Written by: Jacob Johnston, CFA | Advisor Asset Management

Currently, there is a one-two punch threatening income investors. We are experiencing red hot inflation coupled with low, but possibly rising, interest rates. This not only hurts purchasing power now but has the potential to cause volatility if and when interest rates move higher.

Rising commodity prices, supply-chain disruptions, and labor shortages have been evident in the inflation data for some time. The latest consumer price index reading (CPI) shows a 5.4% increase year over year, the latest Producer Price Index Reading (PPI) shows an 8.6% increase year over year, And the latest personal consumption expenditures price index or PCE inflation rate was 4.4% on a 12-month basis. Yet the yield on the 10-year Treasury currently sits around 1.6%.

Something's got to give — either inflation will moderate, or interest rates will rise to reflect the higher inflation levels. We believe it likely will be some combination of the two — and income investors may want to consider making tactical adjustments to their strategic asset allocation in anticipation of the next phase of the market cycle that might include higher inflation and rising interest rates.

One of those adjustments might be to consider alternative sources of income including equity income strategies. This segment of the market currently offers the potential for three key advantages:

- High current income

- Growth of income

- Less sensitivity to rising interest rates than most fixed income instruments

The current indicated dividend yield of the S&P 500 is 1.44% with 53% of the companies carrying a higher dividend yield than the 10-year Treasury. This is high even in the low-interest rate world we have been living in since The Great Recession. If we focus on dividend-paying equities, as measured by the Dow Jones Select Dividend Index, the indicated dividend yield is 3.96%, significantly higher than the broad equity market and the 10-year Treasury.

In terms of income growth, the S&P 500 has grown dividends per share 7.3% on average over the last 20 years. This easily outpaces any long-term inflation metric and has the potential to maintain purchasing power for investors.

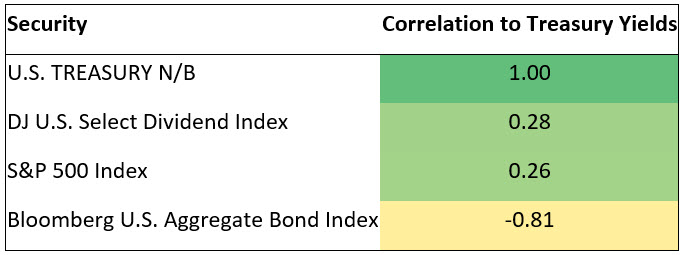

Lastly, equities and dividend payers are relatively less sensitive to changes in interest rates compared to fixed income instruments. We can measure this by an index’s correlation to Treasury yields. The Bloomberg U.S. Aggregate Bond Index, for example, has a strong negative correlation to Treasury yields, confirming that Treasury yields and the bond index have historically moved in opposite directions.

The S&P 500 has a moderately positive correlation to Treasury yields meaning that interest rates and the S&P 500 tend to move in the same direction. This is one of the reasons we believe that equity exposure, in general, makes sense in an inflationary or rising rate environment.

What might surprise you is that dividend-paying equities, as measured by the Dow Jones U.S. Select Dividend Index, have a slightly higher positive correlation to Treasury yields than even the broad equity market, indicating a stronger relationship.

Weekly Correlations, 12/31/12–11/1/21

Source: Bloomberg data, AAM | Past performance is not indicative of future results.

In an environment in which income is hard to come by, yet interest rates may need to rise to compensate for the high levels of inflation we are currently experiencing, we believe equity income strategies offer a unique opportunity for investors to potentially generate high current income, experience growth of that income, and should be well positioned if and when interest rates begin to rise.

We continue to favor stocks with attractive yields, with exposure to the ongoing economic recovery and that have shown the consistency to maintain and grow their dividend.

Related: Small Business Optimism Remains Volatile Since the Pandemic Began