I have been writing about, and valuing, Tesla for most of its lifetime in public markets, and while it remains a company that draws strong reactions, it is also one that I truly enjoy valuing. It has been a while since my last valuation of the company, which occurred in January 2020, and given how much the landscape has changed since, partly as a result of the company's own actions and partly because of how COVID has upended its competitors in the automobile business, it is time to revisit the company and reassess its value, especially as the company’s market capitalization crosses a trillion dollars.

Tesla: The Back Story

I first valued Tesla in 2013, as a "luxury automobile company" and I have valued almost every year since. If you are interested, you can see my valuations from 2014, 2016 and 2017. If you review those valuations, you will notice that in each valuation, my story for the company expanded, and my valuations increased, but the market price for the company jumped even more, leading me to conclude in each of them that it was not a company that I would invest in. While these valuations led me to different assessments of value, there were common themes across time:

- At its core, Tesla has been an automobile company: In my 2016 post on Tesla, I described it as the ultimate story stock, driven less by news about its most recent financial performance, and more by news that alters its story trajectory. I would be lying if I said that I have had clarity about Tesla's story over the last decade, because it has so many tangents, distractions and shifts along the way, flirting with narratives about being a battery company, an energy company and a technology company. In 2021, looking at the company, I feel more convinced than I was a few years that it is, at its core, an automobile company, and while it will continue to derive revenues from batteries and perhaps even software, its pathway to becoming a trillion dollar market cap company still runs through the "car company" story.

- Tesla has disrupted and reinvented the automobile business: Putting any company into the automobile business handicaps it, when it comes to value, for a simple reason. The automobile business has been in trouble for quite a while, struggling with anemic revenue growth in the aggregate, and abysmal profit margins, with even the very best in the group struggling to earn returns that match, let alone beat, their costs of capital. As I have valued Tesla over the years, I have come to the realization that it is the most 'uncar-like" automobile company in the world, and its uniqueness shows up on two dimensions. The first is on profitability, where its operating cost structure, unconventional distribution model (which bypasses dealerships), and capacity to augment revenues with related products and services, has given it an opening to deliver much higher margins than any automobile company in history. The second is on investment and capital intensity, where it has managed to take what critics pointed to as weaknesses (unwillingness to build large and expensive assembly plants ahead of time, to meet future demand) and made them into strengths. Put simply, the company has been able to scale up more quickly, while reinvesting less in capacity, than any other automobile company.

- Tesla positioned itself well for structural shifts in the economy: Tesla's success over the last few years has also been fed by three other external forces. The first is in the government and business response to climate change, and the resulting policies favoring electric cars over gas-powered, cars. It is undeniable that Tesla, especially in its early years, was a beneficiary of tax credits and other benefits meted out to electric car makers and buyers. The second is the rise of ride sharing, with a host of companies around the world upending the status quo in car service. While Tesla has not directly benefited yet from this trend, it has opened up possibilities for the future, built around self-driving cars, that have added to the company's allure. The third is the rise of ESG as an investing force, and the resulting shift away by investors from all things fossil-fuel related, has benefited Tesla, at the expense of the legacy automobile companies.

- Tesla is built around an outsized personality: When valuing publicly traded companies, I seldom talk about its top management explicitly, since the numbers reflect what they bring to the firm. That rule does not work with Tesla, since its founder and CEO, Elon Musk, has many qualities, but being self effacing is not one of them. Tesla and Musk are locked at the hip, and it is almost impossible to have a view on one, without having a similar view on the other. Put simply, I am still to meet an investor who loves (dislikes) Tesla as a company, and dislikes (loves) Musk. On the plus side, Musk is a visionary and out-of-the-box thinker, and an evangelist for his visions, who draws true believers to his cause. On the other side of the ledger, he is unpredictable and prone to distractions that draw attention away from the company, and his impulses have created costs for the company and its investors. While his net effect has clearly been a net positive for investors in Tesla, over the last decade, it is worth remembering that you are getting a package deal, when you invest in the company.

