We live in a very different investment world from even a few years ago. That is not lost on us at Sungarden. Markets behave and move differently than in the past, and react based more on what computer algorithms, index funds and Fed Committee members say. It’s as if much of what impacts our accumulated wealth is in the hands of inanimate objects (the markets)…because it is, unless you are proactive about it.

At any time, investors can see years of hard work and disciplined saving and investing get eroded in weeks or months by the whims of Wall Street. While many in the publishing business seem to talk about this like it’s some sort of game, we at Sungarden are, shall we say, more straightforward about it. And plan to be even more so as this year goes on. More on that soon.

For today, let’s simply spell out a few bullet points on what we see, and what perspective we think is most helpful to financial advisors and investors right now.

- This is the most complex investment environment of our lives: bubbles bursting, inflation returning, war disrupting

- That means it is also THE best market conditions for tactical management vs. traditional investing

- The primary trend is down for stocks AND bonds. That rarely happens, so many investors and financial advisors are not prepared. It is catching them totally off-guard.

- 2022 has been all about stocks in a trading range, as rising interest rates and inflation threaten the “easy” times. So, if stocks break below this year's lows, the strategy shifts from defending what appears to be new bear markets in stocks and bonds, to exploiting them for profit.

- The stock market is rotating quickly from sector to sector. How to play it: "take the money and run" when you can. And “rent” more investments than you “own.” Shorter time frames and holding periods are more productive this year than I’ve ever seen in 30 years of managing money.

- There have been brief, isolated opportunities to do this during the first 4 months of the year. We expect there to be plenty more before the year ends.

- The bottom-line for financial advisors and investors: play the cards you are dealt, not the market you wish you had right now.

