No sense in dwelling on 2022…but for the record, let’s memorialize some stats and figures.

First, let’s start at a high level

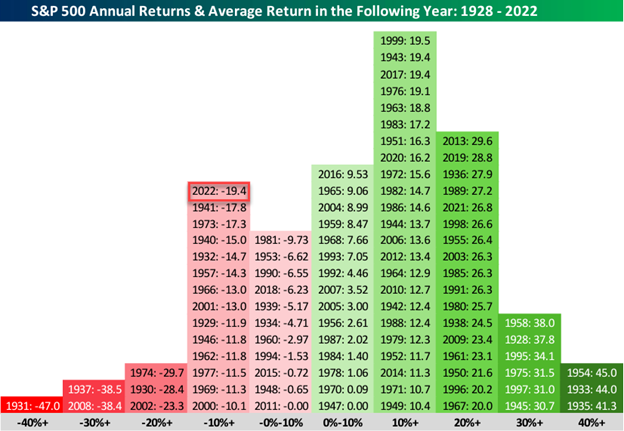

The chart below shows the annual returns of the S&P 500 broken down into groups of 10 percentage points intervals. You’ll notice that 2022 was the 14th year since 1928 that the index has been down between -10 and -20% in a single year. Not only that but it is also the 7th worst loss since 1920. You just count the boxes from 2022 over to the left to see that.

If you’ve known me for any amount of time, you’ll know I’m fond of distinguishing between ‘possibilities and probabilities’. Please note the number of years that fall out to the right vs the left on the graph above.

Ok, moving on…

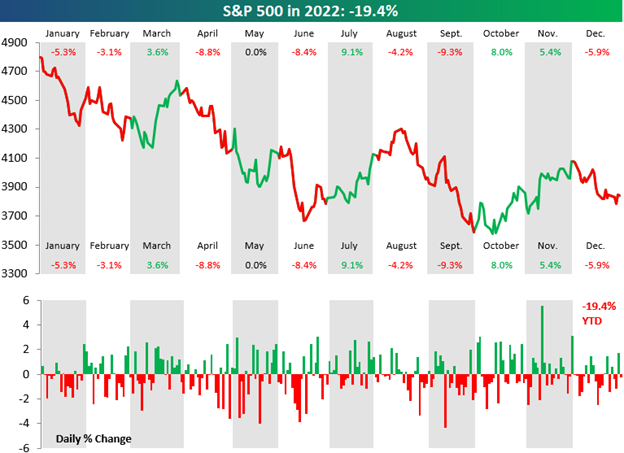

Here’s the S&P 500 in 2022, broken down by months

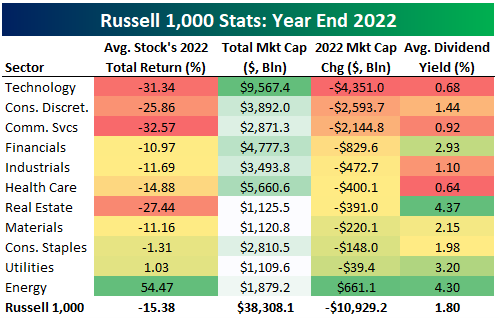

Now, here’s how the sectors ended up for the year

I’m using the Russell 1000 (R1000) because some sectors in the S&P 500 only have a few securities, so this is just more interesting.

Below you will see the R1000 sectors by Return / Total Market Cap / Change in Market Cap / Ave Dividend Yield – look at those top three changes in market cap.

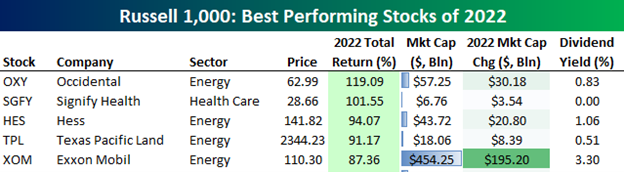

Energy crushed everything in 2022. In fact, of the 30 best performing R1000 stocks, 22 are in the Energy sector. Exxon Mobil (XOM) logged a total return of ~87% for 2022…and it ranked 5th!

