Written by: Jack Manley and Sahil Gauba

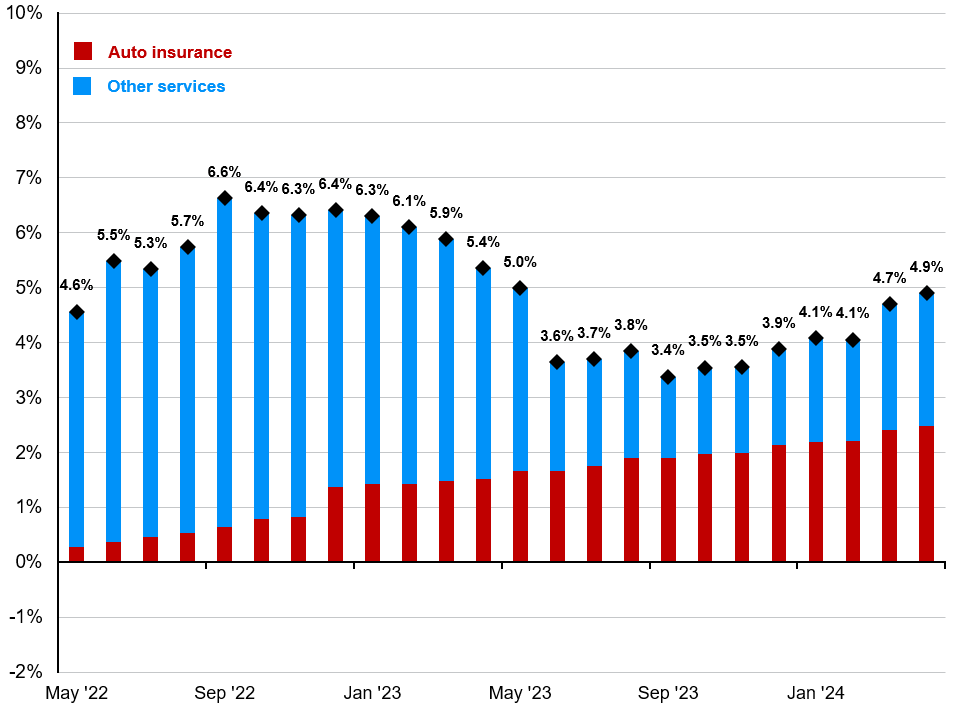

April’s CPI print came in as expected, a welcome sign to markets struggling with hotter-than-expected economic data. Still, CPI inflation remains uncomfortably high (and “sticky”) for the Federal Reserve. This stickiness is due to a shift in inflationary forces: service inflation now dominates overall inflation, replacing the goods inflation caused by supply chain issues in the aftermath of COVID. The ex-shelter “core services” index, or “super core” inflation, has been especially troublesome: the latest read of 4.9% y/y is much higher than the headline CPI print.

Within that “super core” index, one small category (only 3% of the overall CPI basket) has been making outsized contributions: auto insurance. Its most recent annual increase of 22.6% was the strongest this cycle and accounted for half of April’s “super core” inflation. For many investors, this is puzzling. Why has auto insurance become a critical driver of U.S. inflation? The answer comes in multiple parts.

- Increased vehicle costs: Initially, post-COVID supply chain disruptions and reduced production spiked vehicle prices through 2022; current labor shortages and increased manufacturing costs (especially as cars have become more technologically advanced) have kept prices elevated. Since 2019, the price of new vehicles in the U.S. has soared by 22%, making replacing the aging vehicle fleet more expensive and driving up auto insurance premiums.

- Higher claims: Despite newer vehicles featuring advanced safety technologies, car fatality rates increased by 10% from 2019 to 2022 (the latest available data). This rise in severe incidents has increased costs associated with repairs, replacements and legal liabilities. Factors contributing to this trend include inexperienced drivers on re-congested roads and psychological impacts, like increased isolation-driven aggression post-pandemic.

- More uninsured drivers: The cost of auto insurance has rendered it unaffordable for many, leading to a rise in uninsured motorists, from 11% of drivers in 2019 to 14% in 2022 (the latest available data). This shift burdens insured drivers with higher premiums to cover the risks posed by the uninsured.

- Regulatory delays in rate adjustments: Auto insurance rates are controlled by state regulations, requiring insurers to obtain approval for rate increases based on loss trends and cost projections. The pandemic's impact on driving patterns led to a backlog of unprocessed rate increase applications, especially in larger states, delaying the reflection of these higher costs in consumer policies.

For investors, the good news is that many of these factors seem to be improving, not worsening. Moreover, interest rate policy has little baring on these issues, and auto insurance has minimal influence on the Fed's preferred inflation measure (PCE), which accounts for auto insurance differently than CPI. As a result, despite robust “super core” inflation, the Fed should still feel comfortable with cutting rates this year.

Contributors to core services ex-shelter CPI inflation*

Contribution to y/y % change in custom CPI index, non-seasonally adj.

Source: BLS, FactSet, J.P. Morgan Asset Management. Contributions mirror the BLS methodology on Table 7 of the CPI report. *Core services ex-shelter CPI is a custom index using CPI components created by J.P. Morgan Asset Management. Data are as of May 15, 2024.

Related: Is Private Credit Growth Cannibalizing the High Yield Market?