Written by: Jack Manley

With greater attention being paid to younger Americans by the investment management industry, financial professionals are increasingly curious about the “what”, “why” and “how” of Millennial money management.

A major component of this conversation is understanding how and where younger Americans are investing, useful information when aiming to make a potential working relationship more fruitful. Below are a number of key takeaways on this front:

- The “democratization” of investing has brought money off the sidelines

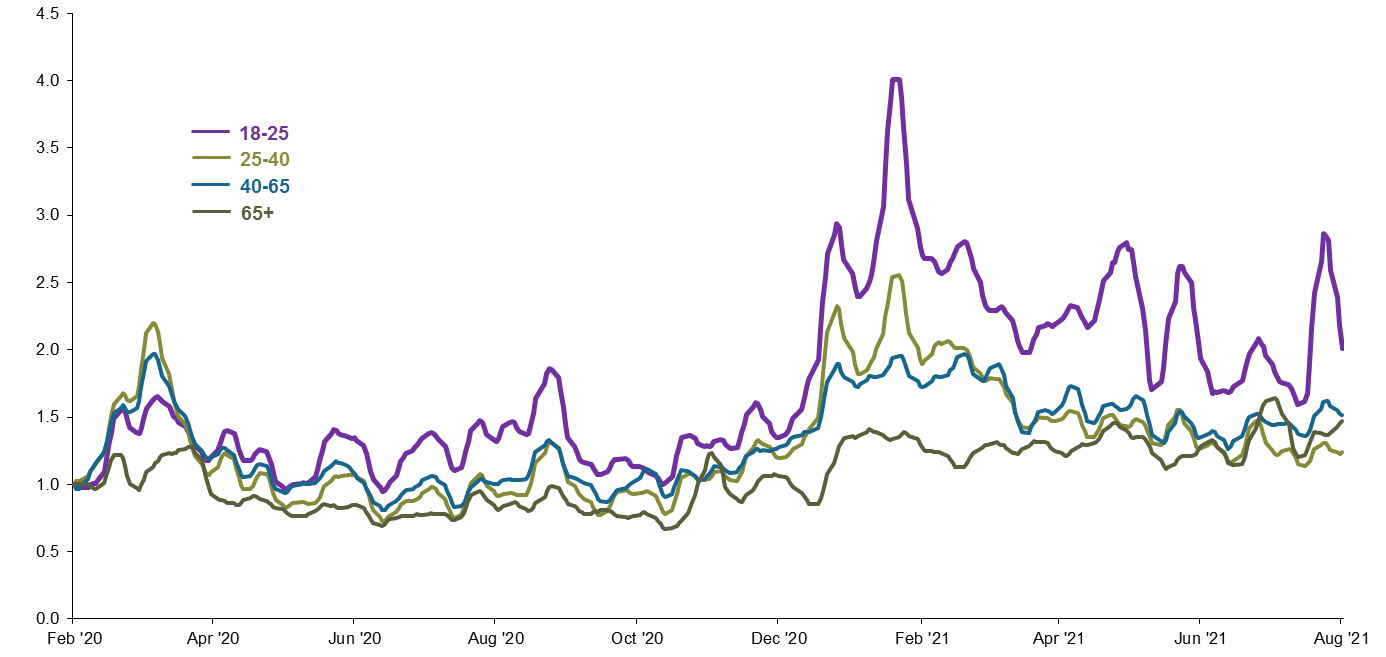

As shown in the chart below, younger investors saw the greatest change in investment activity relative to pre-COVID 2020. Some of this is attributable to increased downtime during the pandemic; some is attributable to government stimulus; and some to the “democratization” of investing through low-cost app-based brokerage services – in fact, during the frothier period of 1Q 2021, the four major online brokerages accounted for nearly 30% of total U.S. equity market volume.1

- Risk is king and investors are willing to get creative

Equities are the largest holding for both Millennials and Gen Z, with a particular focus on tech (likely due to both familiarity and perceived growth potential). However, risk appetite extends beyond traditional assets: cryptocurrency investing is becoming more mainstream, with 40% of investors aged 18-40 reporting a crypto-holding; and options are playing a bigger role in portfolios, with just under one-third of investors aged 18-40 reporting an option position. 2 In fact, some of the spikes in investment flows seen below, which often coincide with the “meme-stock” frenzy, are likely tied at least in part to options trading.

- ESG matters, but not exclusively

ESG – Environmental, Social and Governance – is becoming more relevant in the investment world. However, despite being more politically engaged than in the past, younger investors are less interested in ESG than some may assume. 3Research shows that some of this could be due to a lack of understanding of what ESG is, although as education increases, this issue should fade. Nonetheless, it also seems clear that many younger investors are unwilling to give up performance to achieve social goals, especially given stretched valuations and the massive student debt burden. In other words, ESG integration may be considered a nice feature, but it is not a priority as of yet.

As the investment management industry gains greater traction with Millennials and Gen Z, the ability to tailor investment solutions to generational needs and wants will be critical. Through increased flexibility, an acceptance of nontraditional asset classes and the understanding that generations are not homogeneous, financial professionals will serve their future clients, and their practices, well.

Younger Americans have been more active in investing in 2021

Investment flows by age group, indexed to 100, weekly

Related: What Is the Cost of Extreme Weather?

1 J.P. Morgan Index Research, based on company filings and SEC 606 disclosures. Brokerages are: E*TRADE, Schwab, TD and Robinhood.

2 Based on April 19, 2021 survey conducted by the Motley Fool of 1,400 of American adult stock investors.

3 Harvard University Kennedy School Institute of Politics, March 2021 survey of 2,513 Americans under the age of 29. 36% of respondents reported themselves as “politically active.”