Written by: David Waddell | Waddell and Associates

The S&P 500 reclaimed the zero bound this week, having now fully recovered, and then some, from Trump’s Liberation Day macro shock. Markets care more about trends than levels. Positive GDP growth in the second quarter will more than offset negative GDP growth in the first quarter, negating recession calls. First quarter corporate earnings handily outperformed expectations increasing the probability that they will handily outperform expectations in the second quarter as well. And while the first half of the year seemed dominated by depressants such as DOGE cuts, deportations and Tariff tirades, the market seemingly recognizes that the second half of the year will provide anti-depressants in the form of tax cuts, rate cuts and tariff cuts. At this moment the scales have rebalanced, and markets have rationalized back in line with our annual expectations. Much has changed since the beginning of 2025, but as we near its midpoint, our 2025 Outlook forecasts… have not.

This week, the S&P 500 reclaimed the zero line, emerging unscathed from the tariff tornado. Despite the histrionics year-to-date, the markets stand within range of where we projected them to be in our 2025 outlook.

As anticipated, stocks are slightly higher despite the Mag 7 becoming the Lag 7, the sectors most closely aligned with Trump’s American re-industrialization ambitions (including industrials and financials) have outperformed, and the yields on longer-dated Treasuries remain lofty, supported by resilient economics.

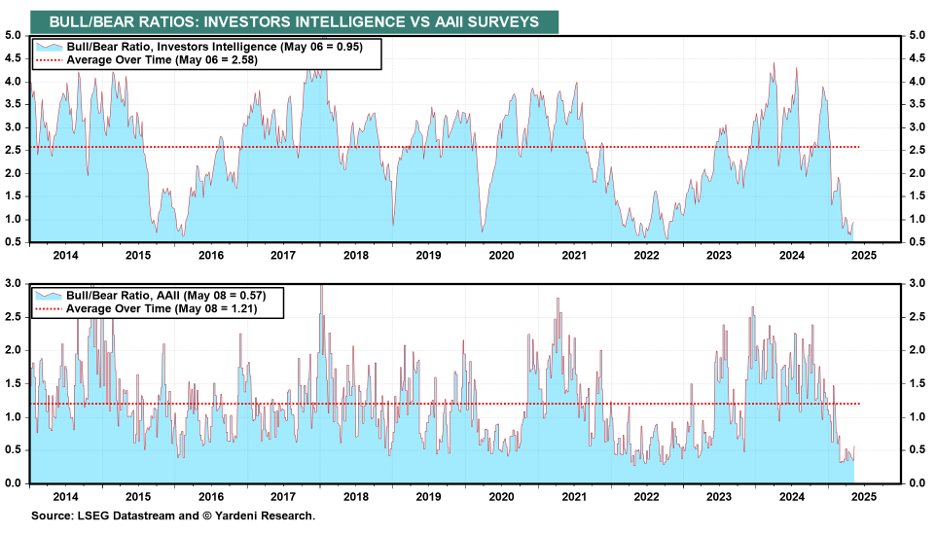

The heightened animal spirits that concerned us most entering the year have also reset. The following chart divides professional and retail investor bulls (optimists) by the bears (pessimists):

Even after a V-shaped recovery in stocks, investor sentiment remains well below its long-term average, particularly for professional investors. As sentiment has plunged, so have economic and earnings expectations, lowering the bar for upside surprises offering support for markets as we near the year’s midpoint.

In sum, the economy and markets have once again proven their resiliency despite the most recent macro shock called “Liberation Day.” From here, the combination of lower sentiment and fundamental expectations mixed with the three cuts to come should ratify early April’s lows.

Cut #1: Taxes

Tax cuts provide economic stimulus. This week, the House republicans within the Ways and Means Committee approved its 389-page version of the tax reconciliation bill. Their version includes the permanent extension of the 2017 TCJA legislation “status quo,” but also tacked on an another trillion or so in tax relief—including accelerated depreciation for businesses, an increase in the SALT deduction for homeowners, tax elimination on tips and overtime for consumers, and more relief for parents and seniors.

Among several other provisions was the introduction of the “MAGA account,” which aims to encourage tax exempt savings for kids under the age of 18. The House budget committee now has the bill, anticipating House passage before the month’s end. The Senate will then begin their approval process, calibrated towards a camera worthy July 4th signing for President Trump.

Cut #2: Interest Rates

Rate cuts provide economic stimulus. April’s Consumer Price Inflation data, released on Tuesday, pleasantly surprised investors. Over the past twelve months, prices have risen a mere 2.3%, the lowest level of annual inflation since February of 2021 and well within range of the Fed’s 2% target. This should add comfort for the Fed that absent temporary tariff impacts, underlying inflation rates remain in descent.