- Tesla draws extreme reactions: I have never valued a company, where there is as much divergence in views about the future, cross market players, that I have seen with Tesla and Musk. There are some who see Elon as the ultimate con man, and Tesla as a shell game, and many in this group have spent the last decade making Tesla one of the most shorted stocks in history. There are others who view him a savior, and map out pathways for Tesla to become the most successful company of all time, and many of them have bought shares in the company, and held through good and bad times.

My two most recent valuations were in June 2019 and January 2020, and I am going to go back to them, not just because they are recent, but because they led to investment decisions on my part.

- In June 2019, Tesla had hit a rough spot, partly due to concerns about production bottlenecks and debt, and partly due to self inflicted wounds. Musk's tweets about going private, with funding secured, contributing to a sell off, driving the stock down to $180 ($36 in today's split adjusted terms). I valued the company, with conservative assumptions about growth and margins, and incorporating my concerns about managerial missteps, at about $190: While the buffer (between value and price) was small, I did buy shares in the company.

- Between June 2019 and January 2020, the stock went on a tear, as the stock price more than tripled, and I revisited my Tesla valuation. With a more expansive view of future growth and profitability, I revalued Tesla in January 2020 and more than doubled my valuation, though that still left me well below the market price. I sold my shares then, and I know that many of you have pointed out how much money I have lost as a consequence of that sale, as the stock price has increased almost ten-fold since then, and I will come back and talk about my regrets, or absence thereof, towards the end of this post.

Tesla: The Numbers

It has been roughly 22 months since my last valuation of Tesla, and it is astonishing how much change there has been, not just in the company, but also in the macro environment that it operates. In this section, I will start by chronicling the astonishing rise of Tesla in public markets in the last decade, follow by looking at the company's operating details and close by examining how the company has found a way to turn the COVID crisis into an opportunity.

Stock Prices and Market Cap

To put Tesla's explosive performance in the last two years in perspective, I will look at its market performance since its entry into public markets. The graph below contains Tesla's stock price, adjusted for stock splits, going back to 2010, and ending in November 2021:

While the graph illustrates the surge in the stock price, the table embedded in the graph conveys the rise more vividly, by listing Tesla's market capitalization in millions of dollars. In sum, the company's market cap has risen from $2.8 billion in August 2010 to more than a trillion dollars in November 2021, and along the way, it has not only made Elon Musk into the wealthiest man in the world, but also enriched those who bought into his vision early, and stayed invested in the company.

Revenues and Earnings

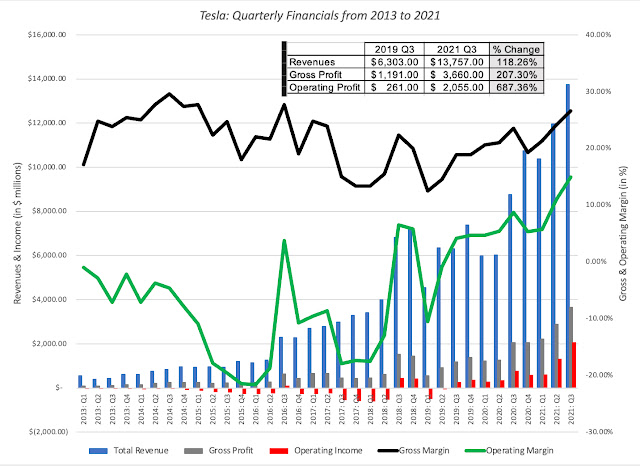

While the initial rise in Tesla's market capital was driven by the promise of the company, and detractors were quick to note Tesla's paltry revenues and big losses, the company's more recent financials reflect how it has acquired substance over time. In the graph below, I report on Tesla's quarterly revenues, gross profits and operating profits going back to 2013:

Tesla's quarterly revenues have risen from negligibly small values at the start of the last decade to almost $14 billion in the third quarter of 2021, making it the 20th largest automobile company in the world in 2020 (in revenue terms). The company spent much of the last decade losing large amounts each year, but it now not only generates an operating profit, but a healthy one at that, with a pre-tax operating margin of close to 15% in the third quarter of 2021.

