Written by: Marc Odo | Swan Global Investments

Challenges to the Traditional Portfolio

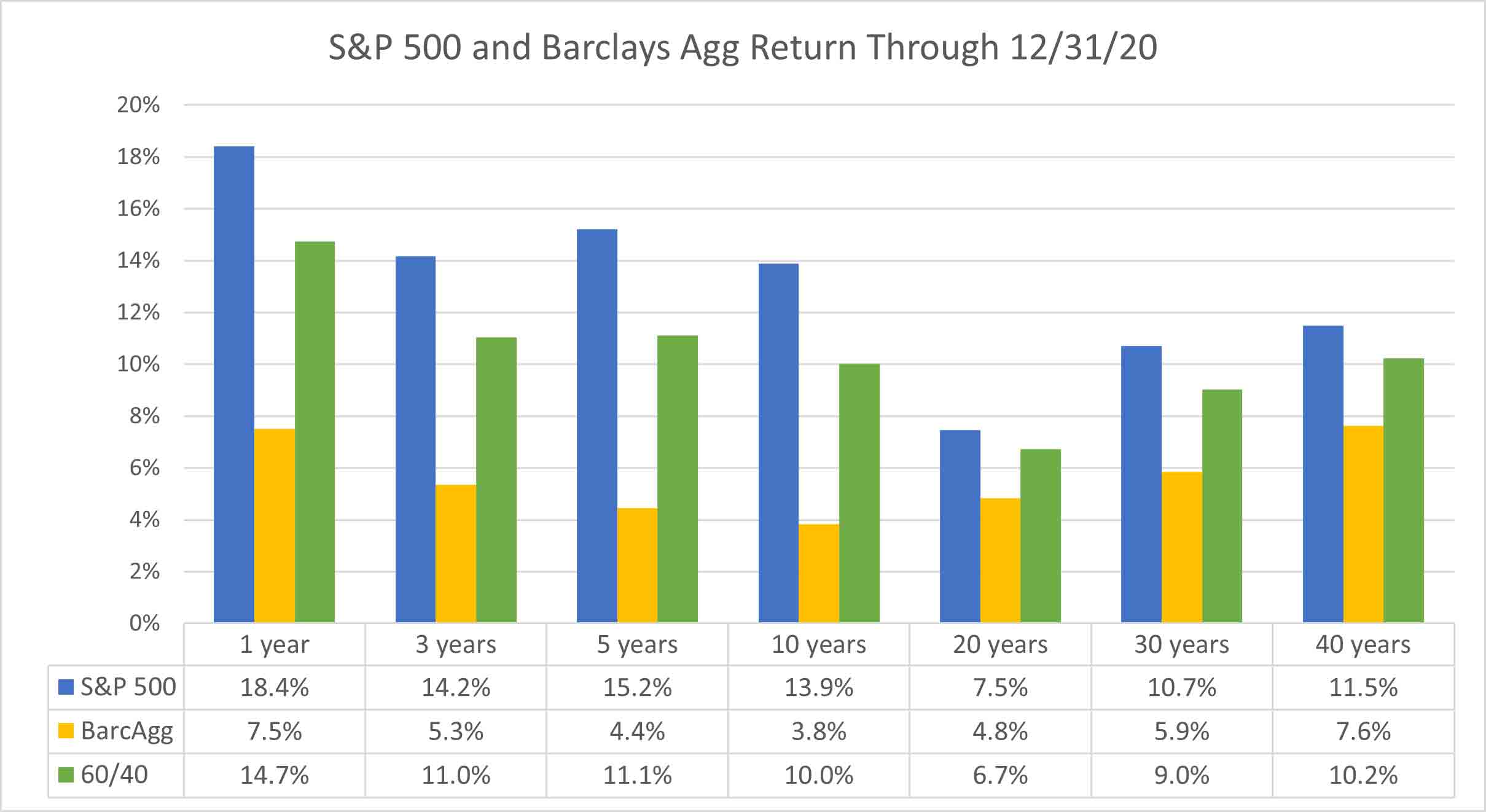

For decades, the standard representation for a balanced portfolio has been the “60/40”- 60% equities, 40% bonds. Although most investors diversified beyond this model and incorporated small caps, foreign stocks, high yield bonds, and perhaps something more exotic like REITs or commodities, a simple mix of 60% S&P 500 and 40% Barclays U.S. Aggregate Bond is often the shorthand definition of a balanced portfolio.

