One of the most deceptive and destructive investment pieces has been published under the title “2021 Midyear Roundtable”.

Those are pretty strong words for something that seems innocent, and may even appear helpful for investors. Don’t let the subtlety fool you – that is part of what makes this so destructive. It may come across as helpful; that is just an illusion. This type of article may very well influence investors to abandon their plan and make unwise financial decisions.

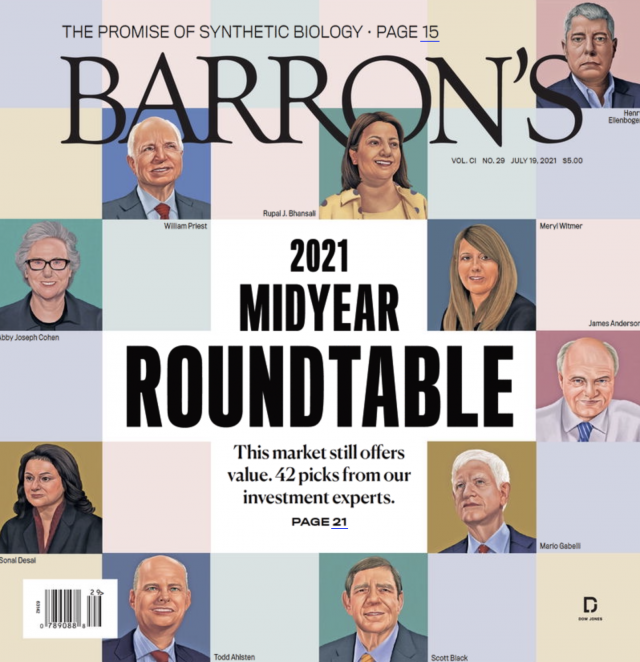

The Roundtable consists of ten Barron’s proclaimed “investment experts” discussing the economy and picking stocks that they believe will outperform the market. Each one of these “experts” is experienced and well-seasoned. Barron’s describes them as “stock-picking savants.” They represent reputable firms. I don’t know what makes them an expert, but suffice it to say most people don’t even ask such a question. To the average investor, such proclamations break down the wall of skepticism and makes what they say more believable.

The Illusion of Predictability

Forecasting the economy and making stock picks is not a question of intelligence, experience or knowledge. It is a question of predictability. It doesn’t matter how many PhD’s or years of experience you have, selecting which number will hit on the next roulette spin is random. Economic and stock market outcomes are mostly random in the short run. But the brain isn’t thinking about that.

The brain loves the illusions of predictability and certainty that forecasts provide. The more confident the forecast, the more we will believe it. There is a strong correlation between the confidence of a prediction and its perceived believability. Belief in a forecast is further strengthened when accompanied by evidence supporting a given viewpoint. But what about contradictory evidence and data? There are almost always two sides to the story, especially when it comes to divining the future of the economy and markets. No matter, at this point we are just about convinced what the future holds and may change our portfolio accordingly.

Two Questions You Must Ask

With the advances in computing, algorithms and AI, it is very easy to evaluate past data. In sports, we can know the statistics of each player and team. A quick internet search will tell us just about everything about a professional athlete’s career performance. Absolutely amazing! Think about how many times a baseball player comes to the plate in a given season, all the pitches he sees and all the data that is instantly available at our fingertips.

- So what is the performance of these “experts”? They have significantly fewer data points, making it much easier to calculate a “batting average” for economists and market forecasters. So why aren’t they published or at least easily accessible online? The fact that they aren’t is a red flag. There is a reason it is not readily available. I’ll give you hint. It’s because the historical accuracy of forecasts by “investment experts” and “stock-picking savants” is awful. CXO Advisory has graded nearly 7,000 forecasts and found that the accuracy rate is less than a coin toss.

- What is the historical accuracy of Barron’s Roundtable “experts”? Barron’s proudly proclaims that they have provided “expert” Roundtables and forecasts since 1968. They have a lot of data. So how well does Barron’s select “experts” that accurately predict the markets and economy?We have no clue. That is a red flag.

Surgeon General’s Warning

We are susceptible to economic and market forecasts largely due to the way our brains are hardwired. Our brains hate uncertainty and often fall for the illusion of certainty. We want to be able to trust another with more knowledge and experience as us. Forecasts, especially by “experts” can be destructive to investors.

For that reason, I suggest there be a law that all forecasts come with a warning. At least tobacco products have a surgeon general’s warning of the danger of consuming the product. The financial media, and you could even say the financial regulators, are doing a great disservice to investors by not requiring a warning statement that accompanies all forecasts.

The warning statements could vary in messaging similar to that of tobacco, so long as the overall danger is clearly identified. Here are a few ideas:

- Warning: For entertainment purposes only. The historical accuracy of expert forecasts is so bad we aren’t even going to tell you.

- Warning: Expert forecasts are highly unreliable and may do investors more harm than good.

- Warning: The market and economy can’t be predicted. The enclosed predictions should not be relied on

Related: Walking the Talk: The Psychological Importance of Consistency