Every couple of years, it seems, the world watches in apprehension as the U.S. president and Congressional leaders play chicken over the nation’s debt limit. If the so-called ceiling can’t be raised, the U.S. Treasury risks running out of cash, and the country could default on its debts.

This would result in a series of potentially “cataclysmic” events, according to a new dystopian report by Moody’s Analytics. Credit rating agencies would immediately downgrade Treasury debt, followed by U.S. financial institutions, nonfinancial corporations, municipalities and more.

In Moody’s worst-case scenario, an economic downturn triggered by a U.S. default would rival that of the global financial crisis. As many as 7.8 million jobs could be lost, and stocks would fall by almost a fifth, erasing $10 trillion in U.S. household debt. The contagion would spread to global markets.

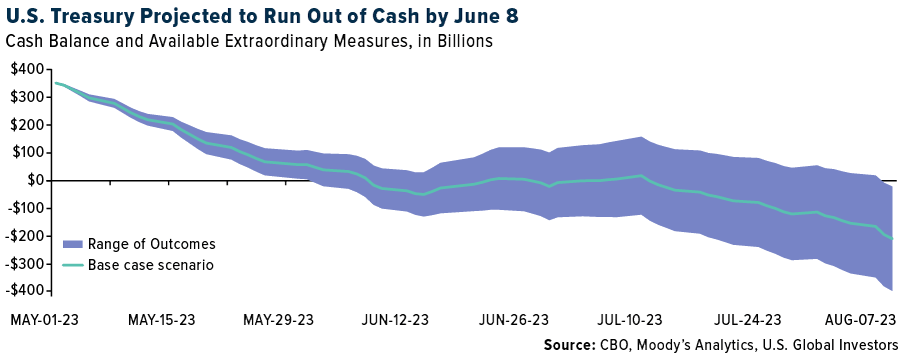

Oh, and did I mention that President Joe Biden and Speaker Kevin McCarthy have until June 8—less than a month from now—to find common ground? That’s when the Treasury’s coffers run dry if no progress is made, based on Moody’s estimates.

My gut feeling is that an agreement will be reached before it’s too late. As was the case in past showdowns, the political wrangling is more Kabuki theater than anything else. At the same time, Biden and McCarthy are playing with fire.

Debt Ceiling Reform, Spending Reform

So why does the United States put itself, and global onlookers, through this every few years? The U.S. is one of the very few countries on the planet that has a debt ceiling, and of those that do, none seems to allow it to threaten economic stability.

Is it time we scrapped the debt limit altogether?

I would be in favor of debt ceiling reform if it did two things: 1) remove the serious threat of a government default, and 2) hold lawmakers accountable by automatically triggering spending cuts if the ceiling were reached.

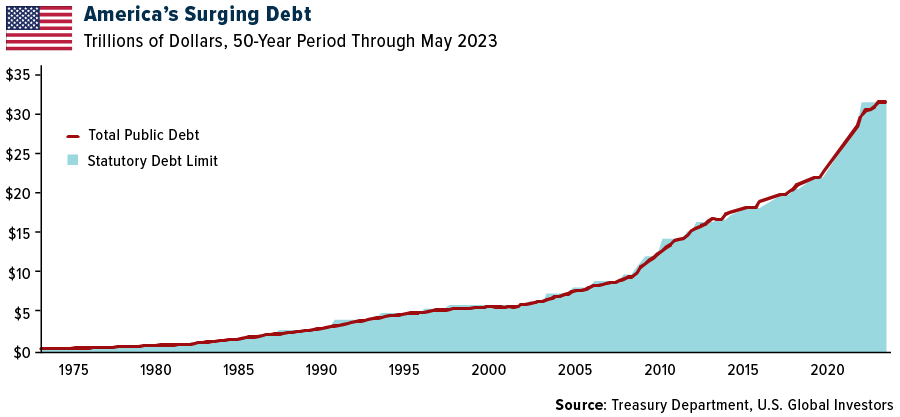

Spending is precisely what needs to be addressed. Today the national debt stands at $31.7 trillion, or 120% of U.S. gross domestic product (GDP). For the past 20 years, during Republican and Democrat administrations alike, the U.S. government has run an average annual deficit of almost $1 trillion. Much of this is due to the steep interest payments on public debt, which are now as much as the country’s spending on defense.