The COVID Effect

While Tesla's resurgence has been building for a while, its growth has clearly exploded in the last year and a half, a period where our personal and business lives have been upended by COVID. During this most trying of times for all businesses, and especially for those in manufacturing, Tesla has not just survived, but thrived, gaining market at the expense of its rivals and accelerating towards profitability. To understand why, I would point you to a series of posts that I did during 2020 about how COVID was playing out in markets, and the winners and losers. In particular, I noted to the following aspects that made the COVID crisis different, from prior crises:

- Risk capital stayed in the game: The most striking feature of last year's crisis was how quickly markets came back from the savage sell off between February 14 and March 23 of 2020, and I argued that the biggest reason for that come back was the resilience of private risk capital. Instead of withdrawing from markets, as in prior crises, venture capital investing, initial public offerings and investment in the riskiest segments of both stock and bond markets continued, and actually increased, through 2020, and those trends have continued this year.

- Flexibility over Rigidity: While the overall market quickly recovered, the recovery was uneven, and the crisis left behind winners and losers. In this post, I argued that one of the key dividing lines between the two groups was flexibility, with companies with more flexible investing, financing and dividend policies winning out over companies with more rigidity on those dimensions. To be specific, service/technology companies gained at the expense of manufacturing & natural resource firms, debt-light firms won at the expense of those with much bigger debt burdens and firms that paid large dividends lost value, relative to firms that did not.

- Young beat old: Another factor differentiating winners and losers during 2020 was that, unlike prior crises, young companies (early in their life cycles) benefited at the expense of mature and aging companies (with far more of their value coming from investments in place).

I summarized the transfer of wealth in a table in my final update:

As you can see young, high growth companies, with little debt and no dividends, benefited at the expense of older companies, with more debt and dividend commitments. You could argue that if central casting were creating the perfect COVID winner, it would look a lot like Tesla, a young, adaptable company in a sector filled with companies with expensive manufacturing facilities, large debt burdens and legacy dividend policies. In fact, many of what many (including me) considered to be Tesla's weaknesses (make-shift manufacturing, seat-of-the-pants financing) in the pre-COVID age became strengths during COVID. While conventional automobile companies shuttered and scaled down manufacturing, Tesla continued to make and sell cars through the pandemic, and it is inarguable that it has come out of this crisis, far stronger than it was going into it. The table below breaks down the Tesla's performance from the last quarter of 2019 to the third quarter of 2021:

|

| Tesla: The COVID Quarters |

Focusing on the key financials of the company and looking at Tesla's performance through the COVID quarters, there are trends that stand out.

- The first is that the company stumbled briefly on revenues in the second quarter of 2020, as COVID restrictions kicked in, but saw a surge in growth in the quarters since, with growth rates significantly higher than in the pre-COVID years.

- The second, and more significant, is that the company seems to have turned the corner on profitability, with margins not just improving, but dramatically so, with gross margins moving towards 30% and operating margins exceeding 14% in the most recent quarter.

In brief, if there Tesla's growth was lagging, leading into 2020, and there were worries about its capacity to be profitable, the COVID quarters seem to have removed both concerns.

Tesla: Updated Story and Valuation

I have long argued that the three most freeing words in investing and valuation are "I was wrong", and with Tesla, I have had to say those words repeatedly over the last decade. Through its lifetime, I have under estimated Tesla's value, and while COVID may have given the company an assist, my updated valuation will reflect what I have learned, since January 2020, about the company.

Story Components - Revisiting the Past

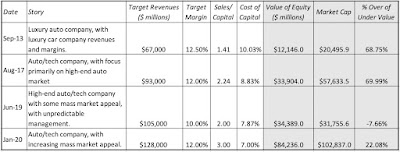

Over the years, I have tried, not always successfully, to navigate between the extremes on Tesla, and tell a story that reflects the company's strengths and weaknesses. Not surprisingly, that story has changed over time, as the company, the business and the world have all changed. In the table below, I list the stories that I have told, with end-year revenues, operating margins and valuations for equity, for each one, in 2013, 2017, 2019 and 2020:

Over time, as you can see my story for Tesla has become bigger (in what I see both as its potential market and the revenues from it) and I have adapted my story to reflect the company's capacity to reinvest far more efficiently than the typical automobile company that I used in my very first valuation.

