As we posted this week, and saw it confirmed that afternoon, we are in the midst of another momentum-fueled rally. Investors have been plowing back into risk assets with a vengeance, leading to an enormous bounce off the recent lows. The S&P 500 (SPX) couldn’t make it all the way back into positive territory for April, closing down -0.76%, but the Nasdaq 100 (NDX) did eke out a +1.52% gain after an atrocious start. After eight straight days of higher closes for SPX, I wondered whether it was time to reconsider our prior admonition to “don’t fight the tape, insure against it instead.” It turns out that others are thinking that way as well.

It is certainly a sign of resilience when traders can shrug off truly awful economic reports and nonetheless take stocks higher. We saw stocks shrug off another set of lousy Consumer Confidence numbers on Tuesday, and then stage a remarkable recovery from a major selloff yesterday on the back of weaker GDP and higher PCE readings. Fortunately, we were alert to that possibility when we wrote:

Thus, considering that today’s month-end offers the possibility, if not the likelihood, of a late-day markup, it would not surprise me in the least if we saw an unchanged – or even a positive – close. The intra-day momentum has been powerful enough to outweigh most market concerns for several days, so today could be no exception. At least in the short-term, positive momentum is outweighing soggy fundamentals.

So, what comes next? Stocks got off to a roaring start after well-received earnings reports from Meta Platforms (META) and Microsoft (MSFT) after yesterday’s close. It is nearly impossible to expect anything less when two of the largest index components are up +4.5% and +8.5%, respectively. Yet by midday, we saw indices give back about half their peak intraday gains. They were still up nicely – about +0.85% for SPX and +1.6% for NDX – but it seemed as though traders were taking a breather – at least for a little while. We’ll see if the party resumes after lunchtime.

Nonetheless, our contrarian instincts get triggered after a period of near-unanimous sentiment. We know that fighting a powerful momentum-driven trend can by quite treacherous and costly, but after noting that volatility measures like VIX (Cboe Volatility Index) have come down from stratospheric to merely elevated levels, we had hoped that protective puts might have followed. In a word, “no”.

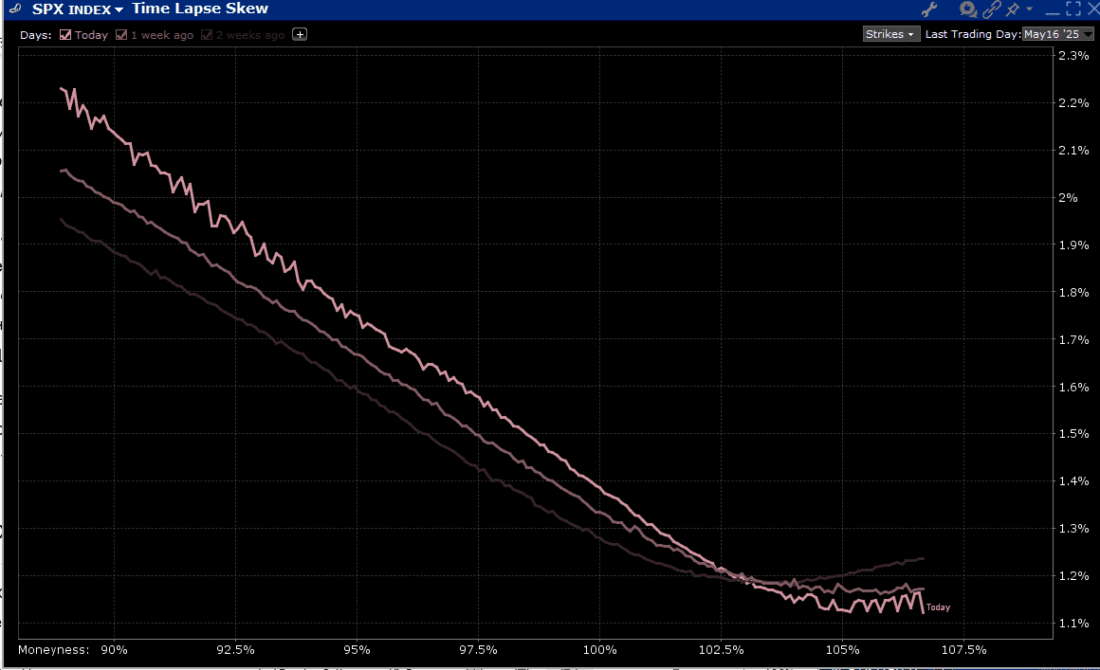

The following graph shows skews for SPX options expiring Friday, May 16th. Those are “regular” monthly expiring options, and while many of you prefer to use shorter-dated options for speculation and hedging, the longer trading history of monthly expiring options gives us more historical perspective. We can see that skews have steepened, rather than flattened, and that at-money implied volatilities have also risen.

Time Lapse Skews for SPX Options Expiring May 16th, today (top), 1-week ago (middle), 2-weeks ago (bottom)

Source: Interactive Brokers

Two theories for this rise come to mind. First is that others share my contrarian impulses, which is entirely possible. Second, is that we have a very important event on the horizon. The FOMC meets a week from yesterday. While expectations disregard the likelihood of a rate move (IBKR Forecast Trader shows a 4% chance), they are likely to offer some important clues about their willingness to cut rates in the coming months. Both Forecast Trader and the CME FedWatch indicate reasonable likelihoods for as many as 4 rate cuts over the 5 meetings that follow May’s.

Does this reflect reduced inflationary concerns or recession risks? At least one, if not both, are required for that much monetary accommodation, and only the former is market friendly. Furthermore, might the recent verbal attacks on Chair Powell by the President stiffen his resolve not to appear as though his is caving to outside pressure. All are fascinating scenarios, and it appears that at least some traders are considering the possibility of a poor market reaction.