With Halloween on the horizon, I thought back to a visit to a haunted house in Tuxedo, NY many years ago with a group of colleagues. This haunted house was purported to be THE SCARIEST EVER. Nothing like we had experienced before. I was primed to be scared out of my wits. Upon entering the house, we were greeted by run-of-the-mill spooky stuff—fake gore, zombie mannequins, screaming soundtracks—and then BANG! A human in a ghoulish costume jumped out from behind a curtain. This first unexpected incident indeed made me jump. But each successive surprise became less and less effective. Expecting to be shocked readied me NOT to be shocked. When the haunted journey ended with a guy in a ski mask chasing you with a hatchet on the opposite side of a chain-link fence, it seemed like a joke. Walking back to our cars in the dark, I recalled the grotesque and shocking events now seared in my mind. Suddenly we heard rustling in the wooded area next to the parked vehicles that sounded like a large animal. THAT is when my blood ran cold.

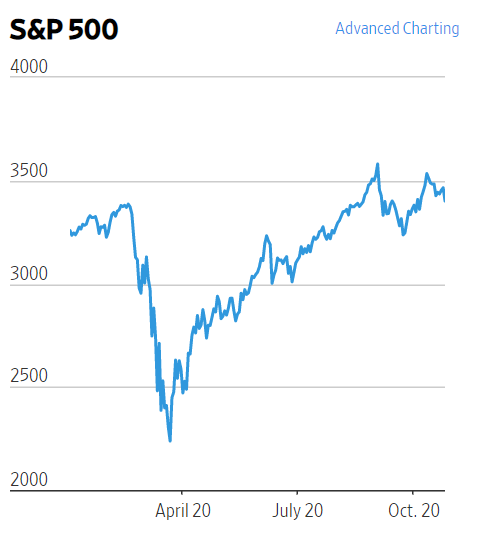

Capital markets in 2020 could be described as a haunted house that effectively spooked investors early in the year. After news of the first Coronavirus infections, the S&P 500 dropped over 30% in just over four weeks to hit a low on March 23. As time wore on, investors seemed to shrug off the continuous stream of scary news: COVID-19 case surges, continued closed businesses, high unemployment numbers, polarized politics as well as the fires in the West to name just a few. The S&P 500 proved to be resilient throughout, in August beating the high in February and then going even higher in September. But are investors even a little bit spooked? To answer this question, let’s explore a couple indicators of investor confidence produced by the International Center of Finance at the Yale School of Management.

The U.S. Crash Confidence Index estimates the percentage of investors who believe there is a less than 10% chance of a market crash like that of “Black Monday” October 28, 1929 or October 19, 1987 in the next six months [1]. A high U.S. Crash Confidence Index estimates that more investors believe a market crash is unlikely to occur. A low number estimates that more investors believe a market crash has a better than 10% chance of occurring.

The U.S. Valuation Confidence Index estimates the number of investors who think the stock market is valued too low or just right. A high U.S. Valuation Confidence Index suggests that many investors believe markets are correctly priced or there are buying opportunities. A low number suggests that markets are too high and could likely move lower.

The Crash Confidence Index for individual investors has moved down from 31% in February 2020, when we were unprepared for the havoc ahead of us, to 15% in September. For institutional investors—nonprofit and foundation investors among others—the index also moved down from 49% in February to 24% in September, its lowest for 2020. These index results suggest that under current conditions more investors believe there is a greater than 10% chance a crash could occur within six months. The Valuation Confidence Index too dropped for both individual and institutional investors, suggesting that more believe the market to be overvalued in September than did in February.

What are we to make of this and how does it square what we know about stock market volatility? First, as many investment professionals will tell you, the stock market is not the economy and that theory still holds.

The economy and stock markets though are not mutually exclusive, as stock prices are a representation of investors’ forecasts of economic trends. Today the market seems to be lagging the economy suggesting that investors 1) are accustomed to the daily onslaught of ghastly economic and health reports and/or 2) presume governments will bail out and stimulate their respective economies thereby bringing markets back to health.

When investors stumble upon ominous news they did not expect, their price outlook can change suddenly, as has happened this October. So as always, and particularly now, it is prudent to maintain a well-diversified investment portfolio that also includes bonds.

Because, like a Halloween reveler making her way through a house of horrors, all it takes is one unexpected event outside the ordinary for fear to set in.

Related: The Global Market Portfolio

[1] “Black Monday” started a stock market tumble in which the Dow Jones Industrial Average ended with a 23% loss over in two days and 90% lower after four years. During the Global Financial Crisis, October 2008 was the beginning of a drop of over 50% after 18 months.