The financial services landscape has been overrun with a myriad of different marketing efforts, new tools, and approaches. Claims as to the single best marketing strategies are all over the place, whether its SEO, content, social media, or digital campaigns. How do you digest all these approaches and issues on financial marketing and growth? The real issue is how do you deal with all these options? A different mindset may be needed - a way of looking at this marketing endeavor that helps make sense and enable good decisions that lead to strategic action.

“Virtual distribution” has been offered as an energizing term and a mindset that is trying to tie all these components together. Trying to break through our crowded, noisy marketplace may need a multipronged effort that strategically determines and co-ordinates various marketing tools and approaches into a precise course of action most benefiting client goals. Altering your mindset and looking at your landscape from a different lens by taking a more expansive approach for growth marketing may be what is needed.

To better understand the dynamic behind virtual distribution, we reached out to Institute member Dan Sondhelm of Sondhelm Partners – an experienced provider of marketing, digital, public relations and strategic growth strategies for boutique asset managers and RIAs focused on High-Net-Worth wealth management. His firm just won their second industry award as a third-party marketing firm from HedgeWeek. We asked him to share his unique perspective and experiences in working with a different mindset and approach to generating awareness, demand, and increased growth for your firm.

Hortz: Why do you feel a different mindset is needed for financial services marketing?

Sondhelm: Industry trends working against boutique asset and wealth managers before COVID have only accelerated since, requiring that they reevaluate their old ways of thinking. Many are locked into the traditional mindset that says, “We are portfolio managers, not marketers. Investors will find us.”

This approach relies on the belief that investment performance alone will attract investors. While investment performance is key, this mindset ignores the highly competitive landscape driven by differentiation, communication, personalization, and engagement.

To thrive in this new era, boutique asset management firms and RIAs with growth ambitions must understand that marketing is not an optional add-on but a critical component that synergizes with their investment expertise and sales efforts. And that Adding marketing to the mix is not a distraction from core competencies but rather an enhancement that enables them to leverage insights, craft compelling narratives, and strategically position themselves in the market.

By effectively aligning marketing within a structured framework, firms can increase their visibility and credibility to act as beacons, guiding potential investors to discover and engage with their offerings.

Boutique firms must also dislodge themselves from another archaic way of thinking: "We just need more salespeople to make phone calls.” This approach emphasizes sales efforts to generate leads and convert them into prospects, often at the expense of strategy and modernization. Sales teams do play a vital role. However, a traditional outbound approach relying on cold calling and blast emails limits reach and efficacy.

In this digital world, firms must recognize that adding marketing to the sales equation can amplify results. The strategic utilization of digital resources helps sales teams target more qualified leads, create more personalized engagements, and operate synergistically within a coordinated and data-driven framework.

Hortz: Why are you advocating for the term “Virtual Distribution” in financial marketing? What activities and strategy does it comprise?

Sondhelm: We have long advocated for a fully integrated, multi-prong strategy for growing assets and only recently put a label around it — Virtual Distribution — that shows how they work together to drive more prospects to boutique asset managers and RIAS.

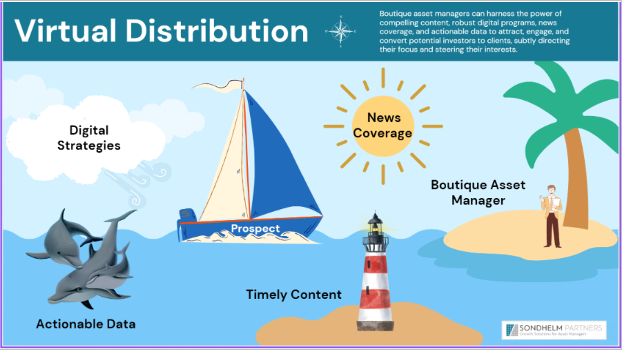

The goal of Virtual Distribution is to create demand and lead flow for a firm’s investment product by adding the capacity to harness the power of compelling content, robust digital programs, credibility-building strategies such as news coverage, and actionable data to attract, engage, and convert potential investors into clients.

We use this graphic to illustrate how asset managers can use Virtual Distribution to subtly direct potential investors’ focus and shape their interests to steer them to the firm. Asset managers can control how effectively they steer the boat inbound to their firms using all the pillars of Virtual Distribution, including timely content, public relations or news coverage, digital strategies, and actionable data. This process also makes the sales team's job easier through more, higher quality leads, strengthened credibility, and an enhanced brand.

The great thing about Virtual Distribution as a marketing framework is that it can work effectively with various audiences—large and small asset managers working with advisors and institutions and RIA wealth managers who want to attract high-net-worth investors.

Hortz: What is the role of content in this equation?