Simply put, it’s unsustainable.

I urge everyone to read Stanley Druckmiller’s recent comments on the nation’s out-of-control spending and, specifically, entitlements. Earlier this month, the billionaire investor spoke at the Student Investment Fund Annual Meeting at USC Marshall’s Center for Investment Studies (CIS), where he shared some startling statistics. For instance, the U.S. spends six times as much per senior as it does per child, and in 25 years, its spending on seniors will account for 70% of all tax revenues.

“It is time that we let go of the false pretense that cutting entitlements is a choice. It is not,” Druckenmiller said. “Either we cut them today, or we will have to cut them much more tomorrow.”

You can read his keynote here.

68% Probability Of Recession?

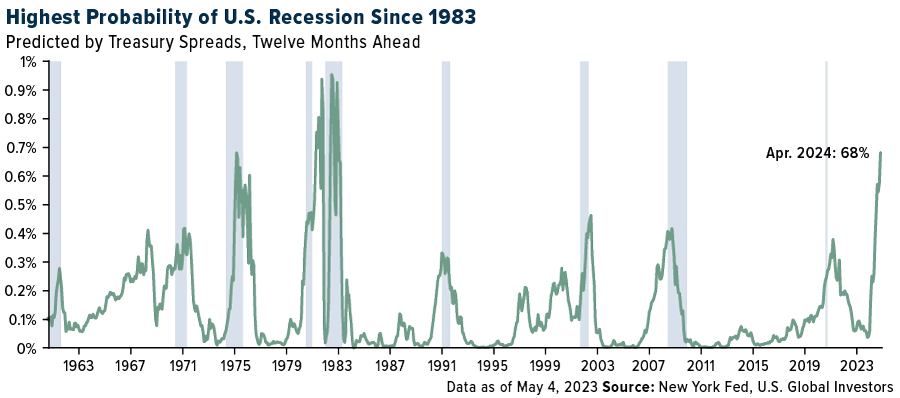

Leaving aside the debt ceiling drama for a moment, investors still have a potential recession to prepare for. Based on Treasury yield spreads, the Federal Reserve Bank of New York now puts the probability of a recession in the next 12 months at 68%. That’s the highest monthly reading since 1983.

The Fed’s tightening program appears to be nearing an end as inflation continues to cool and economic growth slows. That presents its own risks, based on historical precedent. Over the past 70 years, a pause in rate hikes was followed by an economic recession 75% of the time, with an average lag of six months.

If we follow the same playbook, we may be looking at a full-blown recession by the end of the year. As always, getting exposure to gold and gold mining stocks, I believe, is a wise and rational strategy to manage this risk.

Index Summary

- The major market indices finished mostly down this week. The Dow Jones Industrial Average lost 1.11%. The S&P 500 Stock Index fell 0.29%, while the Nasdaq Composite climbed 0.40%. The Russell 2000 small capitalization index lost 1.08% this week.

- The Hang Seng Composite lost 2.37% this week; while Taiwan was down 0.79% and the KOSPI fell 1.06%.

- The 10-year Treasury bond yield rose 0.02 basis points to 3.46%.