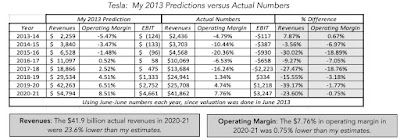

To see how much I was off the mark with my September 2013 valuation, I decided to compare my predicted revenues and operating income with the actual revenues and operating income from 2013-14 to 2020-21:

This may surprise you, since my 2013 valuation seems, at least in hindsight, to be hopelessly pessimistic, but I actually over estimated Tesla's revenues and profitability in the years since; the actual revenues in 2020-21 came in almost 24% below my prediction and my predicted margin of 8.52% was 0.75% higher than the actual margin posted by the company in that year. That said, I assumed in the 2013 valuation that, by 2021, Tesla's growth would be plateauing, and the company would be moving towards being a profitable, luxury car company. Instead, the company seems to be just getting started, redefining itself as a mass market company, with much bigger ambitions. I know that for some, my shifting stories and valuations are a sign of weakness, both in my analytical capabilities and in the very idea of intrinsic valuation. For me, and this may be just my delusions talking, an unwillingness to change your valuation stories and inputs, especially in a company that delivers as many twists and turns as Tesla, is a far greater sin.

Updated Story and Valuation

Whatever your priors were on Tesla coming into COVID, it is difficult to argue with the fact that the company has benefited from the economic changes it has wrought, and that its story has become bigger. The question of how big is what will determine value, but rather than give you my assessment at the start, I want to try an experiment. Ultimately, whatever story you tell about Tesla has to show up in five inputs that drive its value: (a) Revenue growth, or what you see as end revenues for the company in steady state, (b) Business profitability, reflecting what you see as unit economics, and captured in the pre-tax operating margin, (c) Investment efficiency, measuring how much investment will be needed to get to your estimated end revenues, (d) Operating risk, incorporated into a cost of capital for the company and (e) the chance that the company will not make it, gauged with a probability of failure. If you are willing to go along, with each input, I will lay out the choices (as objectively as I can) and I would like you to take your pick, given what you believe about the company. As you make these choices, though, please do not open the spreadsheet that I will provide at the end, to convert your choices into value, since that will create a feedback loop that can feed your biases.

- Revenues: I do believe that Tesla has come out COVID with the potential for far more revenues than it did, going in. In particular, as the automobile market increasingly shifts to electric cars, Tesla will hold a strong competitive advantage in that portion of the market, and have the chance to be a market leader. To get a sense of what this will mean in terms of revenues by 2032, consider the following choices: Note that if your story draws primarily on Tesla remaining an auto company, revenues of $400 billion will translate into about ten million cars sold in that year, more than ten times the number of cars the company sold in 2020-21. If you believe that there are other businesses that Tesla will enter, you can augment your revenues with the added sales in those other businesses, keeping in mind that most of these businesses have far less revenue potential than the car business.

- Profitability: The biggest eye opener for me, during COVID, has been the surge in profitability at Tesla, with the operating margin nearing 15% in the third quarter of 2021. While that number is volatile and there will be ups and downs, it looks like the electric car business has far better unit economics than the conventional automobile business. Notwithstanding Tesla's first mover advantage, this margin will come under pressure not only from increased competition from electric car offerings from existing automakers and new entrants (Neo, Rivian etc.), but also from having to cut prices to increase market share in Asia, where car prices tend to be lower than in the US and Europe. Laying out the choices in terms of profitability: As you make this choice, recognize that Tesla is already approaching peak level gross margins for a manufacturing company, with its 30% gross margin in the last twelve months.