Sondhelm: Content is a huge component of a Virtual Distribution strategy. Timely and compelling content in articles, blog posts, videos, podcasts, digital investor assessments, infographics, white papers, and webinars acts like a beacon, guiding prospects to your firm in a quest for more thought leadership. Generating relevant content that prospects and clients care about is a crucial differentiator setting you apart from firms that spit out mundane factsheets, pitchbooks, and brochures. That’s not marketing; that is sales support, which is essential, but it won’t generate any leads.

The purpose of generating high-quality content is to get your audience hooked on you so you can generate and cultivate leads and start conversations. Content should be educational and insightful, making people want to follow and engage with you. In an industry where the information flow is overrun with dull commentary and jargon-speak, thought leadership content is highly coveted by advisors and investors craving a unique perspective.

For example, in a survey conducted by Fuse Research Network, advisor demand for investment and economic commentary has increased substantially since before the pandemic, with white papers, blog posts, and webinars being the top choices for consuming content.

We just started working with an asset manager that had limited content. They produced fact sheets once a quarter and a monthly one-page portfolio update. The commentaries they wrote were deep in the weeds of their portfolios, and while clients might care about that, prospects who do not know the firm don’t.

We worked with them to make their content more exciting and relevant and get it out digitally to the target audience they were seeking — mostly RIAs who do not know about them. We transformed their website from a mostly static electronic brochure into one that looks like a serious firm that wants to engage. We also worked hand-in-hand with their marketing pros, and equally important, we helped their sales team leverage the content in their day-to-day activities to boost credibility, visibility, and trust.

Hortz: How best do you see that public relations can be integrated into this more expansive approach?

Sondhelm: In our work with asset managers, public relations is the secret sauce. Public relations is often overlooked because most firms do not understand what it is or how it can help them. It also requires a conscious effort, and many firms do not know where to start. However, an effective public relations strategy incorporated into Virtual Distribution is a cost-effective way to gain visibility and build a “buzz” around them to add visibility and credibility to their marketing efforts. All firms have a story to tell. They need to make it buzzworthy and get it out through the media.

Getting news coverage through the right media can bring instant credibility to the firm. Public relations is about building relationships with journalists and other influencers, earning news coverage for your people, products, and services. Media interviews and speaking engagements are golden opportunities to spotlight your firm’s thought leadership and gain third-party endorsements that can be repurposed in your other sales and marketing efforts.

Depending on your firm's focus, aiming for industry awards such as Barrons Top Mutual Fund Families, With Intelligence Mutual Fund and ETF Awards, Hedgeweek US Awards, and WealthManagement.com Industry Awards is another key aspect of an effective public relations strategy. Nothing adds credibility and differentiation like earning a spot on a “best of” list, winning an award, or qualifying as a finalist.

When used in Virtual Distribution, public relations can bring juice to the strategy by repurposing media coverage, interviews, speaking engagements, and awards through digital marketing—on your website, blogs, emails, and social media—and can be used to add credibility to your sales team, as a multiplier effect.

In one case, a well-established boutique ETF client wanted to boost credibility and visibility with Registered Investment Advisors. We secured regular positive news coverage and facilitated their earning of several industry awards by sharpening their portfolio managers' communication skills and connecting them with journalists and industry award panels, positioning them as experts in their specialty.

Hortz: How do you combine this expanded toolset and approach into a firm-specific strategy?

Sondhelm: I have only mentioned two pillars of the Virtual Distribution toolset—content and public relations—which shape a firm’s messaging. The other two—digital strategies and actionable data—are the engine's key moving parts that drive that messaging. All these components can be tailored to a firm’s strengths and target audience.

Digital strategies start with a powerful, high-performing website; when I say “high performing,” I mean fast. You don’t want to lose visitors because your website is too slow. Also, a powerful website is built for lead generation with timely content, calls to action, landing pages, and forms to capture lead information. The goal is to get targeted visitors to engage with your website and do what you want.

Another digital strategy — email marketing — is essential to the process. But we are talking about more than just developing campaigns. Email marketing should be tech-driven, using CRM and marketing automation, such as HubSpot, to organize campaigns and track everything digital, such as engagements and the behaviors of specific clients and prospects.

Many firms continue to blast out emails indiscriminately. With more sophisticated technology and an understanding of how to use it, firms can do more to influence investor interest. For example, instead of simply blasting emails, you can set up a series of emails through sequencing which is a behavior-based approach.

Social media is another critical cog of an effective digital strategy. Not everyone responds to emails. Some asset and wealth managers develop significant followings, which is the purpose of social media marketing. The idea is to guide followers to the firm’s website, where they can be tracked and cultivated into leads.

