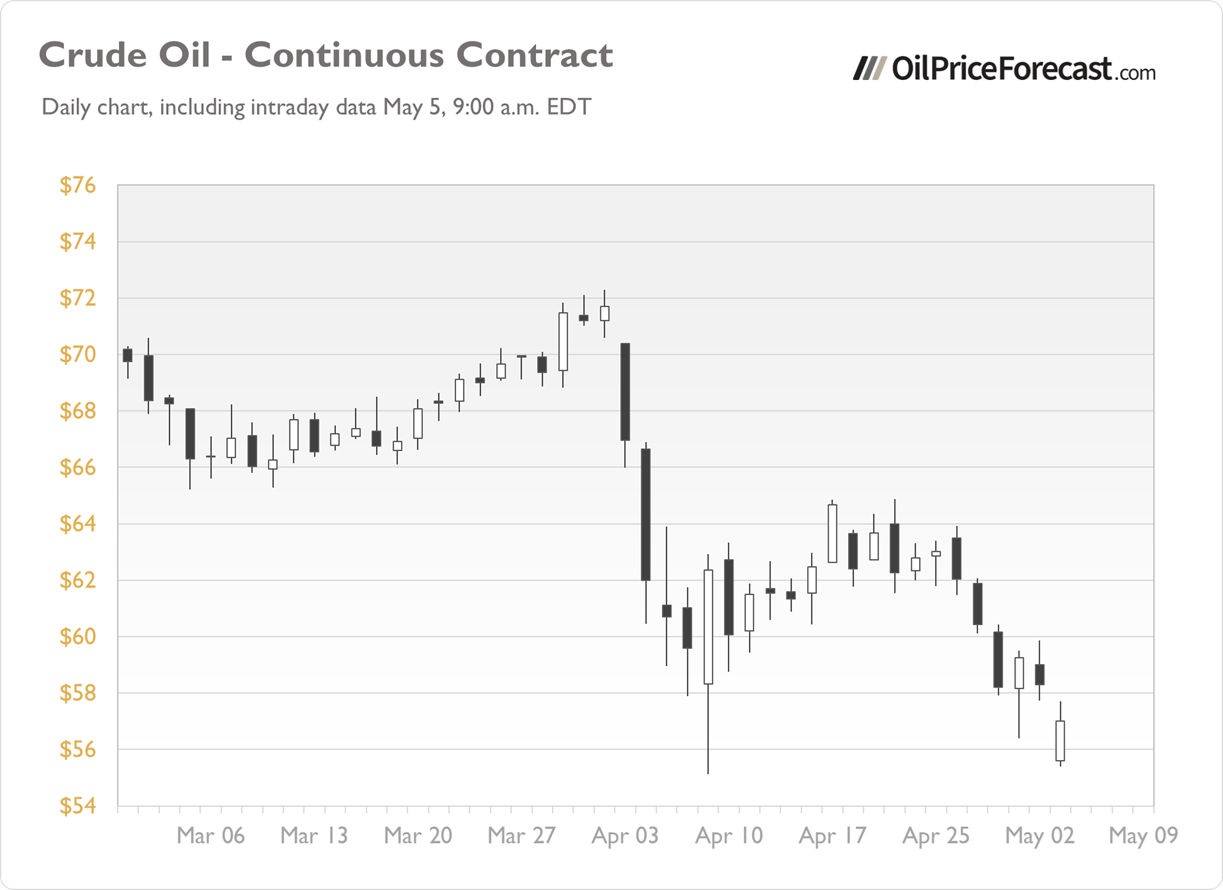

Crude oil sold off after OPEC+ announced increased production over the weekend - has it found support after testing April lows?

Crude oil closed 1.60% lower on Friday, as investors worried about OPEC meeting and potential hike in production. Today, the market accelerated its sell-off this morning, reaching nearly $55 level and its early April low, but is rebounding from lows.

For oil markets specifically, these developments are worth monitoring:

-

OPEC+ agreed to raise output by 411,000 barrels per day from June, nearly three times the volume initially signaled, with key members Saudi Arabia and Russia increasing production.

-

Despite a 90-day postponement of much of his elevated tariffs, Trump has left at least 145% levies on major oil importer China in effect, drawing retaliatory tariffs of 125% from Beijing.

-

Markets are eagerly awaiting the Fed interest rate decision on Wednesday, which could impact broader market sentiment and dollar strength.

Conclusion

Crude oil has sold off following the OPEC+ announcement but appears to be finding some support after testing its early April lows. The market faces significant headwinds from increased production and trade tensions.

For now, my short-term outlook is neutral.

I think that no positions are justified from the risk/reward point of view.

Here’s the breakdown:

-

Crude oil price is selling off this morning following OPEC+ news over weekend.

-

The larger-than-expected OPEC+ production increase could continue to pressure prices in the coming weeks.

-

Ongoing trade tensions between the US and China add another layer of uncertainty for oil demand forecasts.

-

The upcoming Fed decision could influence dollar strength and subsequently oil prices.