Risk is much simpler than what you see on TV – here’s why:

If you watch TV, chances are your perception of risk has been incorrectly shaped by the media. Their definition of risk is warped by their commercial need to keep you watching. What they want you to believe is that volatility equals risk.

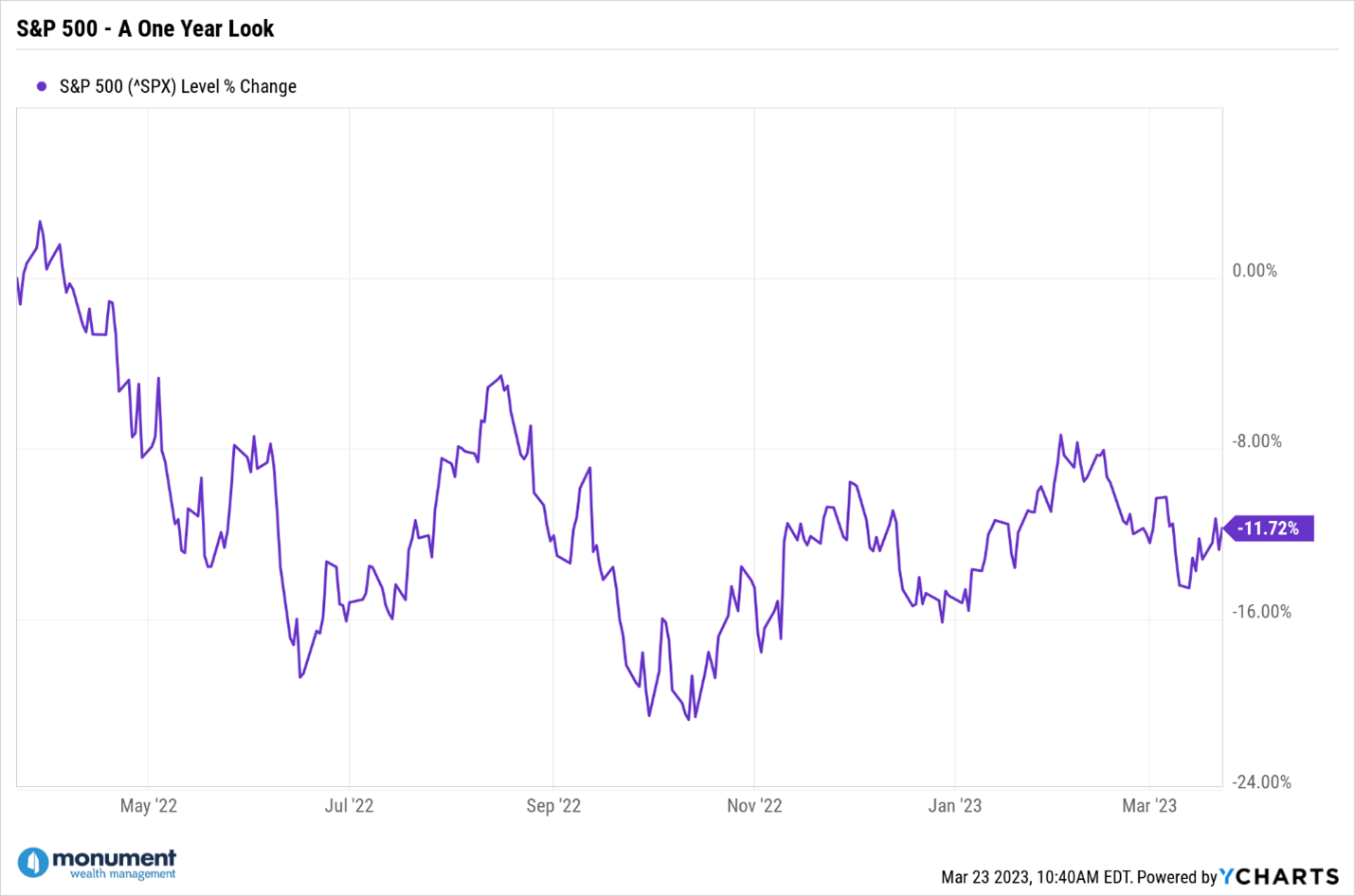

They want you to see this:

Now, this is the right way to view VOLATILITY, but the wrong way to view RISK.

