Written by: Chris Hogbin

For 40 years, steadily declining inflation and interest rates buoyed equity returns. That changed abruptly last year. Investors must now adjust expectations to a new macroeconomic and market landscape that will require a fresh mindset to reach long-term goals.

When the inflation genie burst out of the bottle in 2022, equity investors were understandably fearful for the future. Aggressive interest-rate hikes by major central banks marked the end of an era of near-zero interest rates. Now there will be a real cost for money, with profound implications for business dynamics, corporate profitability and asset-class returns.

In 2023, investors must begin to take the first steps into this new reality. That requires distinguishing the recent market tumult from the regime change that could redefine investing for years to come. By facing up to these new conditions, we can begin to reaffirm the strategic role that equities should play as a key source of real returns for the future.

Few Places to Hide in 2022

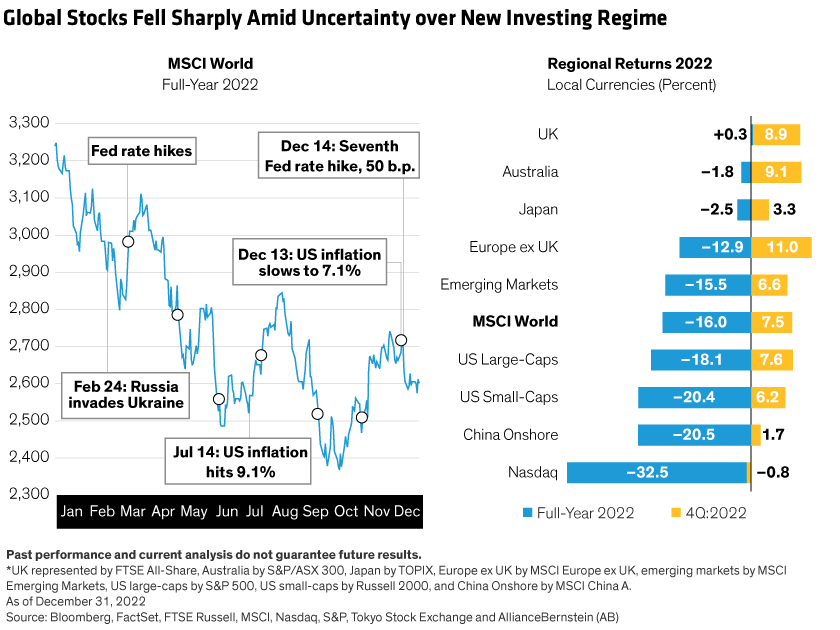

Market conditions were traumatic in 2022, with stocks in many regions falling by more than 20% during the year. Although stocks regained some ground in the fourth quarter, uncertainty lingered at year-end. It’s still too soon to say whether the fourth quarter rebound was a genuine turn for the better or a bear-market bounce that might fade if economies slip into recession or full-year earnings are disappointing.

The MSCI World Index fell 16.0% in local-currency terms over the year, after gaining 7.5% in the fourth quarter. US stocks were hit especially hard, dragged down by a collapse in technology shares. Emerging markets were hurt by China’s weakness. Japan escaped the inflation scourge and ended the year down slightly. The UK’s relative resilience—despite especially grim macroeconomic conditions—was supported by large cohorts of exporters that benefited from a strong US dollar and energy companies.