Airlines And Shipping

Strengths

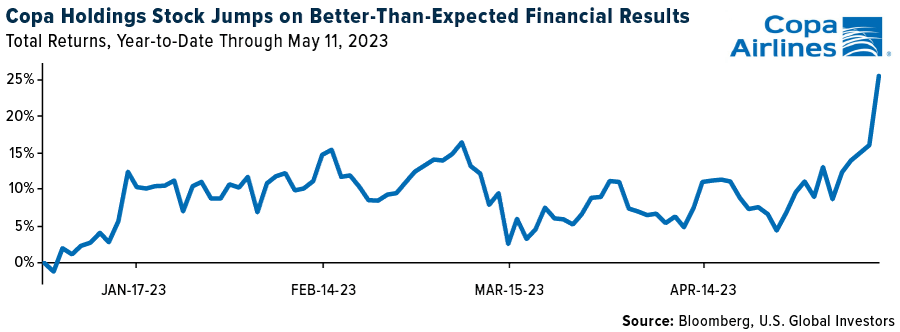

- The best-performing airline stock of the week was Copa Holdings, which increased by 13.1%. Japan Airlines exceeded consensus expectations with its third-fiscal-quarter earnings before interest and taxes (EBIT) of 65 billion yen, beating the anticipated 50 billion yen. The strong performance was driven by higher yields, with fourth-quarter domestic yields unexpectedly rising by 1% quarter-over-quarter and international yields reaching 137% of pre-COVID levels. Traffic also surpassed expectations, with March 2023 domestic and international revenue passenger kilometers reaching 93% and 75% of 2019 levels, respectively.

- The shipping industry has seen less than $2 billion of capital raised compared to an average annual figure of over $16 billion. The industry has faced challenges in terms of corporate governance and capital allocation, leading to public shipping companies trading at significant discounts to their net asset values (NAVs) in recent years. This does not imply that NAVs cannot increase, but historically, it has been more cost-effective to invest in the equities of shipping companies rather than purchasing actual ships.

- Copa Holdings reported better-than-expected results, with EBIT of $193 million, indicating a margin of 22.3%, surpassing the Bloomberg consensus estimate of $137.5 million and 16.9% margin. The beat was mainly due to a 7% positive surprise in yields, partially offset by a higher cost per available seat mile (CASM) of 4.5% compared to expectations. The company revised its operating guidance upward, now expecting a range between 22% and 24% (previously 17% to 19% and above the consensus of 18.7%).

Weaknesses

- The worst-performing airline stock of the week was Allegiant Travel Company, declining by 7.7%. Spirit Airlines’s stock dropped by 15% over two days following its earnings release, while the average decline for the group was 1%. This occurred despite third-quarter adjusted earnings per share (EPS) being mostly in line with consensus estimates. The capacity cut and higher CASM-ex fuel (CASM excluding fuel costs) likely contributed to concerns that the Spirit business model is flawed. While delivery delays have partially led to increased costs, a bigger factor affecting CASM-ex fuel is the reduced stage length/utilization resulting from schedule adjustments to concentrate flying on peak days.

- Global air freight activity (dedicated freighters) experienced a 5.2% year-on-year decline in April. This marks the 13th consecutive year-on-year contraction and represents a larger decline than the contractions observed in March and February.

- Indian low-cost carrier (LCC) Go First has filed for insolvency protection with the National Company Law Tribunal. In addition to existing financial challenges, Go First’s operations have been affected by engine delivery delays from Pratt & Whitney, the exclusive engine supplier for the Airbus A320neo. Pratt & Whitney did not comply with an arbitration order to release spare leased engines to Go First. The percentage of grounded aircraft due to Pratt & Whitney engine issues rose to 50% in December 2022 (compared to 7% in December 2019 and 31% in December 2020).

Opportunities

- Air France-KLM is in discussions with private equity firm Apollo Global Management for a 500-million-euro ($550.70 million) capital injection into one of its engineering and maintenance units. The proceeds from this transaction would be used for general corporate purposes and would not involve operational or workforce-related changes. Air France-KLM expects that this new financing arrangement, if completed, will strengthen its and Air France’s balance sheets.

- UBS believes that Korean shipyards are well-positioned for positive developments. An aging fleet and stricter environmental standards create a strong order cycle, even in the face of weaker global trade. Environmental upgrade demand is expected to benefit Korean and Chinese yards, given their dominance in building green ships. Major yards now have pricing power, thanks to a full order backlog.

- Boeing has received an order from Ryanair for up to 300 737 MAX aircraft. The order includes firm orders for 150 737 MAX-10 aircraft, with the option to purchase an additional 150 aircraft. The list price valuation would exceed $20 billion for the 150 firm orders, and potentially reach over $40 billion if all options are exercised by Ryanair. Deliveries of the MAX aircraft are expected to take place after 2027. Boeing has recently experienced increased order activity, with significant orders from Saudi Arabian Airlines, Riyadh Air, Air India and now Ryanair.