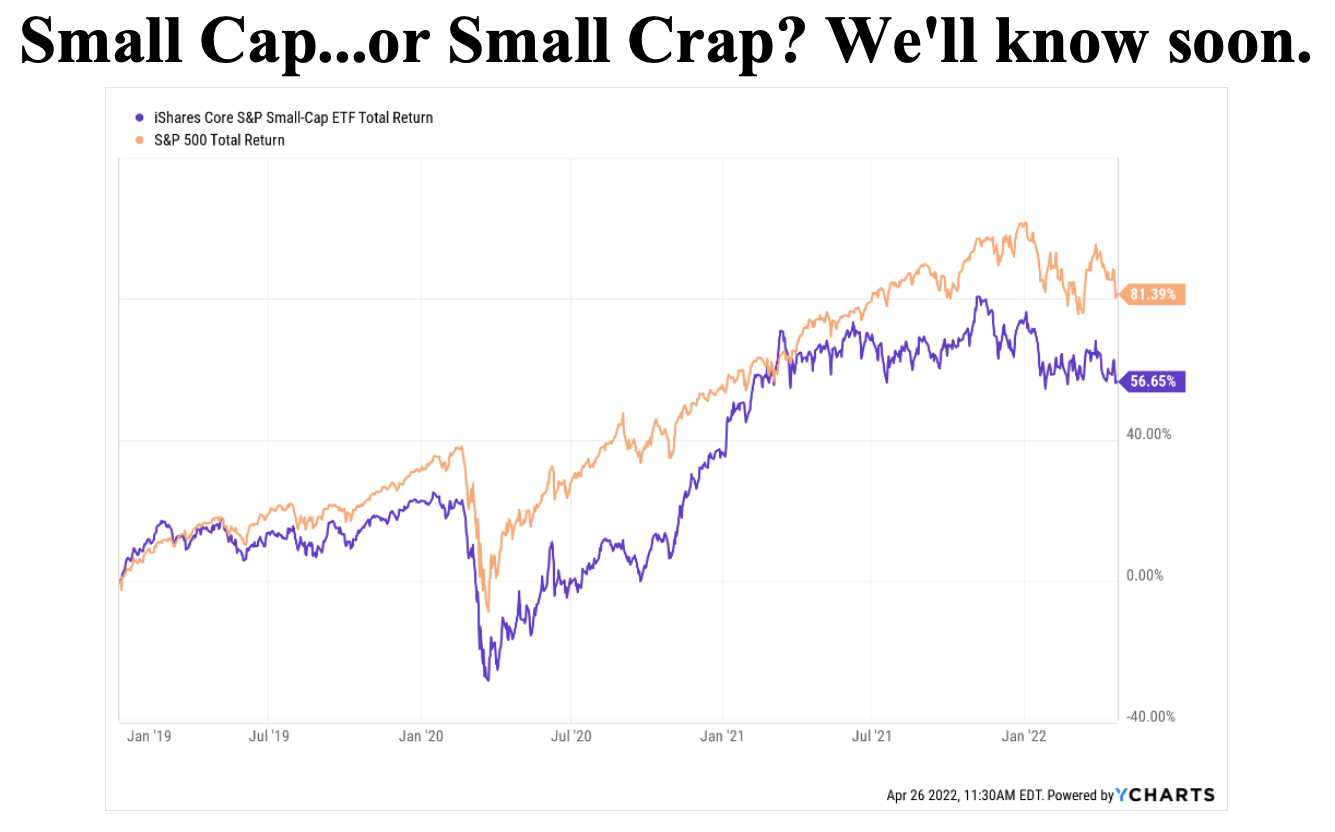

Small cap stocks traditionally were a place to seek higher returns than the S&P 500, albeit with higher risk. But since 2019, the S&P 500 outperformed the IJR Small Cap ETF by 24% (80% to 56%). They are even YTD (-11%) through Monday morning (when I wrote this), testing lows again, as it has done 3 other times during past 12 months. If it fails, look out below, as price targets would be about 15%, 40% and 55% below Monday's open (see my Twitter post on 4/25 for that pic). THAT's how risky the stock market is right now. We don't know yet if that risk will be realized? But even if this turns out to be a bottom, it doesn't mean the risk didn't exist. That's why it’s called "risk management."

