How do Millennials choose stocks?

Millennials like stocks. Why shouldn’t they? Stocks only go up, right Dave Portnoy?

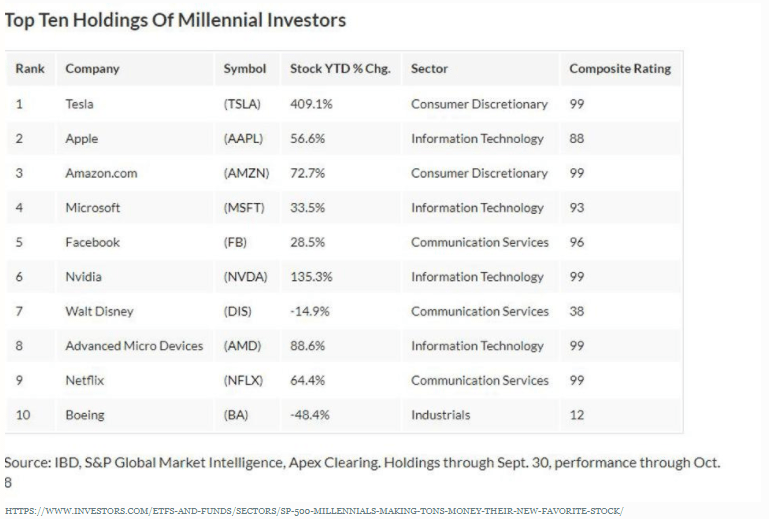

I recently reviewed the latest survey from Apex clearing, S&P Global Market Intelligence and Investors Business Daily. Each quarter, they review account holdings of a large group of Millennial generation investors, and analyze which individual stocks are the most popular in their portfolios. Below, you can see a chart of the Top 10 as of the end of last month, out of their full list of the top 100 stock holdings of this group.

Young investors and stocks: awesome!

Before I specifically deliver some observations from that latest list, let me say this about millennials and stocks: I am thrilled that younger folks are learning about investing while they are still in the earlier stages of their retirement saving. There is an entire generation of Baby Boomers that wishes they had the opportunity to invest in such transparent, liquid markets at such a low cost. But in the 1980s and 1990s, the internet and investment markets were in a nascent stage versus today.

The issue for all investors, including millennials, is that they have not known any serious hardship as investors since they started investing. Market declines have been so quickly-remedied since 2008, you could excuse this generation for thinking that stocks only go up…but when they go down, they come right back.

Index-mania is out there: but there’s a cure

There is also the issue of “index-mania” I have described before. While it is possible that investing in the S&P 500 Index is the only strategy a young investor will ever need until they approach retirement, that is not the lesson from history. In fact, I would say that strategy is on seriously borrowed time.

That implies that investors have been educated early about investing, but that education is woefully incomplete. Essentially, it leaves out all of the bad parts they should be learning about. Like how to expand your “opportunity set” of potential investments beyond what is currently popular. And, how to incorporate investments in your portfolio to take the place of bonds, since bonds are now a low-return, high-risk investment.

The current investment climate will last as long as free money from the Fed and investor confidence does. Then, it will fall apart, quickly. As long as an investor knows that, they are fine.

Investing is better when you can explain to yourself what you are doing

Investors need to be careful when they assign reasons to why a stock is going up. Many of the stocks on this list are not just going up because they are innovative businesses. They are also going up because buyers are more urgent to buy it than sellers are to sell them.

In other words, don’t confuse good businesses with an environment where money is cheap, and it causes stock prices to fly higher for non-fundamental reasons.

Finally, some of the stocks on this quarter’s list are falling like a fading former number one hit on the Pop music charts. At some point, as in past market cycle tops, the Top 10 could become the bubble 10. Remember, the Nasdaq NDAQ +0.7% was all the rage in the year 1999. Not long after, it was down over 75%.

Takeways

Assign a reason to every investment decision you make. And, have it be part of a coordinated portfolio plan. In addition to being excellent investing “hygiene,” it might just save you from some decisions you would otherwise live to regret.