Written by: Nate Tonsager

England is having a tough time adjusting to higher rates – just Google “UK debt crisis 2022”. It’s admittedly a strong statement, but Google works on headlines, and I find that headlines tend to use phrases like that frequently.

Bloomberg, CNN, NY Times, etc., are all writing and/or talking about it, so I won’t spend much time discussing the gritty details, but I would recommend looking into it. It’s interesting stuff – for investment dorks and non-dorks alike.

Here’s a Quick Summary on the UK Debt Crisis: A Gilt-y Moment

- The UK government announced broad tax cuts. This means the government will likely need to borrow more to maintain their current spending levels, especially since they are subsidizing higher energy costs to help soften people’s pain this winter.

- The interest rate on 10-year Gilts (UK government bonds) spiked on the announcement. Anticipated increases in future debt levels for the UK government, lead investors to demand higher interest rates to lend money to an already indebted country.

- In 8 days (9/19/2022 to 9/27/2022), 10-year Gilts went from 3.16% to 4.47%. That’s a +41% jump… in 8 days… THAT’S FAST!

- The increased borrowing costs over such a brief period, led to liquidity concerns across the economy and financial markets reacted negatively.

- The UK government backtracked on their proposal, the prime minister resigned on 10/20/22 after just 44 days in office, and the markets seemed to have calmed down.

Coincidence? Impossible to know, but I think it’s safe to assume the financial markets’ temper tantrum had some impact on the political decisions.

I’m hopeful for a positive resolution, but it’s important to note that the UK economy almost had real debt problems in about a week. All thanks to the spike in borrowing costs that resulted from proposed fiscal policy changes.

It’s been a recurring theme of mine this year, but all markets seem to be moving insanely quick.

What can investors do when markets are whipping around like this?

Answer: Clean up your “Financial House.” In other words, be prepared.

Dave Armstrong recently wrote about how financial market commentary should be categorized into one of three buckets: 1. Interesting, 2. Actionable or 3. Both.

That said, I’d label the UK story as “Interesting” only. No portfolio actions to take, but it is a good reminder about managing your debt costs, especially in a rising interest rate environment. Rates seem unlikely to go back to zero anytime soon. That statement isn’t “Interesting,” everyone seems to know that. But the transition to higher interest rates does present some “Actionable” items.

People, investors, business owners, and executives need to be prepared for fast moves in financial markets and ensure their “Financial House” is in order. They need to be financially unbreakable, so if a high-speed move occurs, they are ready.

A few good first steps to kick off the “house cleaning”:

- Check your cash levels and income flow. If your cash reserves are feeling uncomfortable, consider replenishing them.

- Review your investments’ long-term goals/priorities and update them if necessary. If they have changed, you should review your asset allocation to make sure it’s still appropriate for you.

- Check your debt levels and the cost of carrying that debt now that interest rates are higher. And if you don’t have a final payoff plan for your debt, work to create one.

How Consumers are Navigating Record Debt Levels

Let’s focus on the final bullet point regarding debt. According to the New York Fed’s website, as of 6/30/2022:

- Total household debt rose +2% in the second quarter, the largest increase since 2016.

- Total debt is now $16.15 trillion with mortgage balances totaling $11.39 trillion of that.

- Credit card balances were up +13% year-over-year, the largest increase in more than 20 years.

I’ve started to hear some analysts talk about the overall levels of consumer debt. Yes, there is a lot of nominal debt out there, but that isn’t necessarily a terrible thing – even as the Fed remains committed to hiking rates and pushing lending costs up.

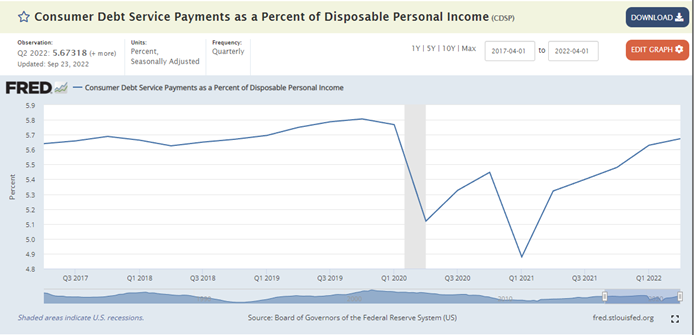

If you can service that debt within longer-term payoff plans, borrowing funds can be a useful part of your wealth plan. However, you must be able to manage it. Look at this 5-year chart from the St. Louis Fed’s website as of Q2 2022. This shows the percent of consumer disposable income (income after tax) that is being used to pay their debts.

While overall debt may have grown rapidly last quarter, the overall servicing of that debt as a percent of after-tax income is about even with pre-pandemic levels when interest rates were near zero. Thankfully, it appears consumers have been doing a good job so far of managing their income/cash flow and paying their debts despite interest rates more than doubling since mid-March.

Having a Plan is the Best Way to Prepare

While the UK’s situation might not present anything “Actionable” from an asset allocation standpoint, it does provide a good reminder to review your debt.

Keep an extra close eye on your variable debt (think of credit cards, lines of credit, margin accounts, etc.) which can have a bigger effect on cash flows. If interest rates continue to increase, variable debt becomes more expensive as the borrowing costs go up too. Debt that was previously manageable can suddenly become unsustainable.

Most importantly make sure you have a plan to payoff that debt. Eventually the bill does come due, and you should be ready for that time. If you don’t have a plan, make one, or contact your wealth advisor to discuss ways to not only effectively service, but ultimately payoff your debt.

Debt is a key piece of your wealth plan and managing it has become even more important in a world of higher interest rates. And it’s vital to be prepared when markets are moving this fast, so you don’t get caught flat-footed like the UK almost did.

Related: What if We Are Not in a Recession?