Written by: Jacob Johnson | Advisor Asset Management

A purposefully abbreviated timeline:

- January 9, 2020: The World Health Organization (WHO) announced that Chinese authorities had made a preliminary determination of a novel (or new) coronavirus, later known as COVID-19

- February 19, 2020: The S&P 500 hits a near-term peak of 3,386

- March 23, 2020: The S&P 500 Index hits a pandemic low of 2,237

- November 9, 2020: Pfizer, Inc. and BioNTech SE announced their vaccine candidate was found to be more than 90% effective in preventing COVID-19

- December 11, 2020: The U.S. Food and Drug Administration (FDA) authorized the emergency use of the Pfizer/BioNTech vaccine, 337 days from the January 9, 2020, announcement of COVID-19 by the WHO.

The 337 days spanning the World Health Organization’s announcement of COVID-19 to the FDA approval of the first vaccine the world witnessed many social, economic, and scientific events few thought possible. This includes the successful development of the vaccine itself – a scientific achievement that should be celebrated; and the broad equity market as measured by the S&P 500 Index had rebounded 56.85% (price basis) from the pandemic lows on March 23, 2020, to November 9, 2020, or “Pfizer Day” when Pfizer/BioNTech announced their vaccine to be 90% effective. For our purposes, we will look at what transpired in the equity markets since the announcement and illustrate an evolving – and perhaps healthier – equity market.

Through the selloff in February/March and the subsequent rebound, equity returns were robust, but over time became concentrated in large-cap companies with the capital to withstand a pandemic-induced recession and/or COVID-19 “winners” such as certain technology industries and consumer staples (yes, toilet paper). By November 2020, the top 10 stocks in the S&P 500 accounted for approximately 28% of the index by market capitalization with the top five stocks accounting for 22%. Additionally, the “Big 5” carried a weighted average price-to-earnings ratio (P/E) of 42.5x, compared to the rest of the index at 22.5x.

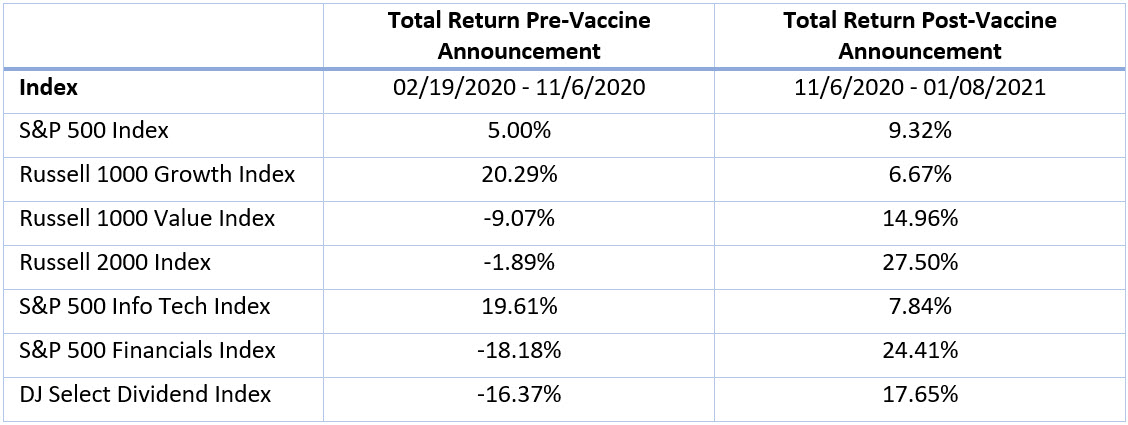

Enter Pfizer and BioNTech on November 9, 2020 – “Pfizer Day.” Following the announcement of a tremendously effective vaccine and economic reopening within sight, equity markets continued their upward climb, but with a significant change in market leadership. Looking at a sample of index returns pre- and post-vaccine announcement highlights the change. Areas of the market that underperformed through the selloff and prior to the vaccine have outperformed since the announcement, such as small and mid-cap stocks, dividend-paying equities, and the value style.

Source: AAM, Bloomberg data | Past performance is not indicative of future results.

