Silicon Valley Bank implodes... The dreaded chain reaction… This is the end of Silicon Valley as we know it...

1. The Fed finally broke something big.

In its ongoing effort to cool inflation, the Fed hiked interest rates at its fastest pace in decades over the past year. And now, things are unraveling quickly...

On Friday, Silicon Valley Bank (SIVB)—America’s 16th-largest bank and a massive player in the venture capital world—went under. It marks the second-biggest bank failure in US history, second only to Washington Mutual in 2008.

What happened? Over the last year, surging interest rates eroded the value of banks’ bond portfolios. SVB was especially vulnerable because of 1) poor management and 2) its unique customer base.

SVB’s customers were concentrated in venture capital/startup companies—which tend to be deeply cash flow negative. Its customers burned through more and more cash, withdrawing more and more money from the bank.

This came to a head last week when SVB was forced to sell billions of dollars’ worth of bonds—mostly US Treasurys—at huge losses, triggering panic.

Venture capital advisors urged their customers to take their money out of SVB, igniting a bank run. Regulators closed down the bank for good on Friday.

There are a lot of important angles to this. In fact, I believe this marks the end of Silicon Valley as we know it.

But for today… let’s go over the most urgent implications for your money.

2. Your money in your bank is probably safe.

Up until yesterday, the rules were clear.

The Federal Deposit Insurance Corporation (FDIC) guaranteed deposits of up to $250,000 per depositor per US bank. If your bank shuts down tomorrow, the FDIC ensures you get your money back, up to $250,000. Above that amount, you might lose money.

According to Barron’s, 87% of SVB’s deposits were above $250,000, and therefore at risk.

As any corporate treasurer knows, there were ways to extend this coverage. You could spread your money across multiple accounts, for example. If you have $2.5 million and put 1/10th into 10 different banks, it’s all insured.

But by the looks of it, there’s no longer a need to do any of that. Because over the weekend, the Feds changed the rules.

Here’s Barron’s:

In essence, Federal Deposit Insurance Corporation protection—usually limited to $250,000 per account—became unlimited. Additionally, the Federal Reserve created a new program to help protect other banks from depositor flight.

This is a HUGE deal. Guaranteeing all deposits should go a long way toward stemming this crisis. It’ll make SVB depositors whole. And it’ll stop most folks from running to their bank to pull out their cash.

But a government changing rules on the fly sets a dangerous precedent. Not only does it introduce uncertainty and spur questions about why we have these rules at all... It sows the seeds of an even bigger crisis because it shields the people who made mistakes from their consequences.

3. Everyone is worried about a chain reaction…

The problem with bank runs is they spread. They shatter confidence and make investors wonder: Could this happen to my bank?

At the time of writing, the latest news is New York regulators shut down Signature Bank—a crypto-focused bank—due to these concerns.

And First Republic, another big bank, looks to be in trouble as well. At one point, its stock went down 60% in pre-market trading.

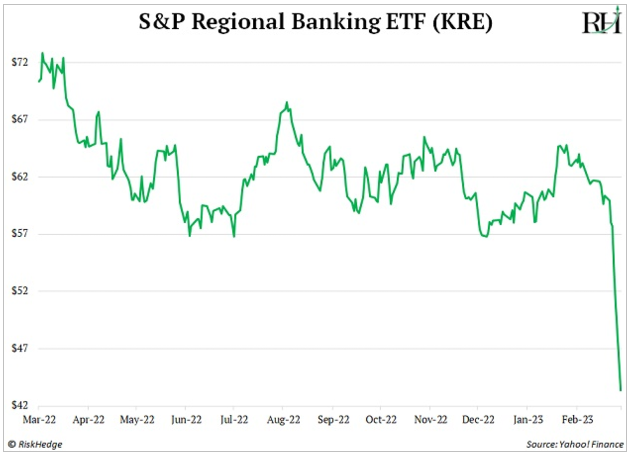

The chart of KRE—a regional bank ETF—looks awful:

I wouldn’t be surprised if more regional banks fail.

4. Here’s my rule for highly emotional times like this…

Think independently.

Remember, the media’s job is to scare you. Of course, they’re saying this is 2008 all over again. Their ratings shot through the roof in 2008.

But the reality is, the end-of-the-world narrative is NOT being reflected in asset prices.

Outside of regional banks and Silicon Valley, markets are holding up well.

The S&P 500 and the Nasdaq are up slightly on the year.

Bitcoin and Ethereum—two of the most speculative assets—are holding up fine.

And many global stock markets—like the UK, France, Denmark, and Australia—are a hair off all-time highs.

Ask yourself: How bad could things really be if the UK’s stock market is near record highs?

5. And the #1 reason I doubt this crisis will crash the stock market is…

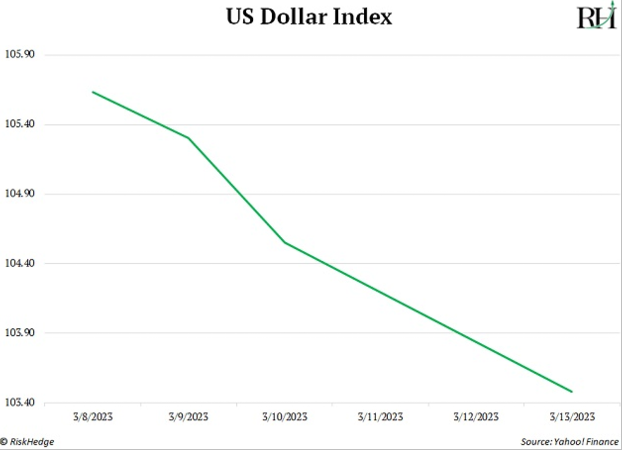

The weakness in the US dollar.

For reasons we’ve discussed many times, the US dollar is the ultimate “canary in the coal mine.”

It ALWAYS spikes during big crises...

It spiked in 2001, 2008, and even leading up to the difficult year that was 2022.

But today?

The dollar is down more than 2% since March 8:

Bottom line: The failure of SVB is a big deal for the banking sector and Silicon Valley.

But there’s a complete lack of evidence that it’s going to crash the stock market. Unless you count media headlines as evidence… which I most definitely do not.

To get more ideas like this sent straight to your inbox every Monday, Wednesday, and Friday, make sure to sign up for The RiskHedge Report, a free investment letter focused on profiting from disruption.

Expect smart insights and analysis on the latest breakthrough technologies, the big stories the mainstream media isn't reporting on, and much more... including actionable recommendations. Click here to sign up.