Investing during a recession can be a very difficult, and often dangerous, prospect. However, it can be done if approached with a bit of strategy and preparation. Follow these tips to avoid losing it all when a recession hits!

What Is A Recession?

Let’s start with the definition of what a recession is. According to the National Bureau of Economic Research (NBER), the agency responsible for dating recessions, a recession is a period of two, or more, consecutive quarters of negative economic growth. While the “R-Word” gets discussed in the financial media as if it is the “coming apocalypse,” in reality, it is a period of declining economic growth.

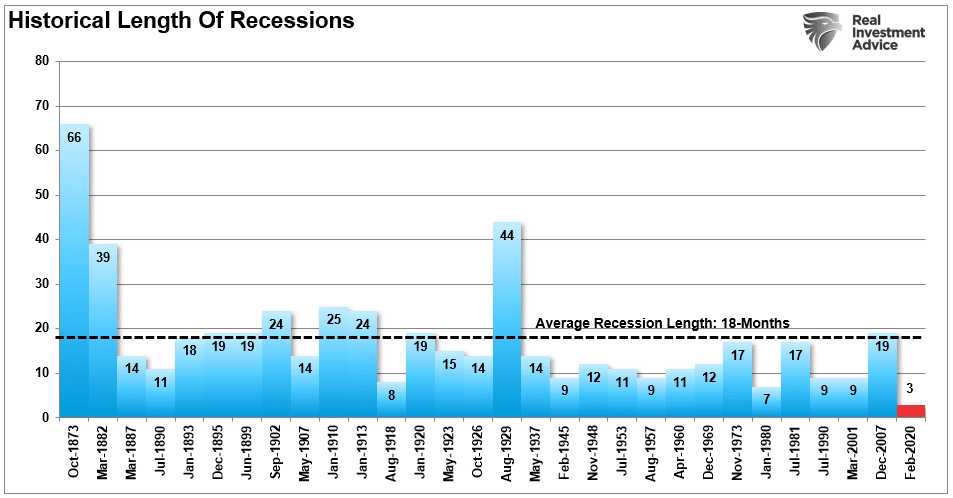

The chart below shows the historical length of recessions over time.

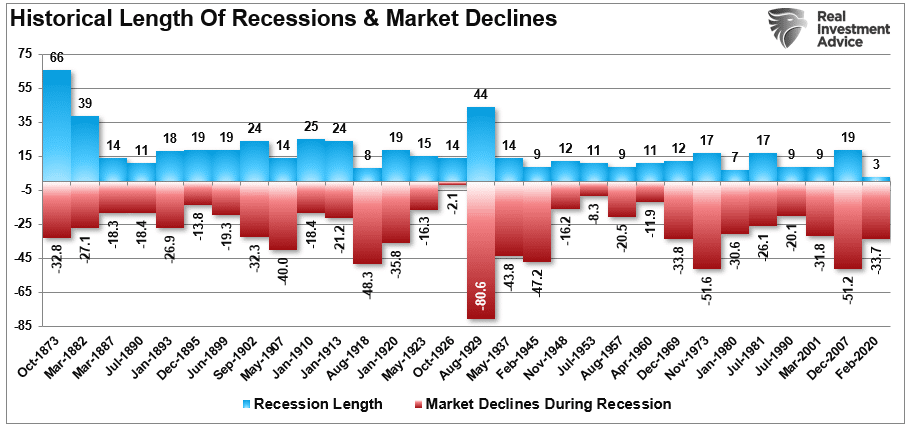

Notably, the risk to investors during an economic recession is high. Historically, markets tend to correct rather sharply during recessionary periods.