Here are the top five performers of the Russell 1000:

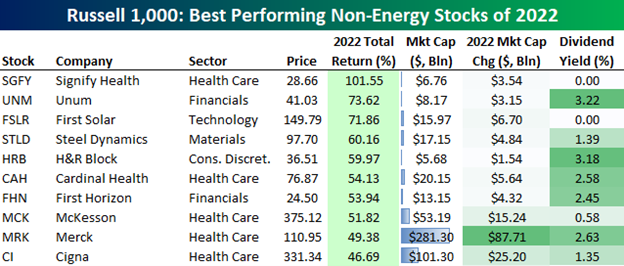

Now, let’s strip-out the stocks in the Energy sector and look at the top 10

Of interest, only 8 stocks outside of the energy sector had a 50% or higher return for 2022. Two of the biggest names in Healthcare, Merck (MRK) and Eli Lilly (LLY), didn’t even clear the +50% hurdle, posting 2022 gains of ‘only’ 49.4% and 34.2%, respectively.

And now, let’s look at the 10 worst performers in the R1000 of 2022

Breaking it down, it shakes out like this: 45% of stocks fell 20% or more (total return), 30% fell 30%+, just about 20% fell 40%+, and 11% fell by 50% or more. You may find your eyes scanning for Tesla because well that seems to be the only stock the press wants to talk about, but it was only down 65.3%. It was, however, in the top 5 market cap losers of 2022 (second chart).

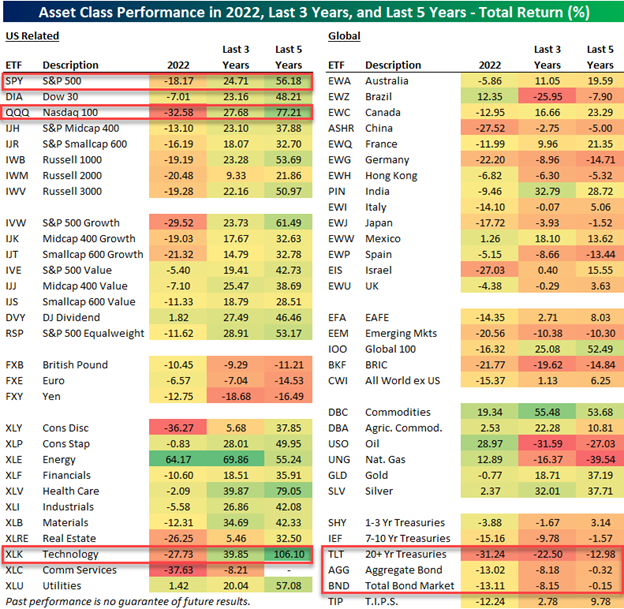

Let’s conclude by looking at ETF total returns across asset classes

We’ll look at these ETF returns for not just 2022, but over the last three and five years as well because (broken record alert) we preach raising the cash you need for the next 12-18 months to help avoid forced sales to fund your needs when the market is down.

Below you’ll notice that some areas that did the worst in 2022 are still up the most on a 5-year basis. For example, the Nasdaq 100 (QQQ) was down more than any other major index ETF in 2022, but when you look out over that past 5 years, it’s still up the most.

Technology (XLK) is an obvious sector to look at. It was one of the worst sectors in 2022, but it’s the only sector up more than 100% over the last five years.

For bonds, the long-term Treasury ETF (TLT) has had a total return of -12.98% over the last five years but that’s primarily due to the 31% drop in 2022. Two other aggregate bond market ETFs (BND, AGG) are also slightly down over a 5-year total return basis.

Ahem…compare that to the S&P’s (SPY) five-year gain of 56.2%.