Threats

- Indian domestic airline traffic has been trending 5%-10% above pre-COVID levels in late April and early May. However, Go First’s insolvency filing and flight cancellations seem to be having an impact, as Indian domestic air passengers have decreased by 3.5% since the beginning of May. It remains uncertain whether Go First will be able to resume operations due to engine issues, pilot recruitment challenges and lessors attempting to repossess aircraft. Go First’s supply disruptions may further tighten an already constrained Indian aviation market.

- According to Bank of America, there is a downside risk to air freight rates as demand cools off and supply recovers. Demand has been declining year-to-date, while supply continues to add capacity. In March, air cargo supply reached 98% of 2019 levels, rising 10% year-on-year according to the International Air Transport Association (IATA). It is expected that belly capacity will continue to normalize in the coming months, particularly with Chinese belly capacity increasing from 10% of 2019 levels in 1Q23 to 45% in 2Q-3Q23.

- The era of ultra-cheap flights is over, and finding last-minute bargains will no longer be as feasible due to significant demand outpacing supply. Sebastian Ebel, CEO of the Hanover-based TUI Group, Europe’s largest tourism conglomerate, stated that airlines will not discount plane tickets to less than €50 (£44) to fill seats. The cost of air travel has increased by more than a fifth over the past year, exceeding the broader rate of inflation across developed countries.

Luxury Goods And International Markets

Strengths

- Over the past weekend, King Charles III was crowned as the new monarch of the United Kingdom. The St. Edward Crown, weighing nearly five pounds (2.23 kilograms), made of solid gold, and adorned with more than 400 gemstones including six sapphires and 12 rubies, was prominently featured in the ceremony. The estimated value of King Charles’ crown, worn by the monarch when leaving Westminster Abbey after the coronation, is nearly GBP45 million ($57 million), consisting of two kilograms of gold.

- Richemont, the Swiss luxury goods maker that owns the Cartier brand, reported strong quarterly results. Operating profit reached 5.03 billion euros ($5.5 billion), and sales rose 14% in the year ending March 2023, beating analyst estimates. The company also announced a plan to buy back as many as 10 million A shares, representing 1.7% of the company’s capital.

- Tapestry was the best-performing S&P Global Luxury stock for the week, gaining 7.6%. Shares surged 8% on Thursday after the company released strong quarterly results. The company raised its annual outlook for the second time in three months, fueled in part by a stronger-than-expected rebound in China.

Weaknesses

- The Sentix Investor Confidence, a monthly gauge of current business conditions in the 17 eurozone countries, declined to -13.1 in May from -8.7 in April. The index measuring the current situation in the eurozone also dipped to -9.0 in May from -2.3 in April, sparking discussions about a possible recession.

- Initial jobless claims in the U.S. rose to 264,000, higher than the consensus estimate of 245,000 and up from the previous week’s 242,000. While the U.S. labor market has remained relatively strong so far, this increase in initial jobless claims is likely viewed favorably by the Federal Reserve as it monitors the labor market for signs of a slowdown in wage gains.

- TopGold Callaway Brands Corporation was the worst-performing S&P Global Luxury stock for the second week in a row, losing 20.1% in the past five days. Shares lost more than 13% on Wednesday after the company released good quarterly results but cut the profit forecast for the remainder of this year.

Opportunities

- According to a report published by Allied Market Research, the global luxury watches market generated $43.66 billion in 2019 and is expected to reach $51.31 billion by 2027. With an increasing number of people becoming wealthier, particularly in Asia, the demand for luxury watches is projected to grow. The electronic watches segment is expected to see rapid growth, as electronics gain popularity among the working population.

- In China, the consumer price index rose by just 0.1% in April compared to a year ago, marking the lowest inflation rate since February 2021, according to the National Bureau of Statistics. There is a growing expectation that the People’s Bank of China may lower policy lending rates to stimulate growth in the world’s second-largest economy.

