Written by: Emma Wall | Hargreaves Lansdown

-

Investors have favoured cash and tech stocks year to date

-

But the outlook for rates is beginning to turn, and recession concerns are rising

-

Diversification is key for a resilient portfolio

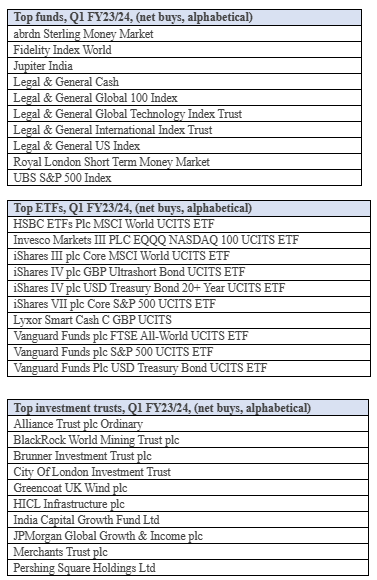

For HL clients – and many UK retail investors – this year has been a two-horse race when it comes to asset allocation. The quintessential bar-bell approach – all risk and no risk – of cash and tech stocks. Yesterday’s third quarter trades on platform revealed investors have been loading up on plenty of money market funds and ETFs, alongside NASDAQ and tech trackers and a few US equity and developed market options – also chock full of big tech. Cash has an important part to play in your financial resilience.

Three months’ salary is the rough guide for your rainy-day fund, to ensure you can weather personal uncertainty. It can also be a great tactical play in a portfolio – in a rising rate environment, with market volatility you are rewarded for keeping your powder dry. But it has limited long term strategic asset allocation benefits, particularly if you are still in the accumulation stage i.e. not yet retired – as retirees should be looking to finely balance capital preservation and income, but care less about growth. Where cash savings offer you personal resilience, an investment portfolio of just cash and big tech is unlikely to weather market uncertainty. Cash just doesn’t pay over the long term – after a market slump, it takes your money twice as long to recoup losses, with cash versus riding the stock market through the downturn and up the eventual rally.

Asset allocators are beginning to tentatively look beyond the current market environment. While the expectation is the momentum trade could continue in the short-term, a highly concentrated portfolio is not sensible. According to data from the Federal Reserve collated by JPMorgan, over the past 40 years, the median length of time between the last rate hike and the first cut is eight months. In a falling rate environment, you want bond funds – witness the 30-year bull run in recent history, and equities, as the falling cost of capital spurs capex and dividends (assuming inflation continues its downward trajectory) offer a real yield and a boost to total returns. In that environment, it is worth noting what is currently undervalued– currently Japan, the UK and emerging markets on a regional view, and consumer stocks, REITs and financials for global sectors.

It is worth noting that the transition between the stages in the market cycle is rarely seamless. There will be volatility, some assets will fall in value. The triggers will be complex – the devastating casualties in Israel have a market impact, or it may be rising oil prices, a political misstep, worse than expected jobs or growth figures, or simply stubborn inflation. And we know that perfect timing is near impossible – see the recent annual Morningstar Mind the Gap report show a negative investor return gap over the five years to the end of June 2023, meaning that investors' timing of entries and exits detracted value compared with a hypothetical buy-and-hold investment. But across multiple data points – versus inflation, in a rising market, in a downturn, over the five worst slumps of the past 100 years – for long-term financial goals, investing delivers better returns than cash. It is therefore better to be early in your trade and sit out the transition volatility if you have financial goals that are more than five years away. Take gains from the US and allocate to the UK and emerging markets. Put cash into strategic bond managers which have the flexibility to take advantage of opportunities when the rate cycle starts to turn. And, if all of this is too time consuming or complicated, outsource to a multi-asset fund. One thing is certain in this uncertainty, eventually this trade will change, and it is better to be ready for it.

If the top buys for the past three months were a rather niche puzzle – where you had to determine the state of the global economy based on fund flows, this quarter would be a tricky one. Short-dated bonds? The outlook for rates must not be certain over the medium term, clouds on the horizon then. And plenty of cash funds – confirming that uncertain outlook theory, and indicating current rates are high. But wait, what else are investors buying? Tech? Alternative energy? Growth-biased US indices? Signals of a buoyant market surely. Even with the cheat-sheet of economic data, it’s a mixed bag.

The flows below – and indeed many investors, and the majority of the market, are assuming the perfect combination of slowing growth, but not quite recession, clearly signalled central bank policy, which includes rate cuts – but not dramatic ones out of dire necessity. Inflation must fall, but employment must not – not too much anyway. It is a classic goldilocks scenario, difficult to pull off, but priced as a certainty. If this does happen, expect money market funds, which have dominated flows year to date, to fall from the top 10 top buys rapidly, as rates fall and inflation fall and both bonds and equities gain appeal. Praise must go to those buying investment trusts – providing some diversification to the cash-and-tech story. Here we see investors buying into UK dividends – currently undervalued on a long-term view – as well as infrastructure, mining and green energy.

Related: Driving the Democratization of Personal Wealth Building