Written by: Erin H. Hay

Google ($GOOGL) – one of 20 constituents in the MWM Growth Model – has finally entered the realm of dividend-paying stocks, announcing a $0.20/share quarterly cash dividend, along with a fresh $70B share repurchase amount. It’s not earth-shattering in terms of yield – the $0.20 quarterly payout is approximately 0.5% on an annual basis – but it does serve as a watershed moment for one of the most transformative tech companies of the last 30 years.

To quote an advisor friend who is quite knowledgeable of Google’s fundamentals: “[The] Market loves the divvy because Google loves to light cash on fire on ‘other bets,’ so it’s nice to see some semblance of capital allocation.”

For us – who of course rely far less on bottoms-up fundamental analysis and more so on “technical” price data – the dividend simply serves as one catalyst that may bolster already-strong absolute and relative price trends, as illustrated below. I’d note the green line on the bottom panel represents Google’s relative return vis-à-vis the S&P 500 – upward sloping good, downward sloping bad. I’d also note that on the margins, Thursday’s dividend announcement may unlock additional investors –such as institutions who are mandated to own only stocks that pay dividends, no matter how small and “token.”

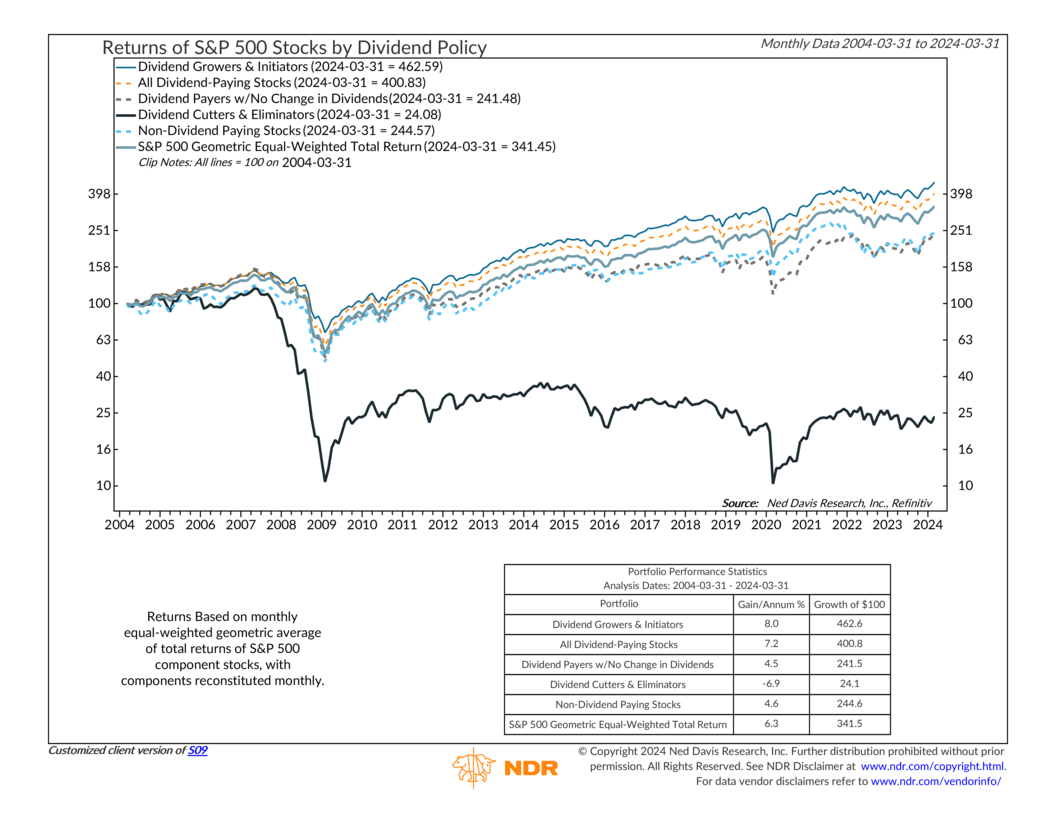

It also gives me an excuse to repost one of our favorite graphics from Ned Davis Research, which illustrates the returns of S&P 500 cohorts by dividend policy. Might we be looking at the beginnings of Google’s journey to dividend aristocrat status?

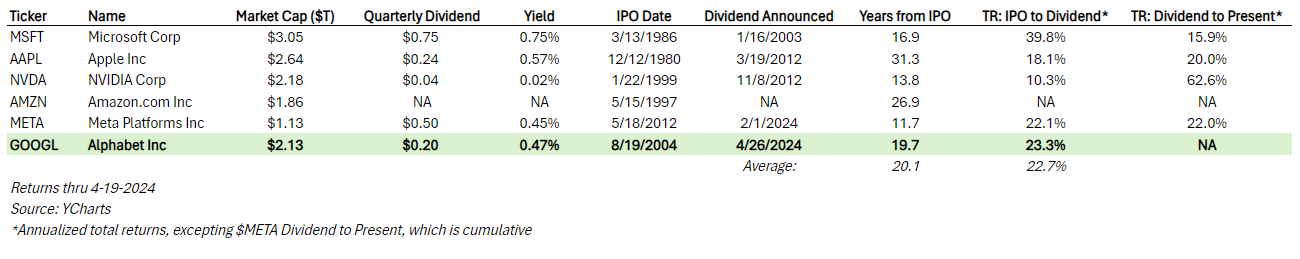

Lastly: it’s worth noting that after Google and Facebook (yes, technically Alphabet and Meta) announced dividends this year, only one member of the Magnificent Seven has yet to initiate a regular quarterly cash dividend, which is of course Amazon ($AMZN). Pure, unbridled speculation on my part, (meaning do not trade on this, it’s just a guess) but I would imagine Amazon spins off Amazon Web Services into a separate, publicly traded company before announcing a dividend. The below table illustrates the date of each company’s dividend initiation announcement, the distance of that announcement from IPO, and the annualized total returns of each stock pre- and post-announcement.