- for the first time in three years. Domestic travelers made 274 million trips within mainland China during the holiday, a 71% increase from the previous year and 19% higher than in 2019. Revenue from domestic tourism reached 148 billion yuan ($21 billion), up 129% from a year earlier and slightly higher than in 2019. The continued post-pandemic recovery is expected to further boost the luxury market.

Threats

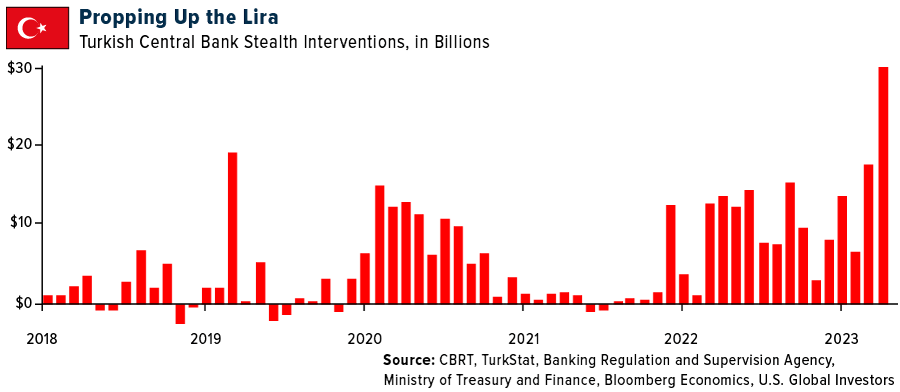

- Turkey will hold Presidential and Parliamentary elections on May 14, with President Erdogan seeking reelection after 20 years in power. The performance of Turkish equities next week is expected to depend heavily on the outcome of the elections. Analysts anticipate potential weakness in the Turkish lira regardless of whether there is a change in power. The central bank’s significant expenditure to support the lira may cease following the election, which could impact the currency’s stability.

- Global luxury home prices, according to real estate tracker Knight Frank, have turned negative for the first time since 2009. The prime price index in 46 cities declined by 0.4% year-over-year, primarily driven by higher interest rates. The luxury housing market is likely to face continued downward pressure in the coming quarters as rates are expected to continue rising.

- PacWest, one of the troubled regional banks in the United States, experienced a 9.5% decrease in deposits during the week of May 5th. The largest outflows occurred after reports emerged that the lender was exploring strategic options. Following the update, the bank’s shares fell by more than 20%, contributing to a decline of over 50% month-to-date. Uncertainty surrounding the bank’s balance sheet arose as deposits fell nearly 17% in the first quarter, as reported by FactSet.

Energy And Natural Resources

Strengths

- The best-performing commodity of the week was natural gas, with a rise of 6.5% on a surprise drop in the rig count. China’s lithium spot price has rebounded after a 70% sell-off, reaching $27.5 per kilogram for carbonate and $30 per kilogram for hydroxide, up 30% and 20% respectively from their lows. This recovery was driven by increased demand and higher prices for lithium products.

- UBS is impressed with the progress of Brazil’s emerging lithium industry. Despite challenges, there is a coordinated effort between companies and the government to grow in this space. UBS predicts that Brazil’s share of the global lithium market will increase from 2.5% in 2023 to 3.5% in 2026, maintaining this level throughout the decade.

- Net steel exports in April reached 7.35 million tons, showing a 2% month-on-month increase and an 83% year-on-year increase. The annualized run-rate stands at 88 million tons, more than double the 2023 forecast. This dynamic is a result of higher domestic steel production (up 6.9% year-to-date) outpacing demand recovery.

Weaknesses

- The worst-performing commodity for the week was nickel, dropping 11.2%. Tightness is not supported in the physical market where poor demand continues to keep premiums under pressure globally. The low stock environment is also impacting contract liquidity, which has often led to price volatility.

- Iron ore prices have reached five-month lows as China’s economic recovery falters and steel consumption disappoints during what is typically a peak period for demand. Prices fell below $100 a ton from a high of nearly $140 a ton in February, returning to pre-restriction levels after China reopened following three years of Covid-related restrictions.

