Diversification is not only an important part of investing but also important in the type of accounts you hold in retirement. These retirement accounts generally fall into 5 categories – i.e., the “Top 5”. A big piece of retirement planning is making sure you have the right proportion of the “Top 5” types of accounts for your personal situation. The process of proper tax planning is selecting the right tax-smart accounts that may help your retirement savings last longer. Learning about the pros and cons of the “Top 5” will help you develop a tax-smart long-term retirement strategy as you will be able to estimate how much of your withdrawals or income in retirement is going to taxes and at what rate.

Here are the “Top 5”:

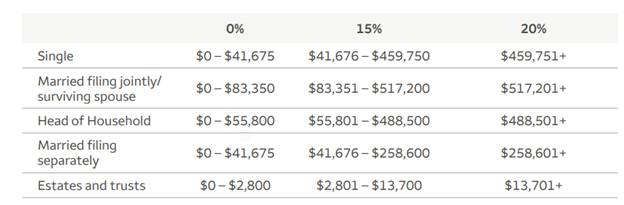

1. Taxable accounts — These are accounts funded with after-tax dollars in a brokerage account (could be Fidelity or Schwab) and have the benefit of buying/selling and withdrawing without any penalties upfront. Each year you receive a 1099 from these accounts with capital gains and income distributions. Short-term capital gains (gains on the sale of capital assets held one year or less) are taxed at the ordinary income tax rate for individuals and trusts regardless of filing status. Long-term capital gains tax rates are not tied to the tax brackets. The table below shows long-term capital gains tax rates. Qualified dividends are taxed at long-term capital gains rates, while nonqualified dividends are taxed at ordinary income tax rates. In volatile investment times like today, it is important to track for potential tax lost harvesting opportunities with these types of accounts. Tax loss harvesting can be used to reduce taxes on other reportable capital gains. This requires selling securities at a value less than the original purchase price to create a loss, which is generally used to offset other recognized capital gains. However, keep in mind that if you replace that investment with a similar investment, you have reset the holding period clock and potential will eventually have a large gain to pay in the future. It is important to have a tax planning conversation with your CPA and your financial advisor to properly plan how capital gains will impact your taxes.

Long-term capital gains table:

2022 Year-End Tax Planning Guide (wellsfargomedia.com)

2. Qualified plans — These accounts generally comprise the largest portion of most retirement plans. Contributions to these accounts—which include 401(k)s, 403(b)s, and traditional IRAs—generally reduce your taxable income dollar for dollar in the year you make the contribution. Furthermore, pretax contributions and gains are not usually taxed until retirement, at which point withdrawals are subject to ordinary income tax rates. Keep in mind that if you continue to work in retirement, there is no maximum age restriction, and you can continue to fund these accounts. In 2022, the max employee contribution is $20,500 and there is a $6,500 catchup for those who are 50 and older. The maximum annual defined contribution plan limit is $61,000. In retirement, distributions from these accounts are mandatory at age 72 and are taxable at ordinary income rates. If you do not withdraw funds, you may be subject to a 50% penalty. In the tax year 2020, 250,000 people paid this penalty which is a costly mistake. Also, since distributions are taxable, they can also affect your social security and Medicare premiums. The only way around paying taxes on your distributions is to take your RMD and give it directly to charities by doing a qualified charitable distribution. Following a Qualified Charitable Distribution strategy has certain requirements that must be met. It is important to have a tax planning conversation with your CPA and your financial advisor to properly plan where you will land within the tax brackets.

Income tax tables:

2022 Year-End Tax Planning Guide (wellsfargomedia.com)

Also important to note is that the standard deduction for MFJ is $25,900 and for Single $12,950. And an additional $1,400 per person over age 65.

3. Roth IRAs — These tend to be smaller in proportion to the top 2. However, they provide the most amount of tax flexibility and help protect against “the widow’s tax.” Unlike tax-deferred accounts, contributions to Roth 401(k)s and Roth IRAs are made with after-tax dollars, so they will not reduce your current taxable income. But when you withdraw the money in retirement, you will not owe taxes on appreciation, income, or withdrawals. Also, you will not have to wait until age 59 ½, since after meeting the 5-year rule, all basis can be removed. In retirement, the easiest way to fund Roth IRAs is by doing a conversion of qualified plans into a Roth.

Benefits of converting your eligible retirement account — 401(k), Traditional IRA, or other non-Roth account — to a Roth IRA can include tax-free distributions for you and your heirs and the elimination of RMDs during your and your spouse’s lifetime. Conversion is not an all-or-nothing proposition, as you can convert a portion or all of your eligible retirement accounts. Note that a Roth IRA conversion will trigger ordinary income in the year of conversion and potentially the Medicare surtax, as the conversion counts toward the calculation of MAGI and may bump you into a higher tax bracket. It is important to have a tax planning conversation with your CPA and your financial advisor to properly plan if a Roth conversion makes sense for your planning needs.

4. Health Savings Accounts — Although not traditionally considered retirement accounts, these accounts can be an effective savings vehicle to leverage in retirement. Many people are now starting to look at high deductible plans to cover health insurance coverage until Medicare. Health Savings Accounts (HSAs) are available to participants enrolled in a high-deductible health insurance plan. At the federal level, contributions to HSAs are not subject to income tax. Distributions are tax-free as long as they are used for qualified medical expenses. In most states, contributions to HSAs are not subject to state taxes and income earned in HSAs is tax-deferred. Similar to federal law, qualified distributions are tax-free in most states. If a distribution occurs from an HSA prior to age 65 for reasons other than qualified medical expenses, ordinary income taxes along with a 20% penalty are due on the distribution amount. Distributions from HSAs after age 65 are not subject to the 20% penalty but are subject to ordinary income taxes. Contributions to HSAs can no longer be made after enrolling in Medicare. If you are looking to retire early or are considering health insurance, it is important to have a conversation to see if an HSA would make sense for you.

5. Annuities — Before you stop reading, most retirees have more than enough in fixed income sources and most likely do not need any annuity. But as more people retire without a pension or are underfunded for their own goals, annuities will be a larger part of the conversation. In addition, some of the new benefit riders are directly solving longevity risk and long-term care costs which are key concerns for people transitioning into retirement. Therefore, annuities may be a part of the conversation for new retirees. In 2010, Congress passed a law called the “Pension Protection Act” that allows exchanging your nonqualified deferred annuity for a long-term care insurance policy. You can use annuity earnings to pay for long-term care insurance without paying income tax on those earnings. This allows you to use otherwise taxable annuity earnings in a more tax-efficient manner. Again, it is important to have a planning-based conversation around these needs.

These “Top 5” accounts may be part of your current retirement plan, or you may be contemplating how to add a new type of account to your mix, like converting qualified funds into Roth IRAs for estate planning. It is important to have a conversation with both your financial advisor and CPA about these plans to create a tax-smart retirement strategy.