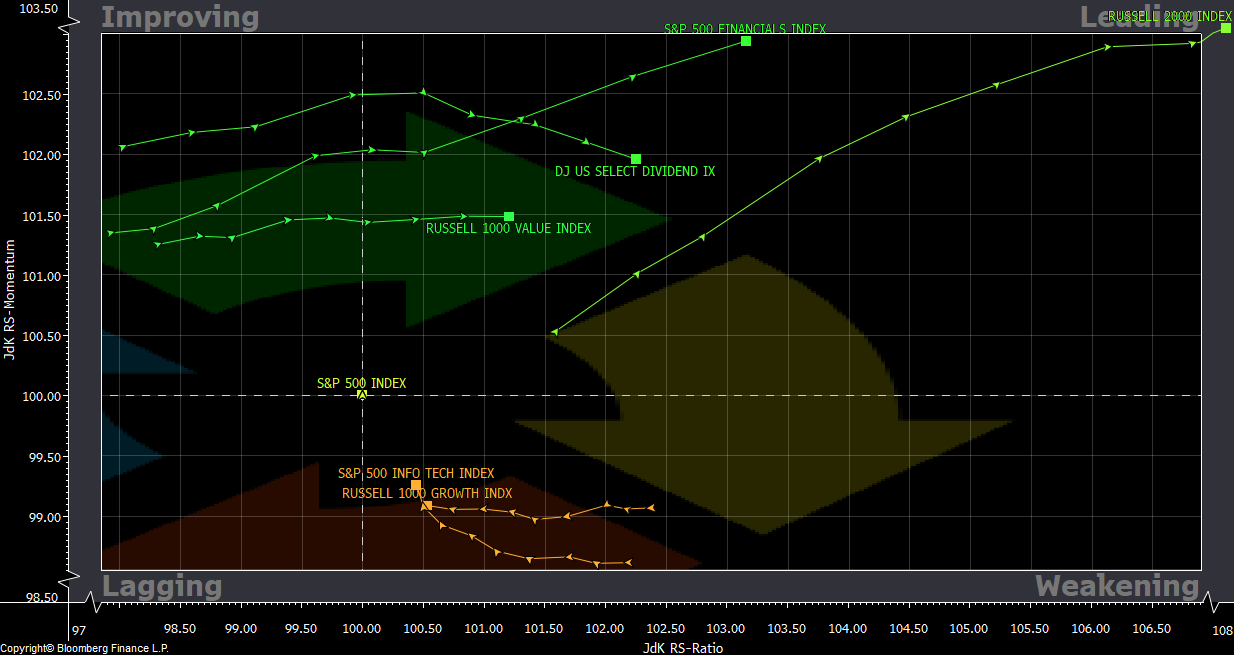

An interesting way to visualize the change in market leadership is with a Relative Rotation Graph (RRG) that measures relative strength and momentum of that relative strength (think of it as: “If the team won the game, and by how much did the team win the game.”) It then breaks down into four quadrants: Improving, Leading, Weakening, and Lagging – relative to the S&P 500. Measuring weekly returns since the vaccine announcement confirms the rotation with small and mid-caps as measured by the Russell 2000 Index literally off the charts in the Leading quadrant joined by financials, dividend payers, and value stocks. The Weakening quadrant includes large-cap growth stocks and the information technology sector.

Source: Bloomberg, AAM

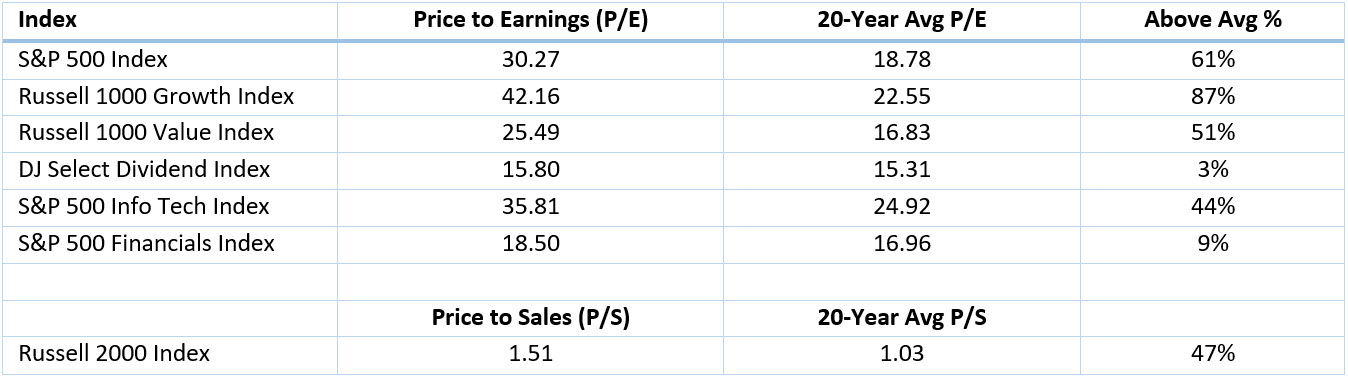

One clear side effect of the vaccine has been the rotation into more economically sensitive segments of the market. We estimate these segments have rallied based on the expectation of economic reopening and recovery. Their continued leadership will largely depend on actual economic reopening and recovery meeting/exceeding those expectations. We also suggest the weakening segments may have met some resistance in terms of valuations. The “Big 5” in the S&P 500 now account for 19.7% of the market-cap and carry an average trailing P/E of 49.39x, pushing the aggregate trailing P/E ratio of the index to a glaring 30.27x. A quick look at valuation multiples shows most indices trading well above long-term averages, but note some pockets are more reasonably valued and have been relative outperformers since the vaccine was announced such as dividend payers and financials.

Source: AAM, Bloomberg data | Past performance is not indicative of future results.

Faced with the prospect of elevated valuations and what is likely to be a bumpy economic reopening, we enter 2021 with muted expectations compared to recent years but with the potential for relative outperformance from unloved segments of the market that have been strong performers since the announcement of an approved COVID-19 vaccine. If these trends continue another possible side-effect could be a healthier equity market in terms of more participation (breadth), less concentration and potentially lower valuations which could bode well for long-term investors. Therefore, we believe a balanced and diversified equity allocation across sectors, market-caps, and styles is prudent in an environment where market leadership can turn on a dime (or a vaccine.)

Related: Two Low-Risk Ways to Profit from Bitcoin

This commentary is for informational purposes only. All investments are subject to risk and past performance is no guarantee of future results. Please see the Disclosures webpage for additional risk information at commentary-disclosures. For additional commentary or financial resources, please visit www.aamlive.com.