The Attraction of the 60/40

For a generation, this simple approach worked well. Stocks provided capital appreciation and dividends, albeit with a dose of volatility. Bonds produced yield, capital appreciation as rates fell, and acted as a volatility dampener when stocks went south. One could have met actuarial demands of 7%, 8%, or even 9% via this simple portfolio.

Source: Zephyr StyleADVISOR

Looking at the above numbers, one might be tempted to say, “If it ain’t broke, then don’t fix it.” However, such an approach is dangerously naïve.

The simple truth is that the likelihood of bonds posting returns anywhere near their historic levels is close to zero.

Swan Resources & Education

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

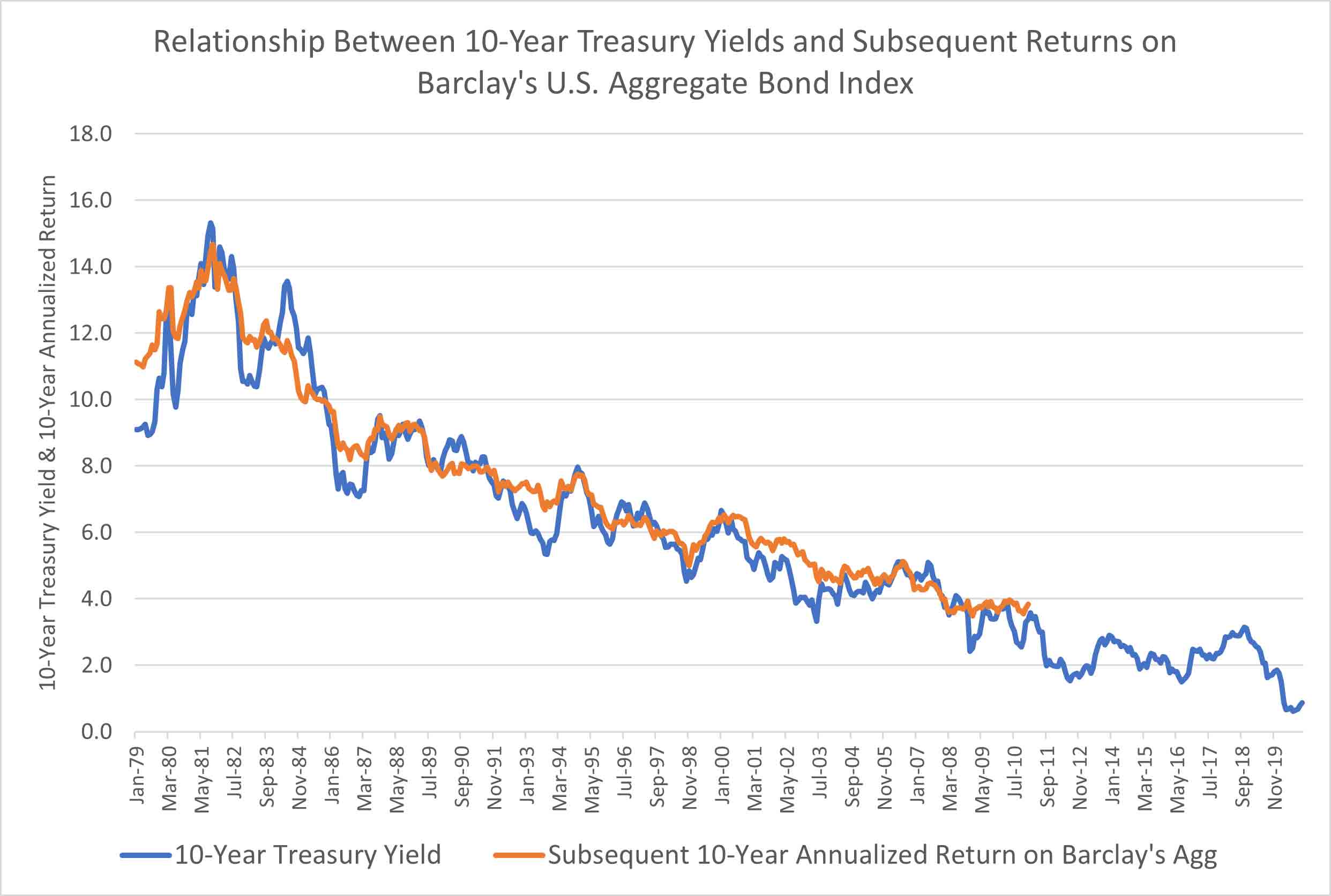

Keeping an Eye on the Yield Curve

In the graph below we can see how the current yield has been a very strong indicator of what future returns in the bond market might be. The graph compares the yield on the 10-year Treasury against the subsequent 10-year return on the Barclay’s Aggregate Index.