I will conclude with this

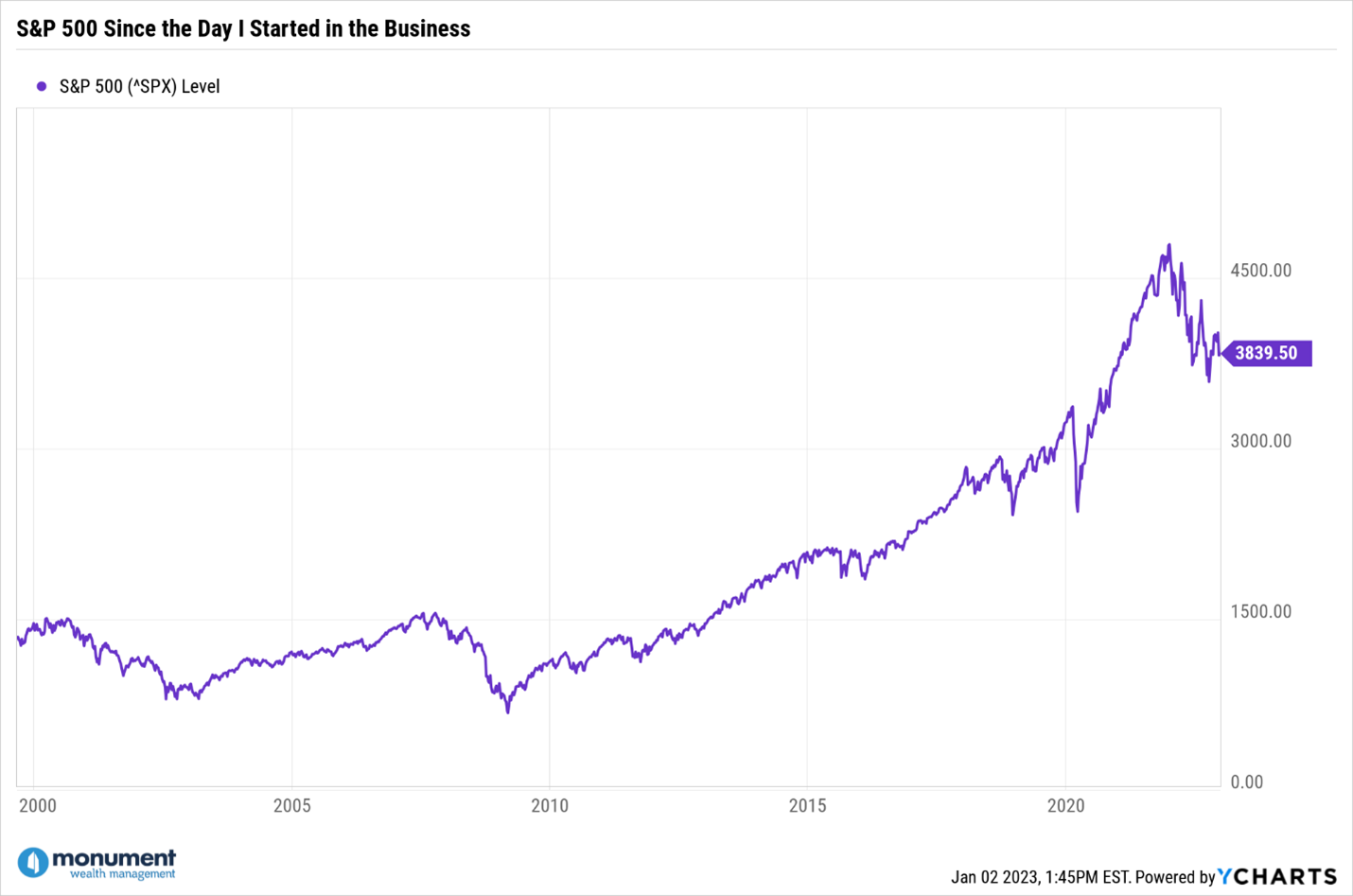

Over the long term, the stock market is undefeated.

We have been through bad times before and they always turn out to be really good opportunities for long-term investors to either continue to be patient or to put some cash to work.

There’s of course no guarantee that next year will be better than this year, but for those people who have the proper long-term perspective on investing and have aligned their portfolios with their goals and objectives things will turn out to be okay.

How can I be so sure? Refer back up to that very first chart and you will see that there have been 20 years where losses in the S&P 500 have equaled 10% or more. Otherwise known as double digit losses.

Since I started out in the industry in 1999, I’ve lived through 25% of those double-digit losses and in fact, I lived through three of them back-to-back – 2000, 2001, & 2002.

Here’s the chart:

The key to 2023 – and forever

Confidence is key.

You may be saying to yourself, “Congrats Dave, you get a gold star for experiencing 25% of those loss periods…but so what?”

Here’s what: I remember the lessons learned, and those experiences were formative and valuable for when I give people advice.

So here it is…as an investor it’s imperative that you become comfortable with uncertainty. While many people will discuss the idea of portfolios that remove uncertainty, the reality is that it can never be fully removed.

A portfolio that reduces uncertainty only removes expected return. If there is no risk of loss, there can never be a gain. It’s simply the way this works. If you lock a roll of quarters in a safe, bury it in your yard, and dig it up 10 years later, you’ll have a roll of quarters.

I could keep going on about the role inflation would play in this example, but I’ll leave it there.

Please let go of the fantasy that you (or your advisor!) can control everything or see into the future with some sort of magic crystal ball. Focus on the things you can control and have a plan and strategy for those that you can’t.

Portfolios should never be set in stone, but strategies are a different story.

If I’ve learned one thing since 1999, it’s that investors who set up a plan and a strategy that lowers or even eliminates the need to liquidate holdings to fund living expenses when the market is down will increase their ability to be financially unbreakable.

Always have a portfolio you need to have rather than the one you wish you had.

Last year sucked…no doubt about it but please remember to…

Keep looking forward.