- Global pulp shipments dropped by 5.8% year-on-year to 4.53 million tons in March, with declines seen in softwood, hardwood and unbleached kraft pulp. Softwood shipments were down 6.1% year-on-year, hardwood down 2.4% and unbleached kraft pulp down 35.5%.

Opportunities

- The world’s top miners have an opportunity to address challenges, such as a decade of underinvestment and complex permitting processes. This is crucial if they want to benefit from a potential surge in copper prices driven by the need to address climate change. The U.S. Inflation Reduction Act, a green industry policy bill, has sparked interest in copper assets. The supply of copper is expected to fall short of demand over the next decade, making new greenfield projects essential.

- Aluminum’s lightweight nature and recyclability make it crucial for the transition to a greener economy. Demand for aluminum in electric vehicles (EVs), wind power and solar energy is expected to increase. JPMorgan forecasts a 10% compound annual growth rate, with aluminum demand in EVs, wind and solar projected to rise from 2.4 million tons in 2020 to 3.8 million tons by 2025.

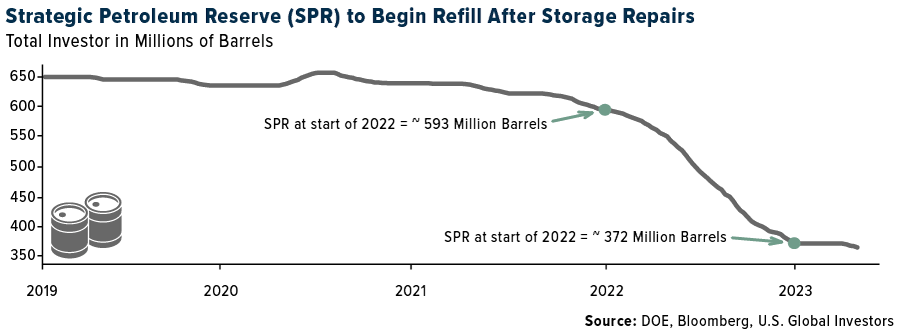

- The Biden administration plans to replenish the Strategic Petroleum Reserve (SPR) after completing maintenance work. The SPR, which is at a four-decade low, will be restocked to strengthen national and economic security. The administration aims to purchase oil once prices reach around $70 a barrel, aiming to deliver the best value for taxpayers and align with congressional mandates.

Threats

- Goldman Sachs expects macro-driven pressures to weigh on aluminum prices in the coming quarters, although they believe $2,000 per ton is likely to hold as a floor for now. While the global aluminum market is projected to balance out the surplus from the first quarter of 2023, the fundamentals alone may not be strong enough to shield aluminum from broader macro risks and recessionary pressures in the near future.

- Bank of America anticipates reduced credit and further interest rate hikes to result in weaker demand for oil, leading them to revise down their global oil consumption growth expectations. They forecast a contraction in OECD demand for 2023 and 2024, contributing to a weaker demand outlook. However, they still project oil market deficits for the second half of 2023 and 2024, supporting Brent crude oil prices. Their average Brent crude oil price forecast for 2023 is $80 a barrel, and they maintain a forecast of $90 a barrel for 2024, anticipating eventual improvement in OECD demand and proactive supply management by OPEC+.

- China’s commodities demand declined in April as the economy experienced setbacks, with imports of crude oil, iron ore and copper dropping compared to the previous month. The economic recovery from Covid restrictions appears to be losing momentum. Recent import figures reflect a favorable comparison to the disruptions caused by the extended lockdown of Shanghai, but they still indicate a slowdown in various sectors, such as manufacturing, services and construction.

Bitcoin And Digital Assets

Strengths

- Among the cryptocurrencies tracked by CoinMarketCap, Kava was the best performer of the week, rising by 13.51%.

- The Reserve Bank of Zimbabwe allocated the full amount available for the recently launched gold-backed digital tokens. Bloomberg reported that 135 applications were received for these tokens.

- Developers have deployed Uniswap’s smart contracts onto the Bitcoin network to take advantage of the increasing popularity of BRC-20 tokens and to foster the development of the decentralized finance ecosystem, as reported by Bloomberg.

