Written by: Gabriela Santos, Sylvia Sheng and Patrik Schowitz

After years of a hands-off approach to its new economy sectors, China surprised investors with several new regulations. Since February all-time highs, the MSCI China is down 31%, with internet stocks down 40%. For select sub-sectors, recent regulations have derailed long-term fundamentals; however, for much of the Chinese investment universe, the long-term positive growth outlook has not changed, while “sell now, ask questions later” behavior has dragged down share prices as a result of a short-term hit to sentiment. It is key for investors to sift through the noise, identifying both risks and opportunities created during this period of volatility.

What is happening:

- Regulatory tightening is targeted, mainly focused on education and internet sectors, rather than a broad-based tightening campaign affecting the whole private sector (like in 2018).

- For the education sector, regulations aimed at private after-school-tutoring were onerous, making these companies largely uninvestable. The direct economic impact is likely limited, with the market representing US$100bn or 0.7% of China’s GDP.

- For the technology sector, regulations have been lighter with the aim to place some guardrails around these companies and close some regulatory loopholes, rather than fatally impair the sector given it represents 3% of China’s GDP and is seen as China’s path to prosperity.

- These regulations are closely related to China’s long-term policy initiatives rather than a coordinated attack on the private sector. Chinese regulators emphasized this message late last week: goal is to promote healthy industry development, with China remaining committed to capital market reforms and further opening up.

- Risk that foreign investors are over-interpreting the recent regulatory changes as a move to prioritize social policy goals over economic growth. It will take time for investors to get a sense of the balance between profit making and social responsibility for private companies in China and thus adjust earnings estimates accordingly.

What to look for:

- End of regulatory tightening campaign: 2018’s regulatory cycle lasted about 12 months, thus the current round of regulatory tightening is unlikely to end in the short-term, unless there are significant growth concerns (which is not expected).

- Changes in macro policy: The economic impact is likely to be modest and thus monetary easing should remain targeted, but any signs of a more sustained policy easing cycle could provide support to Chinese equities.

- Bottoming in valuations: in 2015 and 2018, the MSCI China de-rated to a 8-10x forward P/E ratio. Currently, the multiple is at 15x, thus there is risk of further de-rating as investors build a risk premium for the new uncertainty.

What to do:

- Broadly speaking, this short-term noise has not fundamentally changed the long-term investment opportunity in China based on technological innovation, growth of the domestic consumer, and the development of local capital markets.

- Chinese assets’ roles in global portfolios should only increase over time, given their growth, income and diversification benefits.

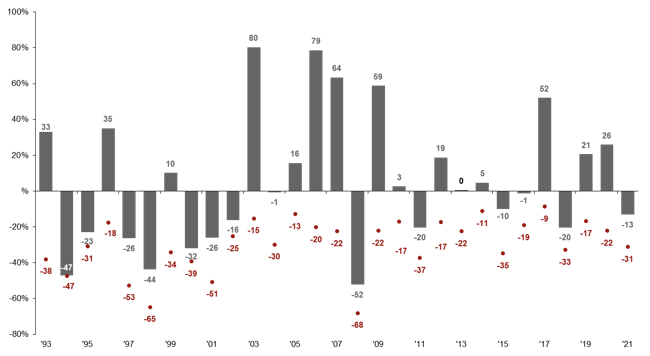

- However, this is a reminder that Chinese equities do come with a higher level of volatility than other markets: an average annual “correction” is over 20% and during periods of regulatory reform (every three years or so) sell-offs can be greater than 30%.

- This higher volatility does limit the optimal size of Chinese equities in portfolios, but also creates significant opportunity.

- Investing in China the right way is key: with a portfolio of companies, listed both offshore and onshore, with a manager that has a local presence and can do long-term fundamental analysis.

Chinese equities come with higher volatility than other markets

MSCI China intra-year declines and calendar year returns, local currency, average intra-year drops of 29.7% and annual returns positive in 15 of 28 years

Source: FactSet, MSCI, J.P. Morgan Asset Management

Related: How Should Investors View the Recent Chinese Equity Sell-Off?