This has been a year where it’s hard to avoid making emotionally driven decisions. Inflation, rising interest rates, and declining stock market values have tested the resolve of everyone.

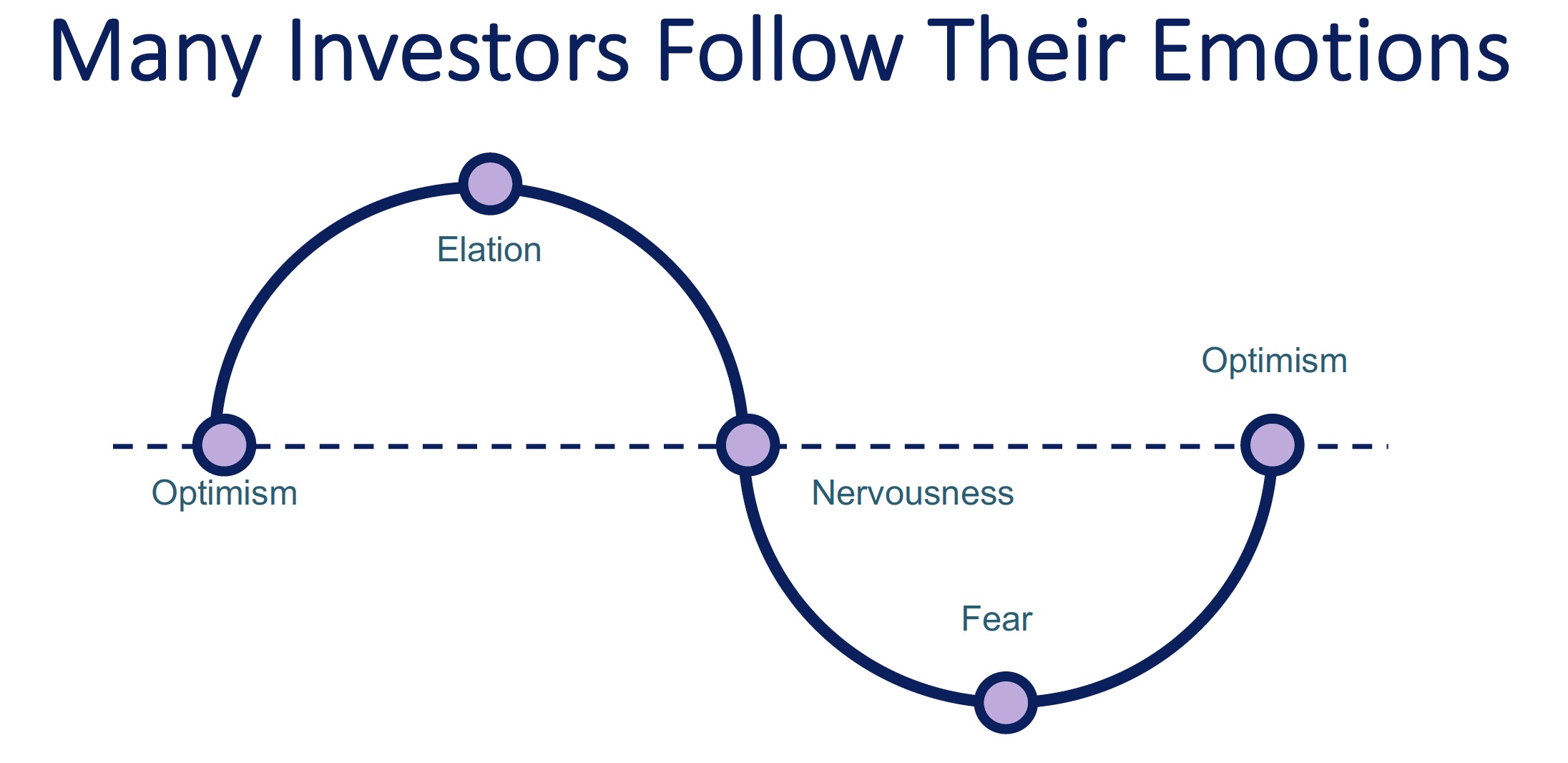

You’ve no doubt seen the chart below that depicts the cycle of human emotions relating to investment decisions. In the current environment, perhaps it’s reasonable to add chaos next to fear at the bottom of the cycle.

Investors crave certainty, but markets are uncertain. There are always potential risks when you invest. Patient investors have been amply rewarded for taking these risks. Since 1926, U.S. stock market returns have provided investors with average annual returns of around 10%. However, in any particular year, returns can be very high, very low, or somewhere in between.

Annual returns for the S&P 500 have been as high as 54% and as low as -43%. Over the entire 96-year timeframe from 1926-2021, the stock market has experienced positive annual returns 71 times and negative returns 25 times.

WHY PATIENCE PAYS

One of the most valuable investing skills you can have is patience. When you exercise patience, you are accepting the current condition as a stepping stone to the future. You understand that today is not the ultimate destination.

On the other hand, if you are impatient, your focus is entirely on the present. You can easily lose sight of your long-term aspirations and react emotionally to the noise of today.

Your emotions are heightened when there is a gap between your expectations and reality.

Almost a century of stock market data shows that stocks have historically provided annual returns about 7% per year above inflation. While every day isn’t a positive day in the market, you have an excellent opportunity to build wealth if you can avoid reacting to short-term noise.

You have to trust the market. Your financial advisor needs to trust it too.

Unfortunately, most of what passes for financial advice is just trying to outguess the short-term direction of the market. Some advisors want you to believe that they know what’s going to happen tomorrow. They don’t.

Certainty about the future is an appealing narrative in topsy-turvy times, but uncertainty is where investment returns come from.

HOW TO AVOID THE CERTAINTY TRAP

Being a successful investor requires that you adopt a tolerance for uncertainty. This helps you avoid the trap of “knowing” what’s coming around the corner. You don’t know; you can’t know, and no one else knows either.

In times like this, it’s critical to be on guard against all those who predict what comes next. There’s an endless supply of enticing stories about what might happen in the future replete with reams of data to support the conclusion. The fact is, markets don’t work that way. Decades of research show how stocks include all known information in market prices.

It’s difficult to stick with your financial plan when markets are falling. Commit to being a long-term investor. That’s the most reliable way to accomplish what matters most to you. Start there. Ready for a real conversation?

Related: The Philosophy of Not Freaking Out