Weaknesses

- Pepe was the worst performing cryptocurrency of the week among those tracked by CoinMarketCap, experiencing a decline of 70.25%.

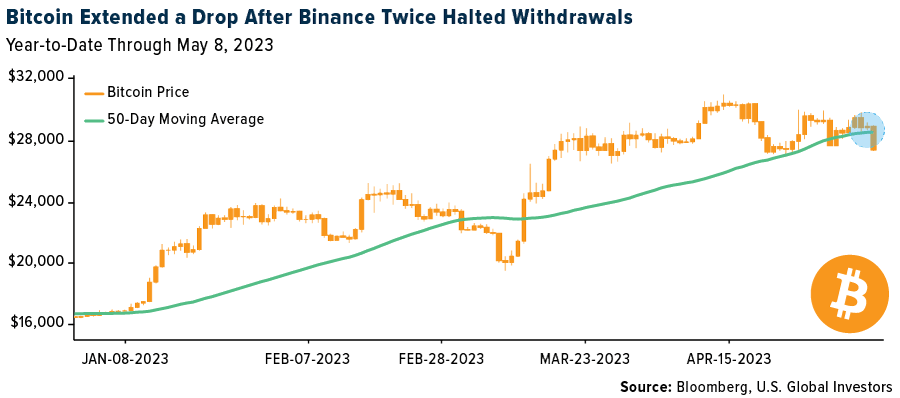

- Bitcoin experienced a decrease of as much as 3.7% after Binance temporarily suspended Bitcoin withdrawals for approximately 90 minutes. Bloomberg attributed this action to congestion on the Bitcoin blockchain.

- Jane Street Group and Jump Crypto, two of the world’s leading market making firms, are reducing their involvement in trading digital assets in the United States due to increased regulatory scrutiny. Bloomberg also reported that Jane Street is scaling back its global crypto ambitions due to regulatory uncertainty, making it challenging for the firm to operate in accordance with internal standards.

Opportunities

- Prime Protocol, a DeFi prime brokerage, has introduced asset-based lending services that aim to eliminate the need for transferring tokens across different blockchains. Bloomberg reported that users can borrow against the value of their entire asset portfolio across multiple supported blockchains.

- Binance NFT, which already supports NFTs on Ethereum, Polygon and its native BNB Chain, plans to expand its offerings by enabling traders to purchase Ordinals on the Bitcoin network. Collectors will soon be able to buy and sell inscriptions, or NFTs created on the Bitcoin network, thereby expanding the reach of the nascent Ordinals ecosystem, according to Bloomberg.

- Despite the recent price correction, Pepe traders remain undeterred and are increasing their holdings, indicating a bullish sentiment for the tokens in the coming weeks. On-chain analytics tool Lookonchain reported on Tuesday that three whales started accumulating Pepe tokens earlier this week, despite a nearly 50% price drop, as stated by Bloomberg.

Threats

- Michael Novogratz stated that Galaxy Digital is shifting more of its operations offshore, partly due to the regulatory environment in the United States, according to Bloomberg.

- A former Coinbase manager has been sentenced to two years in federal prison for trading on confidential information about the listing of new tokens on the cryptocurrency exchange. Ishan Wahi pleaded guilty to two counts of conspiracy to commit wire fraud, admitting that he provided tips about offerings to his brother and friend, as reported by Bloomberg.

- Bitcoin caused volatility for traders when its price fell below $27,000 for the first time in over two weeks, raising concerns about decreased participation from institutional market makers. According to an article published by Bloomberg, Bitcoin experienced a 5% decline within minutes during early afternoon trading.

Gold Market

This week gold futures closed the week at $2,018, down $6.8 per ounce, or down 0.34%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 6.0%. The S&P/TSX Venture Index came in up only 0.02%. The U.S. Trade-Weighted Dollar was up 1.4%.

Strengths

- Palladium was the best-performing precious metal of the week, increasing by 1.3%. Exchange-traded funds (ETFs) raised their palladium holdings by 17,202 troy ounces. China continued to add to its gold reserves for the sixth consecutive month, as central banks worldwide expand their bullion holdings in response to geopolitical and economic risks. In April, China increased its gold holdings by about 8.09 tons, bringing the total to approximately 2,076 tons, following a 120-ton increase in reserves in the previous five months.