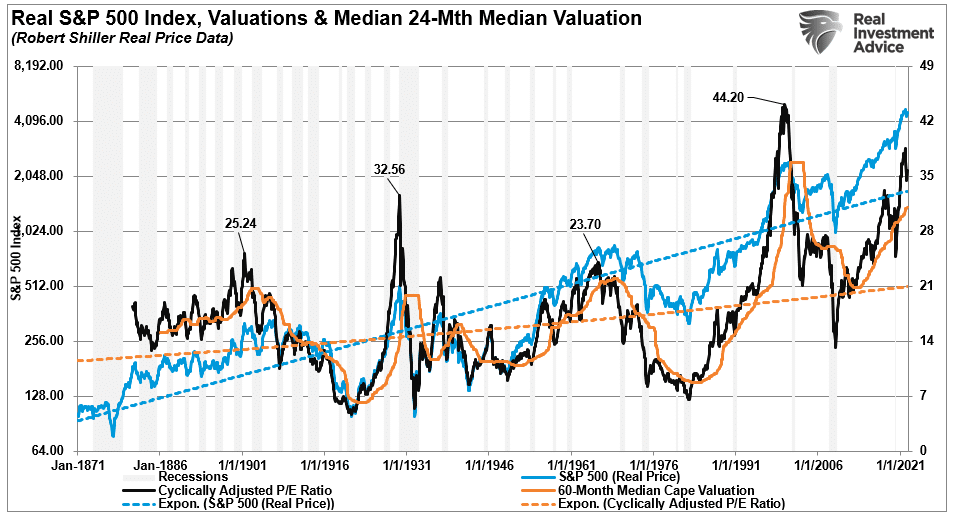

Such is because the markets reprice the excess valuations given to financial assets during the previous expansion. Higher valuations during expansions tend to precede deeper reversions during recessions.

As is evident, recessions are coincident with market corrections and bear markets. The problem with trying to avoid a recession, from an investment perspective, is this: by the time a recession is evident, it is often too late.

A Day Late & A Dollar Short

The biggest risk of investing during a recession is putting a “recession investing strategy” into place at the right time. As I wrote in “Recession Risk Rising:”

“The problem with making an assessment about the state of the economy today, based on current data points, is that these numbers are only “best guesses.” Economic data is subject to substantive negative revisions as data gets collected and adjusted over the forthcoming 12- and 36-months.

Consider for a minute that in January 2008 Chairman Bernanke stated:

“The Federal Reserve is not currently forecasting a recession.”

In hindsight, the NBER, in December 2008, dated the start of the official recession as December 2007.

If Ben Bernanke didn’t know a recession was underway, how would we?”

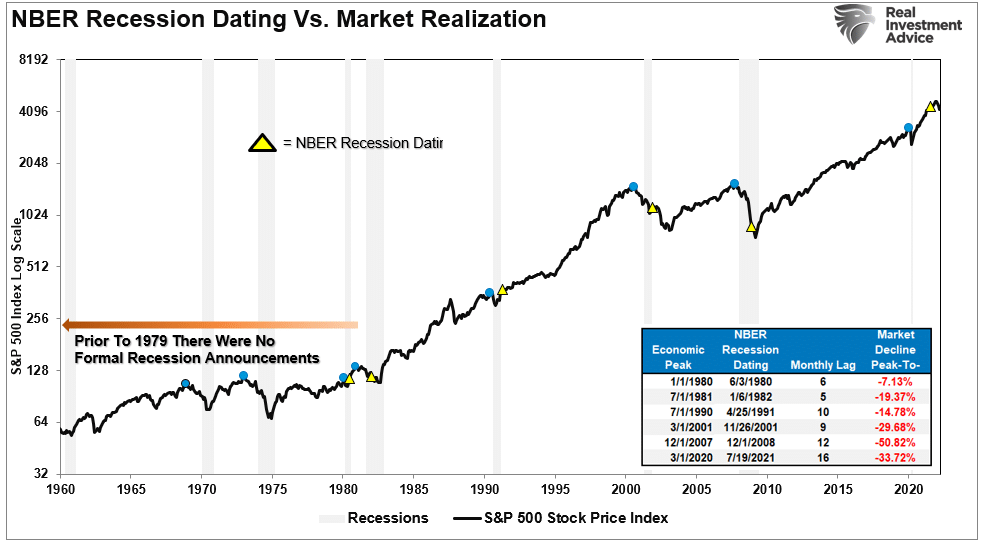

Such is the biggest risk to investors. The chart shows the S&P 500 from 1960 to the present. Each of the blue dots is the peak of the market PRIOR to the onset of a recession. The yellow triangles are the official NBER recession announcements.

The issue to investors is evident. In 9 of 10 instances, the S&P 500 peaked and turned lower prior to the recognition of a recession.

The decline from the peak was considered “just a correction” as economic growth remained strong. Therefore, investors didn’t adjust their strategy to invest during a recession.

In reality, however, the market was signaling a coming recession in the months ahead. The economic data just didn’t reflect it as of yet.

The problem is in waiting for the data to catch up.