Written by: Cohen & Steers

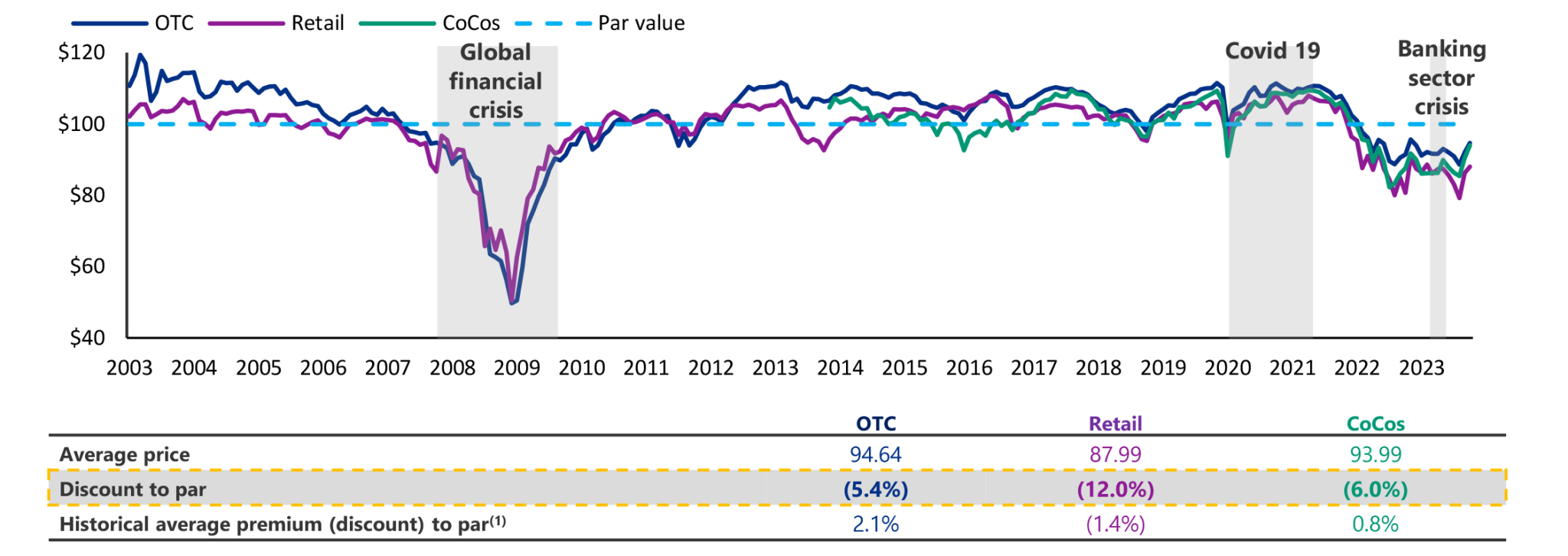

1. Discounts to par value represent uncommon value

Preferreds are trading at discounts to par value not seen since the global financial crisis, representing attractive total return opportunities. Current discounts represent a substantial capital appreciation opportunity for investors, in our view.

Historical average prices by preferreds market

March 2003–December 2023

At December 31, 2023. Source: ICE BofA, Cohen & Steers.

Data quoted represents past performance, which is no guarantee of future results.

(1) Average since March 2003; average for contingent capital securities is since January 2014 inception. (2) Weighted-average rating from Standard & Poor’s. The information presented above does not reflect the performance of any fund or other account managed or serviced by Cohen & Steers, and there is no guarantee that investors will experience the type of performance reflected above. There is no guarantee that any historical trend illustrated above will be repeated in the future, and there is no way to predict precisely when such a trend will begin.