- South African platinum group metal (PGM) exports showed signs of recovery in March, with palladium and platinum increasing by 51% and 37% respectively compared to the previous month.

- American Eagle Gold announced a strategic investment by Teck Resources through structured flow-through financing, resulting in a 28.6% surge in American Eagle Gold’s stock. Teck will issue 14.4 million common shares on a flow-through basis at $0.205 apiece, generating around $3 million in proceeds. Teck will subsequently acquire the shares for approximately $1.9 million, or $0.13 per share.

Weaknesses

- Silver was the worst-performing precious metal of the week, experiencing a decline of 6.9% due to aggressive selling by ETFs. A fire followed by an underground collapse resulted in the loss of at least 27 lives at a gold mine in Peru.

- The World Gold Council (WGC) reported a 17% quarter-on-quarter decline in global gold demand in the first quarter, primarily driven by a significant drop of 24% (152 tons) in global jewelry consumption.

- i-80 Gold reported lower-than-expected gold sales and higher exploration expenses in the first quarter, resulting in adjusted earnings per share (EPS) and cash flow per share (CFPS) misses.

Opportunities

- Canaccord considers SSR Mining as its top defensive pick among mid-cap precious metals producers. They highlight SSR Mining’s scale, exposure to gold and silver, value potential in its assets, strong balance sheet and capable management team. Ongoing operational improvements, exploration programs and solid cash flow generation are expected throughout 2023.

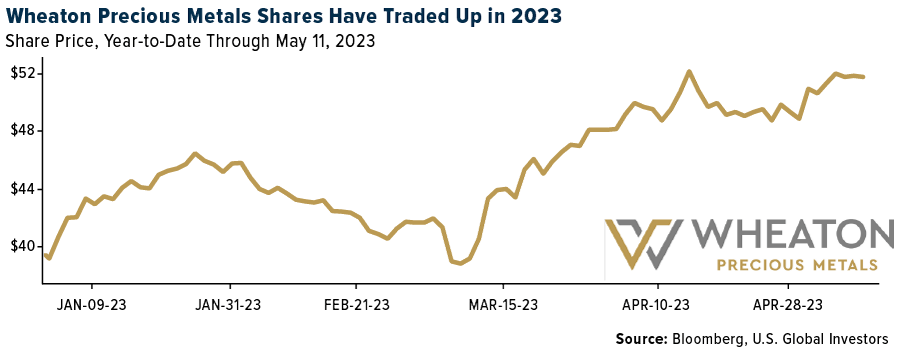

- BMO notes that Wheaton Precious Metals has available liquidity of $2.8 billion, providing sufficient funding for existing commitments and future growth opportunities. The company anticipates a favorable growth outlook for the remainder of the year, with a strong pipeline of opportunities in the range of $150-350 million. While balancing shareholder returns with growth, Wheaton Precious Metals maintains a modest dividend.

- Scotia sees SSR Mining’s acquisition of up to a 40% interest and operational control in the Hod Maden Gold development project in Turkey as a positive move. Leveraging the company’s existing expertise in Turkey, this deal has the potential for operational synergies with Çöpler, enhancing SSR Mining’s prospects.

Threats

- Royal Gold faces key focus areas in 2023, including revenue growth from various projects, the mill expansion at Pueblo Viejo and the pursuit of additional precious metals stream/royalty opportunities. The timing of sales from projects such as Mount Milligan and Andacollo may lead to quarterly sales estimate volatility.

- The bonds of Eskom Holdings SOC Ltd., a state-owned company in South Africa, have experienced a decline in value. This reflects deepening supply cuts and rolling blackouts across the nation. The utility’s use of more diesel than budgeted for and ongoing challenges may impact its liquidity.

- Sibanye Stillwater’s first-quarter results fell short of expectations in several production metrics, leading to downgraded production and cost guidance. A March incident caused damage to infrastructure.

Related: The Silver Lining in the U.S. Regional Banking Storm