- Reinvestment: When I first valued Tesla in 2013, it had one plant in Fremont that produced all of the cars that it sold. At the time, one of my concerns was that the company would need massive reinvestment in assembly plants to ramp up even to luxury car revenue levels, and that this reinvestment would create significant cash burn. In the years since, Tesla has not only added capacity in lumps with assembly plants/giga factories in Storey County (Nevada), Buffalo (New York), Shanghai (China), Berlin (Germany) and Austin (Texas), but has spent far less than I originally estimated that they would have to invest. That said, if you are projecting that Tesla will sell 8, 10 or 12 million cars a year, a decade from now, it will need to reinvest in additional capacity. I use the sales to capital ratio as my proxy for investment efficiency (with higher values implying more efficiency investing), and the choices are below: To the extent that the company has the excess capacity to cover growth for the next few years, I will allow for a a higher sales to capital ratio in the early years, but move it towards a more sustainable number thereafter.

- Risk: When I valued Tesla last in early 2020, I used a cost of capital of 7%, reflecting a risk free rate of 1.75% and an equity risk premium of 5.2% for mature markets. In November 2021, the risk free rate is down to 1.56% and equity risk premiums have drifted to 4.62%, and the cost of capital for the median firm had drifted down to about 5.90%. The choices you have on cost of capital are structured around those market realities: The other risk measure that will affect value is the likelihood of failure, a number that has varied over Tesla's history, partly because it used to lose money and partly because of a choice it made to borrow money in 2016. In making this assessment now, recognize that Tesla now has a cash balance that exceeds its debt due and is making money, at least for the moment.

- Management: Taking to heart how closely Tesla and Elon Musk are connected, one of the concerns with Tesla has always been the sheer unpredictability of Mr. Musk. The Musk effect on value can be positive, neutral or negative, depending on your priors: While Musk has been better behaved and more focused for the year and a half, with the exception of indulging in tweeting about cryptos, he seems to have reverted to bad habits in the last two weeks, seeking guidance from his Twitter followers on whether to sell a significant portion of his Tesla shares and indulging in a back-and-forth with senators about the billionaire tax.

I made the choices just as you did, and in the most upbeat of my forecasts, I aimed for revenues of roughly $400 billion (about ten million cars, augmented by revenues from ancillary businesses) in 2032, operating margins of 16% and a sales to capital ratio of 4.00 for the next five years (making Tesla far more profitable and investment efficient than any large manufacturing company in the world). With a cost of capital of 6% (close to the median company) and no chance of failure, it should come as no surprise that my estimated value of equity for the company has increased more than six-fold since my last valuation, to about $692 billion for equity in the aggregate, and $640 billion for equity in common stock.

|

| Download spreadsheet |

There are very few companies in the world that I would value at more than half a trillion dollars, and with Tesla, I get there almost entirely based upon its potential for growth and profitability. That said, though, the value per share that I get of $571, even in this most upbeat of scenarios, is less than half the current stock price, leaving me with the conclusion that the stock is over valued. Rather than take issue with my valuation, put your inputs into the attached spreadsheet and estimate your value of equity for the firm.

What’s your story?

Given my choice to sell shares in Tesla at precisely the wrong time (in January 2020) and my history of undershooting on value for the company, I am the last person you should be relying on for your Tesla investment judgments. There are multiple caveats that go with my valuation, and it is possible that you are able to find a story that yields a valuation not just higher than mine, but also higher than the stock price. Alternatively, you might be one of those who believes that much of what we have seen as improvements in the last two years at Tesla are a mirage, and that I am being delusional in my assumptions. While I welcome debate and disagreement, I have found that, with Tesla, it is easy to get off on tangents and argue about what ultimately become distractions, and I would posit that almost any disagreement that we have about Tesla ultimately becomes one about how much revenues the company can generate from the businesses you see it operating in, and how profitable it will be as a company.

- Revenues: In making my revenue estimates, I have assumed that Tesla will get a predominant portion of its revenues from selling cars, partly because of its history and partly because its alternative revenue sources (batteries, software etc.) are not big revenue items. It is possible, though, that there are new businesses with ample revenues that Tesla can enter, that can create new and substantial revenue streams. It is also possible that the electric car business will resemble technology businesses in their winner-take-all characteristics, and that Tesla will have a dominant market share of that business. In either case, you will have to find ways to get to revenues far greater than my already-daunting number of $414 billion in 2032. (Just for perspective, the total revenues of all publicly traded automobile companies, globally, in 2020-21 was $2.33 trillion and this would give Tesla roughly one sixth of the overall market.)