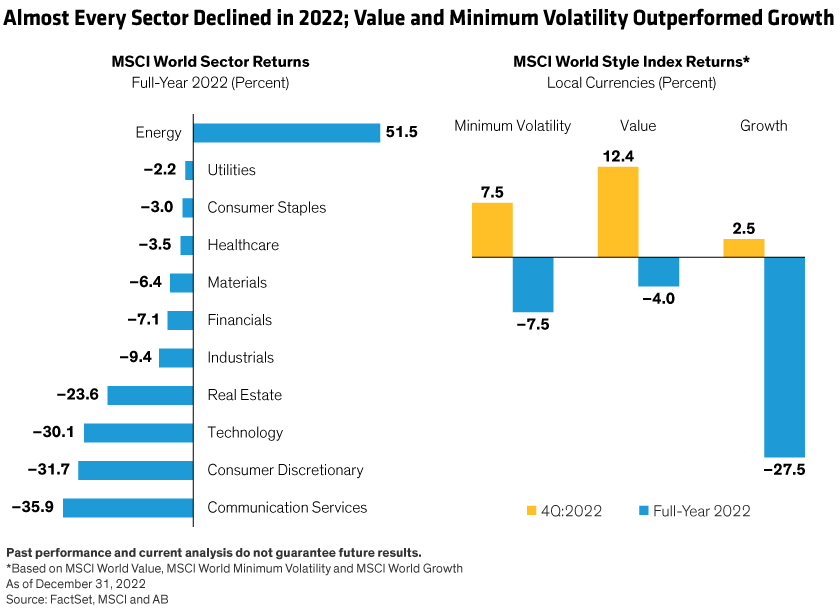

Every sector fell except for energy, which benefited from higher oil and gas prices due to the loss of Russian supply. Technology, communication and consumer-discretionary stocks underperformed. Value and minimum-volatility outperformed growth stocks by a wide margin.

High inflation, rising interest rates and growth fears dominated the narrative in 2022. Investor anxieties were also stoked by Russia’s invasion of Ukraine, which made geopolitical risk a threat to global stability, European energy security and supply chain integrity.

Different regions had different experiences. In the US, the Federal Reserve led the fight against inflation with several aggressive rate hikes. European policymakers’ efforts to fight inflation were complicated by the energy crisis. In Japan, inflation remained low along with interest rates. China’s zero-COVID policies suppressed economic activity until the government started reopening the economy at year-end amid growing public discontent.

Looking Beyond the Recent Turmoil

We believe last year’s extreme volatility reflected the extreme uncertainty about the scale of inflation, the magnitude of rate hikes and the first-order effects of these changes on companies. It’s hard to focus on a distant destination when a raging storm is obscuring the road in front of you.

Since monetary policy takes time to affect the economy, the short-term outlook is still cloudy. Yet we’re seeing signs that inflation may be moderating, from falling freight costs to declining commodity prices. In the US, retail sales growth has slowed and the housing market has cooled. While wage pressure remains elevated, we believe inflation may have passed its peak, which could compel central banks to slow the pace of rate hikes to avoid deeper slowdowns or a recession.

Stabilizing inflation can help investors refocus on fundamentals. This will be crucial in 2023, as the earnings reset unfolds. Consumers and companies are still adjusting to evolving conditions.

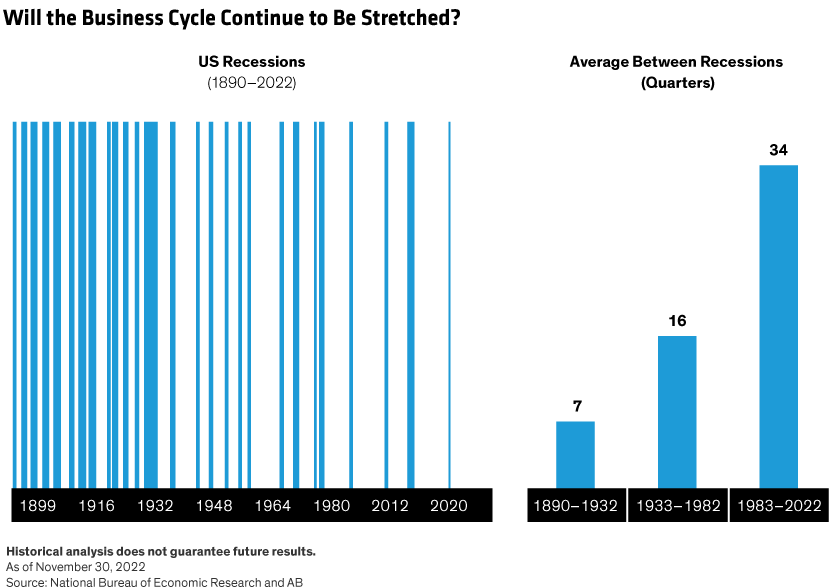

In recent decades, companies have enjoyed supportive policies that have transformed the business cycle. Investors became accustomed to longer spans of economic growth punctuated by much shorter recessions (Display). It’s too soon to say whether the business cycle will shorten again. But it’s clear that higher interest rates and the removal of monetary support will challenge economic growth and profitability.

Regime Change: The Rebirth of Inflation

These developments may prove to be historic. We believe last year’s market convulsions probably reflected the birth pangs of a new regime characterized by persistently higher inflation and interest rates, and potentially lower market returns. Investors will need to rethink how to position their portfolios and allocations to generate real returns above the inflation rate.