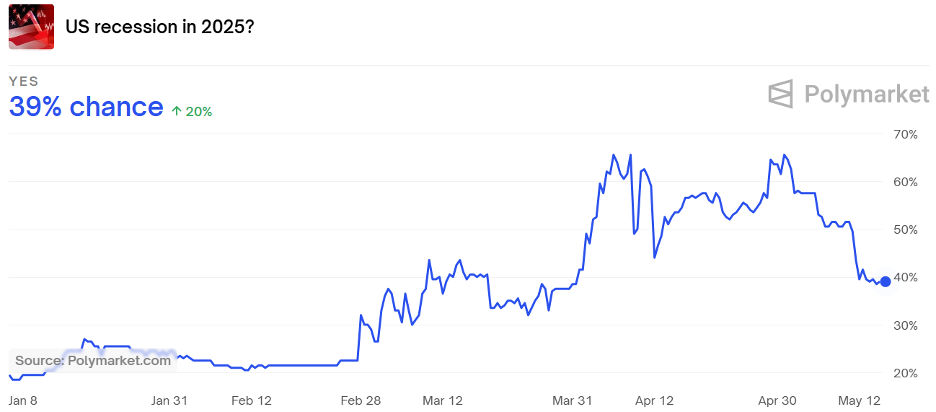

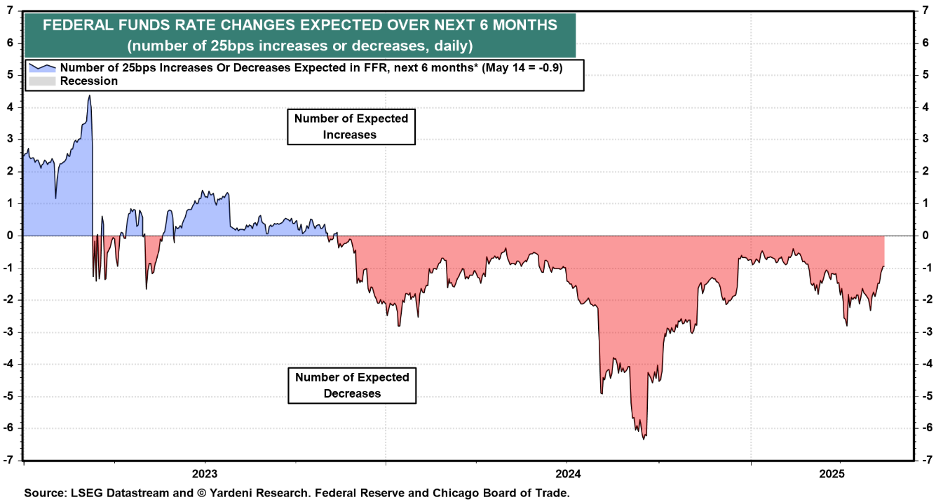

Conversely, as we mentioned above, the hard economic data has proven surprisingly resilient. The Fed’s GDPNow model forecasts a 2.4% GDP growth rate for the second quarter, well above the negative .3% registered in the first quarter, distorted by the surge in imports. Given the economic drag associated with higher tariffs, tariff reductions simultaneously reduce recession odds and rate cut expectations as seen below:

Investors have reduced recession odds from near 70% after Liberation Day to less than 40% while Fed Funds forecasters have cut their expectations to only one rate cut over the next six months—compared with three just a month ago. However, even with tariffs lingering in the foreground, the market expects the Fed will cut rates two more times, for three total, between now and May of 2026.

Cut #3: Tariffs

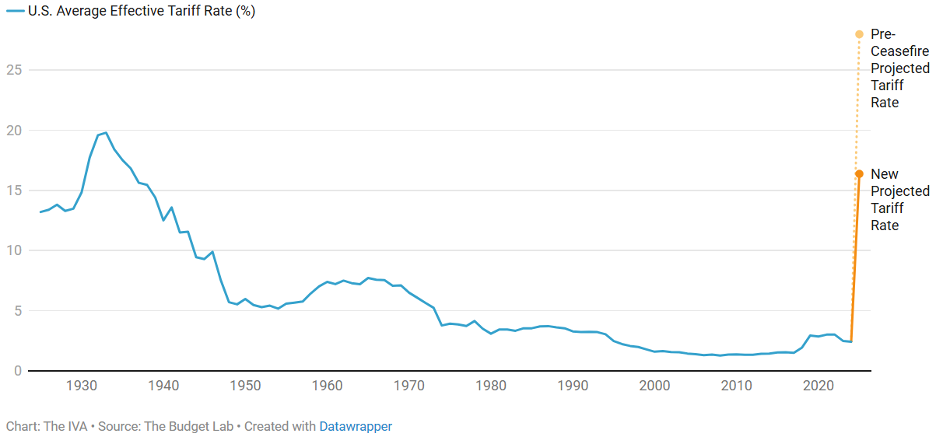

Tariff cuts provide economic stimulus. While it seems paradoxical to highlight Trump’s Tariff cuts as a source of support given that he raised them from 2% to nearly 30% last month, they have also fallen by 40% since Liberation Day.

Markets care more about trends than levels, and at this point, any trade deal qualifies as economic stimulus, like tax cuts and rate cuts. President Trump has recently reached an agreement with the UK, de-escalated massively with China, and secured a $600 billion investment from Saudi Arabia.

According to Kevin Hassett, the Director of the White House National Economic Council, we should see 24 more trade deals in short order. Each of these represents mini-stimulus injections for the US economy.

We forecast that Trump’s tariff campaign would result in a 10% increase in tariff rates overall in 2025. Based upon the UK deal as a blueprint, the 10% universal tariff rate will likely remain post trade negotiations worldwide. If so, GDP growth, inflation rates, and corporate earnings growth should all support mild stock market appreciation and longer-term interest rates within these levels into year end.

Related: Brace Yourself: The Real Impact of Tariffs Starts Now