What segment of the annuity marketplace is the fastest growing?

Have you heard of structured annuities, buffered annuities, registered index-linked annuities or variable index annuities? With so many different names for the same product line it can become confusing but since LIMRA uses registered index-linked annuities (RILAs), I will use it to describe the fastest growing segment in the annuity space and give reasons why sales are accelerating so rapidly.

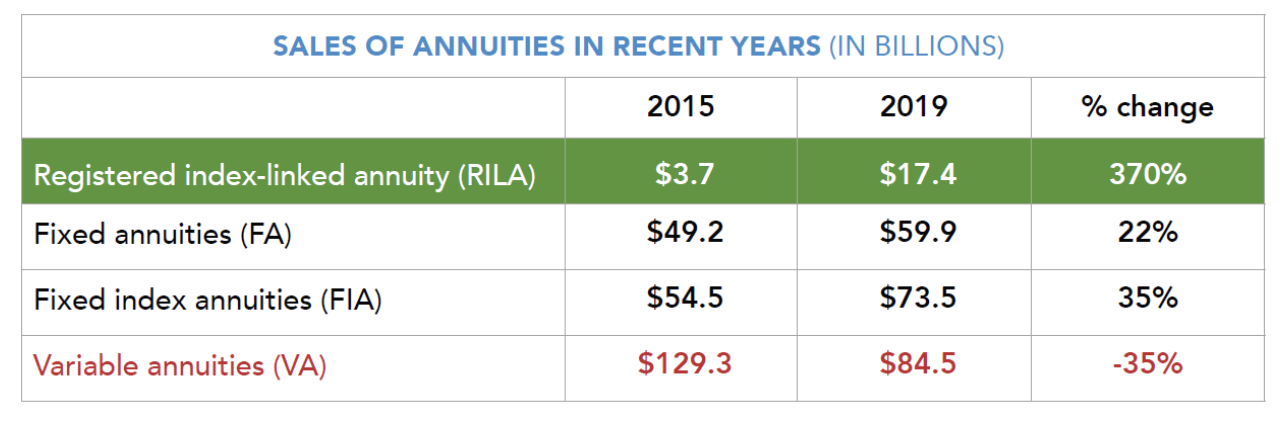

RILAs entered the marketplace in 2010 to bridge the gap on the efficient frontier between fixed index annuities (FIAs) and variable annuities (VAs). Essentially, these products share in a portion of the downside risk and in returns have a greater upside potential. RILA sales totaled $17.4b in 2019*1, which is up 55% compared to 2018 ($11.2b*2) and growth has continued quarter over quarter. RILAs are helping prop up VA sales that have been declining since their peak in 2007*2 —in the fourth quarter of 2019, registered index-linked annuities accounted for more than 18% of variable annuity sales and 9% of all annuity sales1. Why are these annuities beginning to fly off the shelves?

RILAs continue to grow year over year

There are a few possible reasons for this rapid growth and can be described using the three bears. Fixed index annuities offer complete principal protection but with decreasing rates over the last few quarters have limited upside potential. On the flip side, variable annuities offer complete upside exposure with numerous subaccounts but do not have any principal protection and clients are on the hook for any losses, as well as high annual fees. Therefore, registered index-linked annuities are just right, combining a form of downside protection while allowing a client to generate greater upside potential and most do not have fees.

In 2019, we saw additional carriers enter the space with Athene and Symetra, while Great American launched another unique product. This year are likely to see multiple new players as more carriers jump into the RILA market. We are seeing product enhancements with the addition of participation rates, different types of downside protection and volatility control indices. Overall given the current market conditions, RILAs are positioned to have their best year yet by providing downside protection to turn a recession into a correction while allowing enough upside participation to capture the rebound.

1. https://www.winkintel.com/2020/03/fourth-quarter-2019-annuity-sales/

Related: In a World of Low and Negative Interest Rates, What Is an Investor to Do?