Written by: Scott Colyer | Advisor Asset Management

As the Federal Reserve (Fed) ratchets up the tightening of monetary policy in the U.S., it is no surprise what is happening in the U.S. equity markets. As of this writing, the U.S. equity markets — by most any measurement — are firmly in bear market territory with nearly all indices now down at least 20% or more from their recent peaks. The Fed and Congress are primarily responsible for the wave of inflation that is moving across the country and, indeed, much of the world. The culmination of many years of loose monetary and fiscal policy have landed us in the inflation soup, as an endless creation of money injected into the economy, at a time when goods and services are scarce, has produced the same result every time.

Over the past few years, the Fed has monetized nearly $8 trillion of debt created with freshly printed dollars. Additionally, Congress has spent many trillions of dollars that have also been injected into the economy. Now we find ourselves in the proverbial “economic soup” with stubbornly sticky inflation well over 8%. Mid- to low-end consumers have generally been suffering the most as rising food, energy and housing expenses take a much bigger bite out of their discretionary income. While there is a lot of hemming and hawing about what should be done to stop inflation, we see only one simple answer: raise interest rates to the point that products and services become too expensive to purchase. In addition, the government must stop printing currency and drain the excess currency from the economy. All are painful and will likely cause additional economic hardship. Paul Volcker taught us that to break the back of inflation, we have to get the Federal Funds rate well above the current rate of inflation and leave it there until demand is broken. This worked to break the double-digit inflation in the early 1980s.

Given the terrible equity markets here in the U.S. and the bleak outlook for fiscal policy tightening, one might wonder where they can put their capital that might not be so threatening to one’s wealth. In my last Viewpoints commentary, I argued that it was time to begin to look toward Emerging Markets (EM) with a keen eye. The EM world is comprised of many players representing countries that are in earlier stages of development. Normally, we would think of this as a diversification measure, but we believe it also makes sense to add emerging markets to your asset allocation given the large opportunity that we see there. However, with the regime change that inflation has brought, we think that this trade could work for many years to come. You see, not all countries’ equity markets are synchronized; some move very independently of larger more developed markets, as we are beginning to see now.

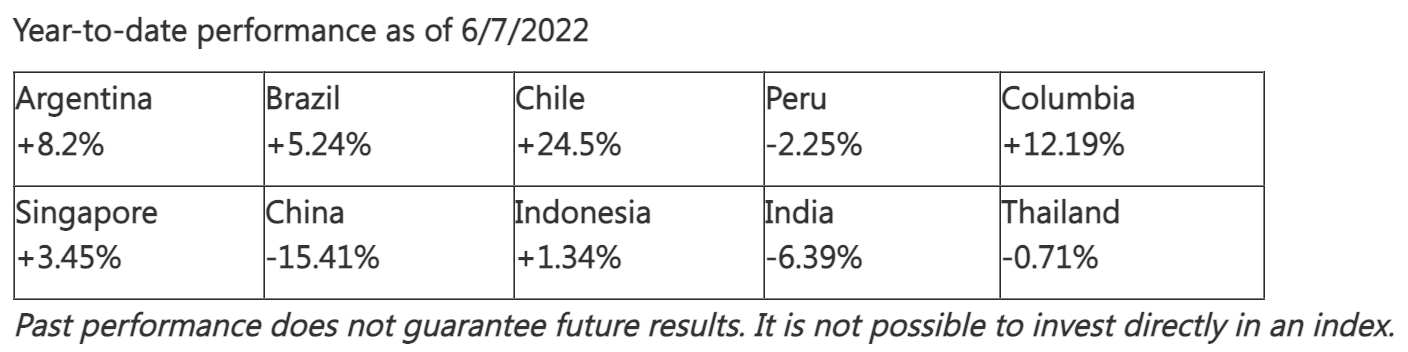

Inflation investing is very different than disinflation or deflation investing. The former often thrives on lower valuations and larger dividends. Many of the emerging markets have greatly outperformed developed markets recently because they tend to do well through inflationary periods. Several emerging markets have major industries in things that are either mined, harvested, or drilled. Thus, in inflationary times, prices for their exports typically rise, bringing with them the value of their countries’ markets. Here are some examples that I recently pulled displaying emerging market performance.

Year-to-date performance as of 6/7/2022

Even though not all are positive on an absolute basis, they are generally quite positive when compared to the U.S. markets down, on average, over 20%. Some, such as the NASDAQ 100, are down much more that this figure. Emerging markets have had a long dry spell in relative performance compared to U.S. indices and it seems to finally be their time. Not only do emerging markets often benefit from inflationary-friendly industries, but the change in China going from tight monetary policy to very loose monetary policy is also a positive. Remember that the recent inflation rate in China is just over 2%. What a difference from the rocketing inflation rate in western nations. China is the second largest economy on earth and are likely to soon have relief from at least some of the Trump-era trade tariffs. With capital aplenty, we think that China — plus the balance of markets in the EM basket — makes up a very nice asset allocation tune-up.

Is investing in emerging markets more dangerous than U.S. markets? I have experienced a couple of these cycles and have found that the volatility of this group is a bit higher, but I believe that by using a managed basket of stocks investors have the potential to be well rewarded.