But how did we get here?

Since the 1980s, the global economy and markets have been defined by falling inflation and real interest rates. These conditions were driven by demographics, accelerated globalization, technological progress and the adoption of pro-shareholder values in developed markets.

China’s growing integration into the world economy fostered globalized supply chains. Companies everywhere tapped China’s cheap labor force and manufacturing prowess, which enabled the cheaper production of goods in many industries. Favorable demographics helped the global workforce expand to record proportions. The technological revolution boosted productivity and supported a leap in corporate profitability. At the same time, Western governments and policymakers became increasingly supportive of shareholder values. Inflation and interest rates gradually fell.

When calamity struck, policy reactions often reinforced these trends. For example, after the global financial crisis in 2008, anemic growth in the US, Europe and Japan led to quantitative easing (QE) and ultralow interest rates. Yet inflation was absent, which fostered a growing belief that it may have been conquered forever.

Pandemic Policies Were a Turning Point

That belief guided policy during the coronavirus pandemic, as central banks pushed interest rates to rock-bottom levels and accelerated QE. Governments delivered mammoth fiscal packages to help keep economies afloat through the massive shock to business activity.

Those days are over. When the economic history of the pandemic is written, it will be seen as the catalyst for changes that were bubbling beneath the surface for years. Populist politics were already threatening globalization and the Chinese workforce was aging. Now, massive capital injections into financial markets and unprecedented supply chain disruptions have pushed inflationary pressures to the boiling point.

Profitability to Come Under Pressure

Changing inflationary forces affect profitability in many ways. Global supply chains allowed companies to maintain smaller inventories. Cheaper labor helped curb expenses, and taxes were low. This was a recipe for companies to boost margins—and returns—often without solid underlying business fundamentals.

Companies will need to learn to live without such support. Expect corporate tax rates to rise as deglobalization hinders companies’ ability to operate in the most tax-efficient locations, and as campaigns for social fairness spread. Deglobalization will require higher inventory levels, which tends to lead to lower profit margins, according to our research. Increased labor power suggests that high wage costs might not come down soon. Meanwhile, the energy transition adds inflationary ingredients that will also erode profitability. The US corporate profit share of GDP was a near record 12.2% in June 2022. That now looks unsustainable.

To be sure, there are strong countervailing winds, most importantly, technology and innovation. Robotics, the Internet of Things and technology-enabled infrastructure will unlock efficiencies to help control costs. Innovative companies that tap into these technologies ahead of competitors will enjoy competitive advantages.