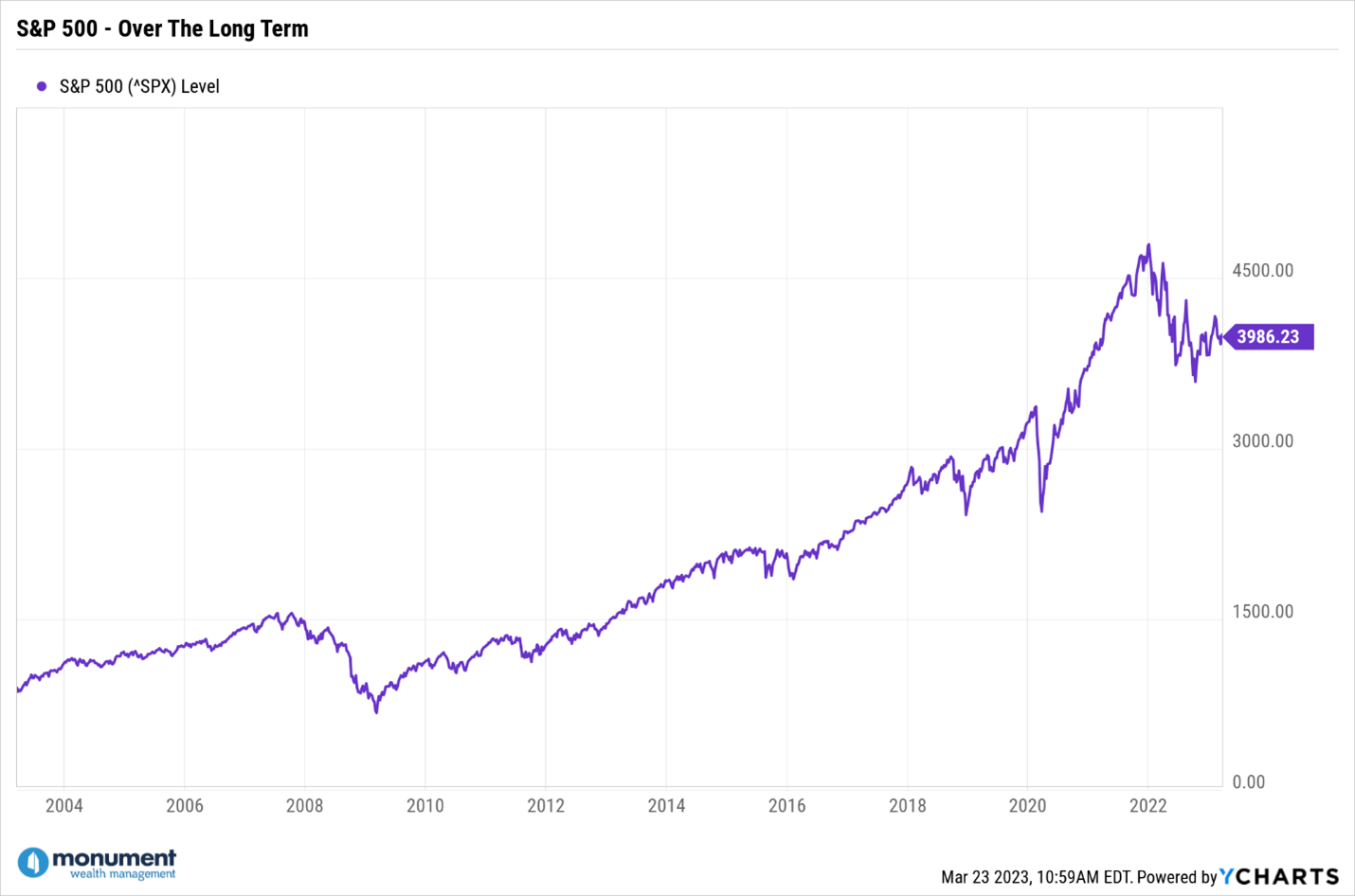

What you NEED to see is this:

When you look at it this way, you see that risk, when managed properly, can actually make you wealthy.

There are two ways an investor needs to see RISK.

TWO WAYS. Period. Well, at least that’s my OPINION. But still, just two:

#1: The risk that you lose all your money.

#2: The risk you make a decision where the outcome reduces the probability of attaining your goals.

I always like to make sure people remember the words “possibility and probability.”

Is #1 possible? Of course.

Is it probable? I say it’s very low…as close to zero as possible.

Why? The long-term diversified market (let’s call that the S&P 500) has always been positive.

Need more proof?

Read Jeremy Siegal’s book, “Stocks for the Long Run” which was published in 1994 and is now in its 6th edition.

Are there PERIODS of time the S&P 500 was down? Of course, but that’s volatility. Remember, risk is about LOSING something…real losses.

#2 is much more likely because now you are talking about DECISIONS with human input (also referred to as meddling).

Risk is often introduced by investors themselves and generally rears its head during periods of downside volatility through statements such as, “I should adjust to something more conservative by reducing my equity exposure.”

It creates a paradox – in an attempt to reduce risk, risk is actually introduced.

Have a Strategy to Deal with Risk and Volatility.

You can have a solid strategy to deal with both risk and volatility by creating and following a plan you create when you are not experiencing or dealing with either.

Your long-term strategy should be set up to give you the highest probability of achieving your goals. To do that, it’s imperative to reduce or even eliminate the RISK of making bad decisions by removing the need to actually MAKE decisions in the first place (since I’ll argue the other long-term risk of losing all your money is essentially non-existent).

Your short-term strategy should be managing your need for the portfolio to provide cash during times of increased VOLATILITY. Having cash makes you financially unbreakable because you don’t have to sell assets at depressed prices during market downturns. That would be an example of a decision that causes the loss of money – which is, again, the definition of risk.

Here’s a way to see it:

If you had topped off 18-months of cash reserves at the beginning of 2022, you’d STILL be living out of those reserves, eliminating any forced liquidation of assets to maintain the same lifestyle…making the downturn irrelevant and keeping the risk of not achieving your long-term goals out of the picture. THAT’S being financially unbreakable.

Don’t get it twisted – the media wants to define volatility as risk. It’s not. Always remember that.

This first appeared on Monument Wealth Mangement.

Related: Why February Is a Weak Month for Investment Returns