- Profitability: The other key driver of Tesla's value is its operating margin. While I think that my estimate of 16% is already at the upper end of what a manufacturing company can generate, there are a couple of ways in which Tesla might be able to get even higher margins. One is to enter a side business, perhaps software or ride sharing (with automated driving cars), that has much higher margins than the auto business. The other is to benefit from technological advantages to reap the benefits of economies of scale in production; this would require gross margins to continue to climb from less than 30% to much higher levels.

You can check this for yourself, but the other assumptions about reinvestment and risk don't have as big an impact on value, and I have computed Tesla's equity value (in common stock) as a function of targeted revenues and operating margins.

As you can see, there are pathways that exist to get to the current stock price and above, but they require that you enter rarefied territory with Tesla, assuming that it will have more revenues than any company (not just automobile) in history, while delivering operating margins similar to those delivered by the largest and most successful technology stocks, none of which have the drag of substantial manufacturing costs.

Tesla: The Pricing Game

If you are holding or buying Tesla, finding a story to justify its current market capitalization will require a real stretch, a story that will require the company to not just be successful but a one-of-a-kind company. That said, I believe that Tesla is a "trade", not an "investment", and that perspective provides answers to four questions that you may have about the stock.

- How do you explain the current stock price? For much of the last decade, Tesla skeptics have struggled with explaining why the stock is priced at the levels that it is, by the market. Put simply, they have wondered how a company with little revenue and big losses acquires a market capitalization of hundreds of billions of dollars. I have never tried to explain what other people pay for a stock, but the answer may lie in the fact that those trading Tesla are pricing it, based on pricing variables (mood, momentum), rather than on fundamentals (earnings and cash flows).

- Why does the price change so much on news stories? Tesla has always been a company, where small and sometime trivial news stories cause big price changes. Take the news story a couple of weeks that Hertz was considering ordering 100,000 cars from Tesla. Given that the current market cap of Tesla reflects an expectation that the company will sell 10 million cars or more in a few years, the Hertz order, by itself, will have a tiny impact on value, and certainly far less than the hundred billion dollar jump in Tesla's market capitalization, after the news. However, if you view Tesla as a "story stock", the Hertz news story can be viewed as a sign that the company has made the transition from being a second car for the wealthy to a much wider market, potentially leading to a higher pricing.

- Does price affect value? Much as I would like to argue that intrinsic valuations are about cash flows, growth and risk, and are therefore insulated from market dynamics, the truth is more nuanced. The ten-fold surge in the stock price since last January did have an effect on my valuation, pushing me towards more upbeat and bigger stories, even though I still found the company to be over valued. If stock prices drop by 50% in the next few weeks, my assessment of value may be lower, as a consequence. In sum, it is almost impossible to value companies in a vacuum, where what the market is doing can be ignored.

- If I think the stock is over priced, why not sell short? To the question of why, if I believe in intrinsic value, I am not selling short on Tesla, it is because I believe that, at least in the short term, momentum beats fundamentals, and I have no desire to be caught in the whiplash effect.

If you are a Tesla trader, I wish you the best, but I do hope that you don't delude yourself, if successful, with tales of fundamentals. You were on the right side of momentum, and whether this was a function of luck or skill, I will leave it for you to decide.

Conclusion

In the last year and a half, I have heard from many of you about my decision to sell Tesla, and while I am thankful for your concern about my investment performance, there are a few of you who have asked me whether I was sorry that I had sold Tesla, just ahead of its run-up in the last year and a half. I would be lying if I said that I did not think about the money I could have made, by holding on, when the stock crossed a trillion-dollar market cap, but those second thoughts have been fleeting and I have no regret. Like everyone else, I would rather make money on my investments, than lose money, but I would also rather leave money on the table and have an investment philosophy, flawed though it may be, than make money, and end up without a core set of beliefs about markets. I can say with certainty that I will be back valuing Tesla some time in the future, either because it has crossed a new threshold or because it is in the news. This company is far too interesting to ignore!