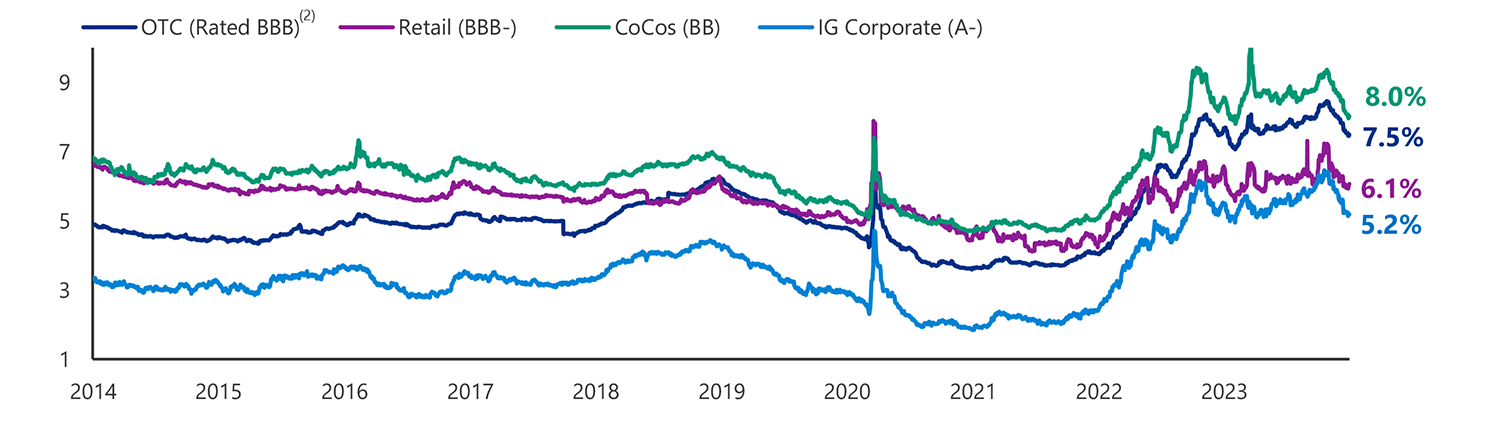

2. High-quality preferreds offer some of the highest yields in fixed income

Issued primarily by investment grade companies, preferreds offer 6-8% yields, considerably greater than investment-grade corporate bonds. Their dividend reset structures can also provide advantages in sustained high-rate environments, a benefit not found in typical fixed income investments.

Yield to maturity (%)

January 2014–December 2023

At December 31, 2023. Source: ICE BofA, Cohen & Steers.

Data quoted represents past performance, which is no guarantee of future results.

(1) Average since March 2003; average for contingent capital securities is since January 2014 inception. (2) Weighted-average rating from Standard & Poor’s. The information presented above does not reflect the performance of any fund or other account managed or serviced by Cohen & Steers, and there is no guarantee that investors will experience the type of performance reflected above. There is no guarantee that any historical trend illustrated above will be repeated in the future, and there is no way to predict precisely when such a trend will begin.

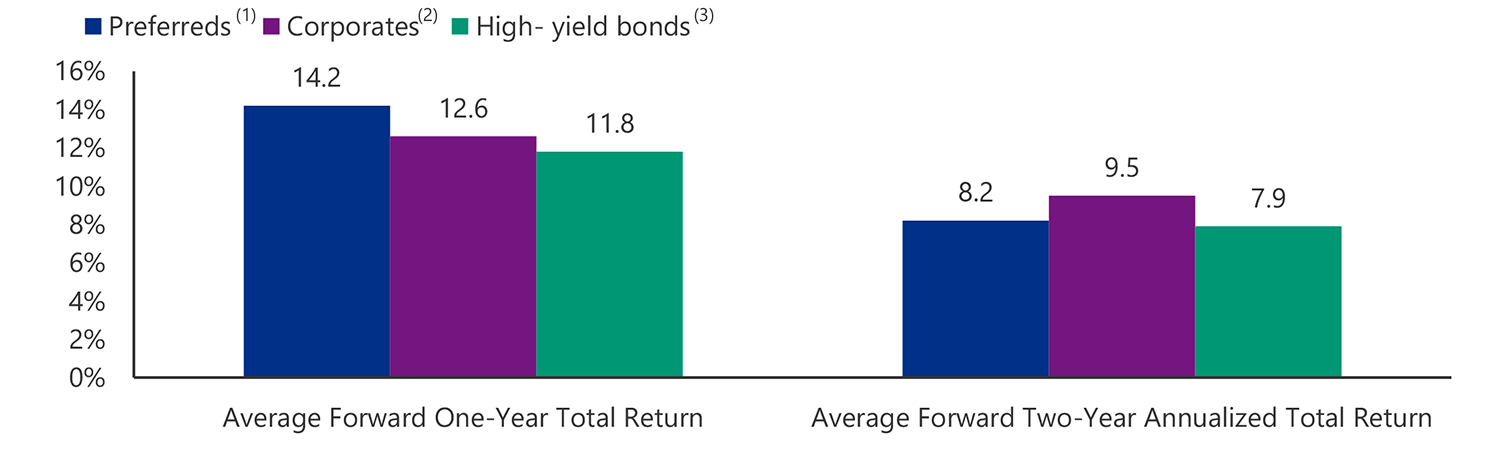

3. Performance has been strong following last rate hike per cycle

Since 1990, preferreds have returned 14.2% on average in the twelve months following the end of the rate-hiking cycle (vs. 6.3% for all 12-month periods).

Significant positive performance following last rate hike per cycle

At December 31, 2023.

Data quoted represents past performance, which is no guarantee of future results. The information presented above does not reflect the performance of any fund or other account managed or serviced by Cohen & Steers, and there is no guarantee that investors will experience the type of performance reflected above. There is no guarantee that any historical trend illustrated above will be repeated in the future or any way to know in advance when such a trend might begin. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

(1) ICE BofAML Fixed Rate Preferred Securities Index (Credit quality: BBB) tracks the performance of fixed-rate U.S. dollar-denominated preferred securities issued in the U.S. domestic market.

(2) ICE BofA Corporate Master Index (credit quality: A-) tracks the performance of U.S. dollar-denominated investment-grade corporate debt publicly issued in the U.S. domestic market.

(3) ICE BofA High Yield Master Index (credit quality: B+) tracks the performance of U.S. dollar-denominated below-investment-grade corporate debt publicly issued in the U.S. domestic market.

Related: The Growth Engine Blueprint for Advisors with Stephanie Bogan