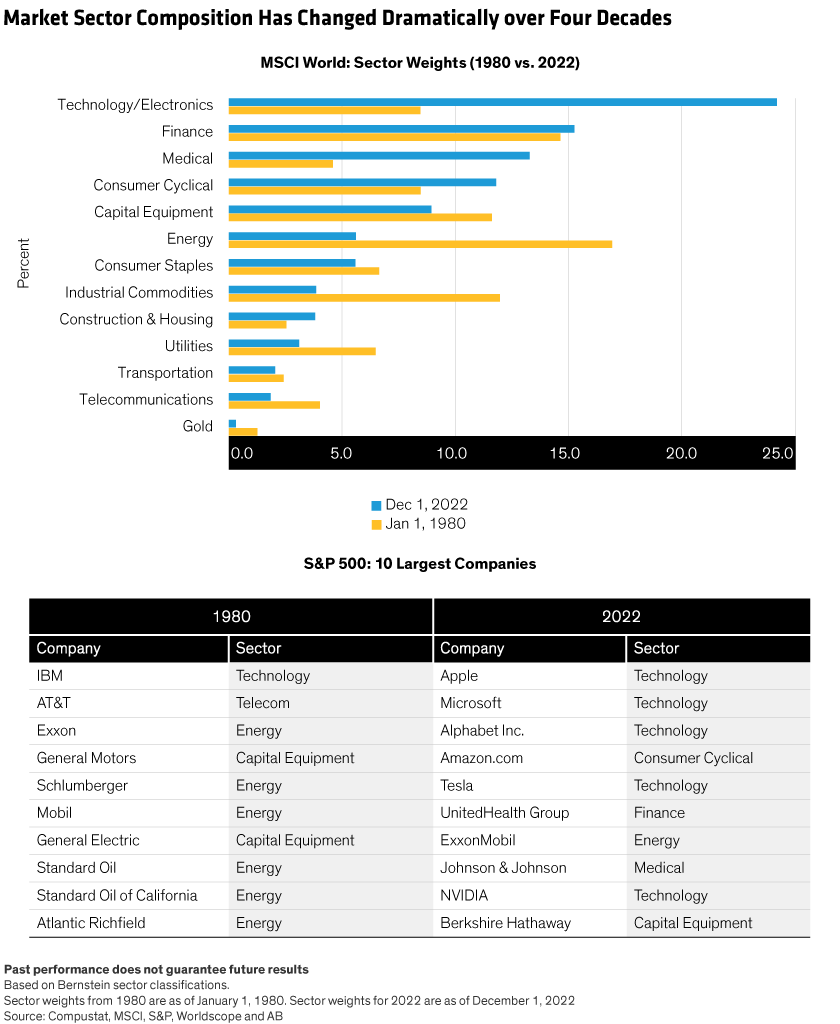

Markets Look Very Different Today

History may not be a good guide to this future. Today’s markets look very different from those of the inflationary 1970s and 1980s. For example, since 1980, technology stocks have more than tripled their weights in the MSCI World, and account for 24% the index, respectively (Display). Many of today’s tech and new media giants didn’t exist the last time we faced inflation, so we don’t know how their businesses will fare. The dominance of energy companies in global and US stock indices has diminished. Just as the corporate powers of yesterday have receded, we believe that tomorrow’s winners could be very different from those in the recent and more distant past.

Passive portfolios could be at a disadvantage in this environment, which we believe will create more differentiated performance within asset classes. We think these conditions will be excellent for skilled active investment managers who know how to find companies with the right business models to thrive in new business conditions.

Beyond the business environment, exogenous hazards abound. From geopolitics to cryptocurrency, vulnerable private markets and liquidity issues, there are plenty of land mines across the landscape that can derail even the best-laid investing plan. No portfolio can be fully insulated from these risks.

However, we believe identifying companies with quality businesses can help position portfolios for long-term resilience. Features such as pricing power, competitive advantages, innovation and management skill will define the companies that can overcome the profitability headwinds created by inflation and higher interest rates. Businesses that benefit from long-term growth trends, whose fortunes are not tied to the short-term economic cycle, are also likely to find favor, in our view. Companies that provide solutions to structural inflation via automation and technology should also do well.

Equities Are Vital for Real Returns

But why should investors want to own equities at all in a world of higher inflation, lower growth and increased volatility? After all, higher interest rates also make fixed-income assets more attractive. And even if inflation settles into the 3%–4% range, the hurdles to positive real returns will be set higher.

Our answer is that investors need equity returns to beat inflation. In the past, equities have performed well during periods of moderate inflation, so as long as the current extreme levels of inflation prove transitory, stocks offer solid return potential, in our view. Assets with explicit inflation protection such as TIPS won’t provide many investors with the level of return they need to meet their goals. And businesses that are well positioned for an inflationary environment can deliver cash flows that support positive real equity returns over time. Yet since today’s market is so different from when we last experienced inflation, an active approach will be necessary to find companies with the right attributes to succeed. The following principles can help guide the way:

- US equities tend to offer earnings resilience. While last year delivered a blow to the tech-heavy stock market, we believe underlying conditions make US equities a prime source of earnings growth through difficult macro environments—and essential to any equity allocation. But the companies and sectors that lead the next recovery might not be the same as those that led in the past, so US portfolios must adapt accordingly.

- Return potential can be found globally, even in weaker markets. Country-specific macroeconomic conditions shouldn’t determine global equity allocations. Investors should look beyond a company’s domicile to find the most promising sources of long-term growth. Even in Europe, which faces particularly acute macro challenges, select companies will benefit from favorable industry and currency dynamics. China’s reopening could spark an economic boost, creating opportunities that may differ from other parts of the world.

- Quality matters across styles. Specific features vary based on styles and portfolio philosophy. But to capture real return potential in a tougher environment, we believe a quality focus is the fundamental anchor to success across growth, value and low-volatility equity portfolios.

Following these guidelines can help investors gain long-term conviction in equities for different risk appetites and return objectives. With greater clarity on the new dynamics facing companies and portfolios, we can find new ways to turn seemingly insurmountable obstacles into investing opportunities.

Related: Preparing Equity Portfolios for a New Investing Era