Hortz: What do you mean by saying actionable data as another key pillar? How exactly do you integrate it into your overall strategy?

Sondhelm: The fourth and most important pillar is actionable data, which brings the entire process together. According to a report by McKinsey, sales and marketing can use data to drive 5-30% higher revenues through behavioral segmentation, data-driven prospecting, personalized marketing, and using predictive algorithms. When people visit your website, open your emails, or engage with you on social media, it creates a lot of data that can be acted on if you know how to harness and use it.

There are two types of data. Metrics like email open rates and web hits are not as important because they are not actionable. It’s useful information to tell you how many people interact with you, but it does not tell you who they are or what they do with the information. There is no way to generate leads from it.

With actionable data, you can track individual leads, learn their interests, and score their engagement level to know when they might be ready to be contacted. For example, if a prospect opens an email, clicks on a link, and then visits our website, we can track them through all our digital channels. We might put them into an email sequence using HubSpot, sending three emails during which they clicked on some links, repeatedly visited our website, downloaded a white paper, and followed us on LinkedIn. We get real-time notifications when these interactions occur, so we determine if or when it’s time to act.

That’s solid, actionable data telling us that that prospect is actively engaged out of 5000 contacts in our CRM. If that interaction generates a high lead score, it signals to a salesperson that they are ready to be contacted. With actionable data, sales teams can focus on high probability leads.

The same capabilities enable asset managers to provide more value with each interaction, whether providing a unique perspective on market or industry trends or personalized solutions to help advisors grow their practice. The more personalized the engagement with advisors, the more value they receive.

It’s essential to have the digital tools in place— fresh and compelling content, a proactive public relations strategy, a high-performing website, and email marketing—but without actionable data, you’re just performing individual tasks. Harnessing and using actionable data turns it into a lead-generation process that constantly repeats itself, providing asset managers with control over how they grow assets under management.

Hortz: Are there different applications of this integrated approach to wealth management versus asset management firms?

Sondhelm: The applications of Virtual Distribution are the same for wealth managers as they are for asset managers. The primary difference is in their audiences, which means the content must be tailored differently. Wealth managers or RIAs cater more to high-net-worth clients, while asset managers cater to institutional investors or RIAs looking for portfolio management.

It also depends on what the wealth manager is offering. Many wealth managers are essentially stock pickers who rely on their investment performance to attract new clients. If you go to their website, you might see information about their disciplined and repeatable three-step process and proprietary fundamental research approach. But that message won’t necessarily resonate with high-net-worth clients concerned about retirement or generational wealth transfer.

To attract high-net-worth clients, you must have a story that resonates with them, zeroing in on what keeps them up at night.

One of our clients, a wealth manager for high-net-worth individuals, initially focused on stock-picking strategies. However, they found that high-net-worth clients were more interested in solutions to their wealth challenges, like preservation and generational legacy planning. Recognizing this disconnect, we helped reposition them as a hybrid of solving wealth problems and stock pickers.

We transformed our client's approach by developing content that resonated with high-net-worth individuals' real concerns. The result was a surge in new leads, and conversations. This experience highlighted the importance of aligning services with the target audience’s needs, turning our client's focus from stock-picking to meaningful wealth management.

Hortz: Any advice or recommendations you can share with financial firms about developing a different mindset on their marketing and branding efforts?

Sondhelm: Considering how fierce the competition is among asset and wealth managers, boutique firms need to be able to showcase their value and communicate their stories in the digital realm. Boutique firms eyeing the next level of AUM must think through each of the elements I have described as part of their growth strategy, starting with the first and then moving on to the next.

The good news is that, according to Cerulli Associates, more than three-quarters (79%) of asset managers have increased their budget dedicated to distribution technology in the past year. Firms with serious growth ambitions want to implement a digital distribution system simultaneously, but that may not be realistic. Established firms can do all these things because they have teams working on them. It’s challenging for boutique firms because they might lack the resources to do it. Smaller firms should think about how to do more to grow their assets under management, but they do not have to do all these things on day one.

Instead, have a plan to phase a Virtual Distribution strategy in, build it incrementally, create momentum, and make progress. By doing more of the right things in a way that produces more actionable data, you will create more engagements and start more conversations while boosting the morale and productivity of your sales teams.

Even firms without a sales team can use a Virtual Distribution strategy to raise assets. With all the components working synergistically, you can look the part of a serious firm and outshine your competition with a higher profile internet reputation.

Sondhelm Partners has a road map to help firms build their Virtual Distribution and grow their lead generation over time. As growth partners, we work with asset manager and wealth management executive teams to take a step back and think more strategically about their business and what it takes to reach the next level.

Related: Innovations in Tax Management