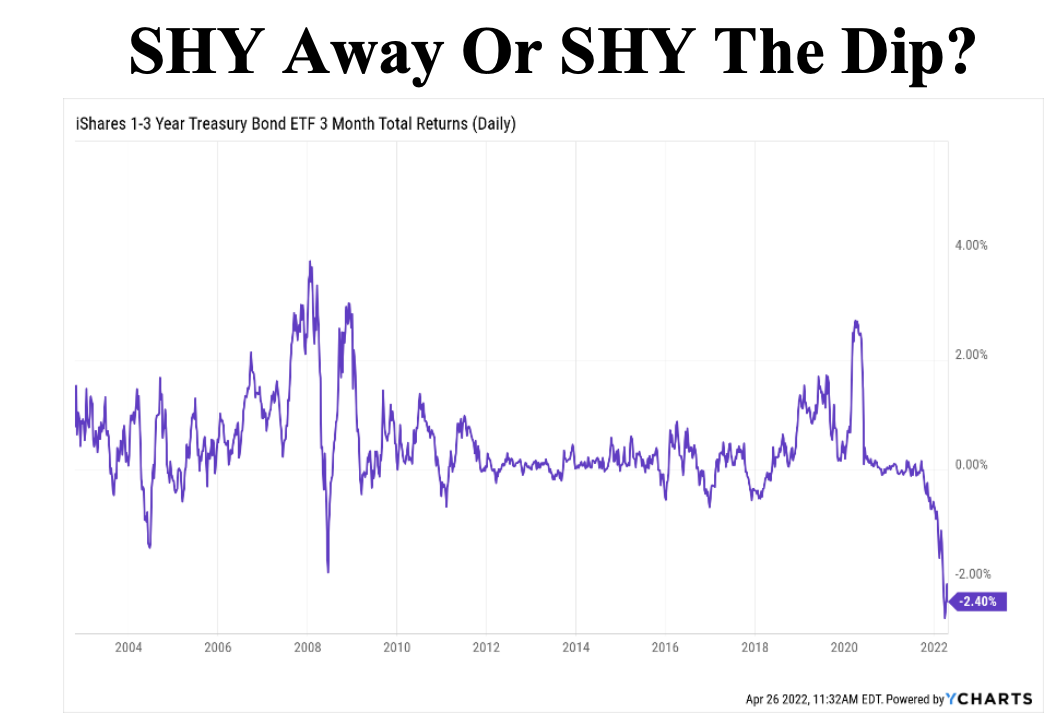

SHY is the symbol for the 1-3 Year Treasury Bond ETF. That means it owns US Treasury Notes that mature within the next 12-36 months. As capital preservation tools go, it’s pretty high up there...except for recently, when SHY fell more in 3 months than it ever has. And, while a 2.5% decline in 3 months is quite good versus the broad stock and bond markets, if you are a conservative investor experiencing the right "tail" of this chart, it could be unnerving. The bond market may have done the Fed's rate-raising work for them, or not. SHY will be a good indicator of what the market thinks.

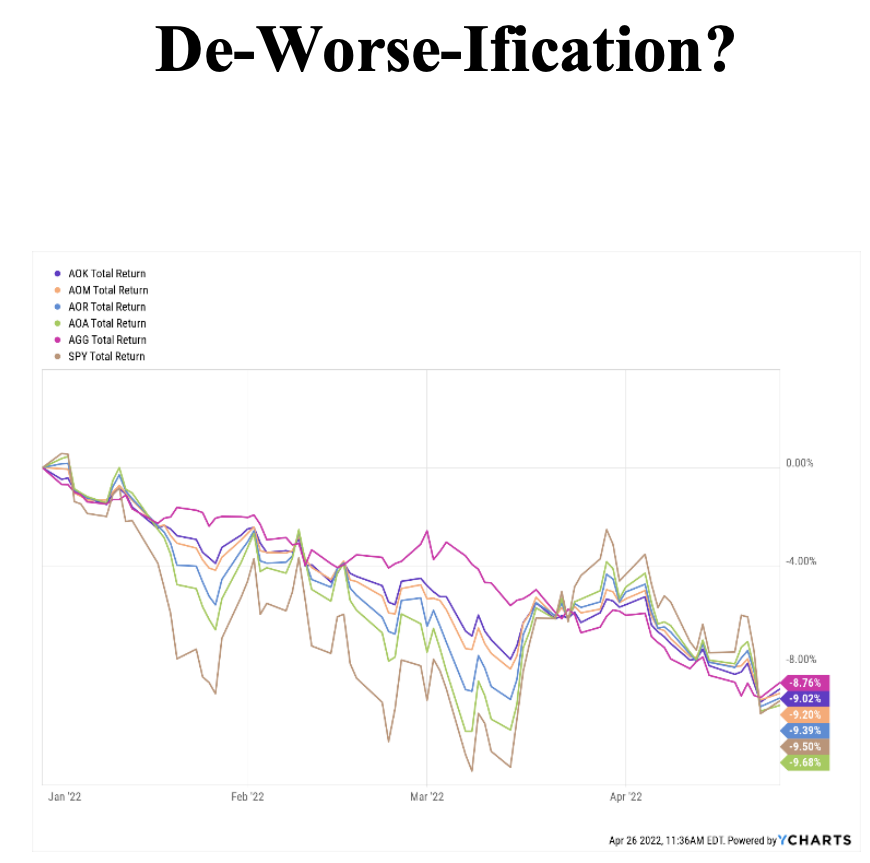

Diversification has been called Wall Street's version of a "free lunch." Perhaps we should clarify that. At times like these, that free lunch is whatever you want from the menu...as long as it’s one particular chicken dish. That might make you ill if you eat it. You see, in 2022's reality, the traditional stock-bond mix, in nearly any combination, has cost you about 10% of your portfolio over the past 4 months. This begs the question: is there something else out there to choose from? The answer is yes, but you need to look for it. Every week, we help you look.