Source: U.S. Treasury Department, Zephyr StyleADVISOR

With yields currently in the sub-2% range, the forecast for future bond returns in not good.

What impact does this have on the standard 60/40 mix?

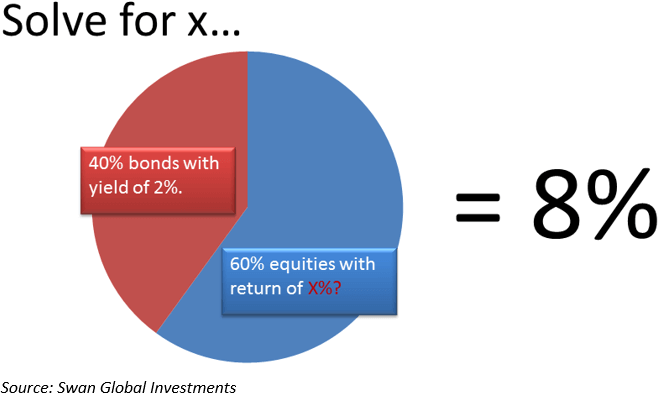

Impact of Low Yields on Portfolio Return

Let’s run a simple algebraic calculation. Assume we have a standard 60/40 mix and the target return for the overall portfolio is 8%. If we assume that the 40% position in fixed income will return 2%, what would the remaining 60% in equities have to return in order to lift the portfolio up to 8%?

The answer may come as a nasty surprise: 12%.

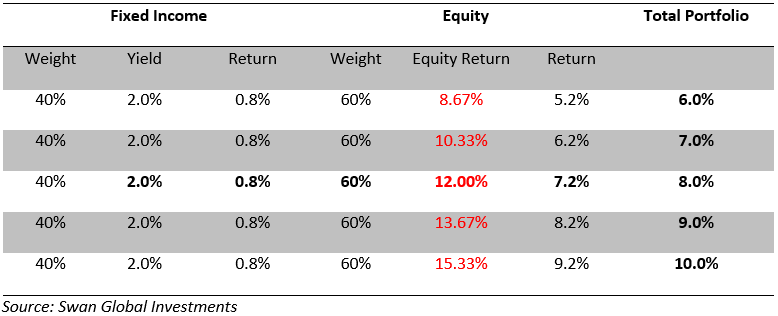

If bonds can only deliver a 2% return, then equities must return 12% in order to produce an overall portfolio return of 8%. The table below details the levels of returns the 60% position in equity must generate in order to achieve different levels of total portfolio returns, assuming the fixed income return is locked in at 2%.

Unappealing Options

Given these circumstances, investors are left with an unappealing set of options, which include:

- Lowering the return expectation for the overall portfolio

- Taking on more risk and increasing the equity portion

- Simply hoping that the capital markets will do better than expected and deliver high returns

Hoping that capital markets will do better than expected is a dangerous choice.

A forecasted return of 2% on bonds might actually be too generous. After all, ten- year yields are only 1.58% as of May 31st, 2021. Moreover, should rates rise bonds could suffer losses.

Rising Rates Means Losing Value

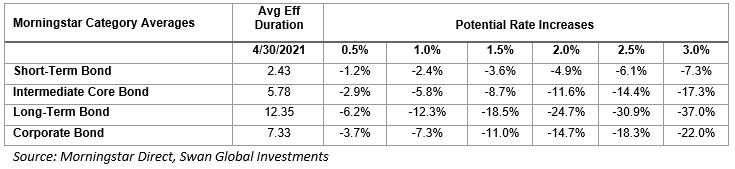

The average duration of several Morningstar fixed income categories is listed below. Should rates rise the average fund in these categories would be expected to lose the following amounts.

Although bonds are typically assumed to play the “capital preservation” role in a portfolio, if rates rise it is highly likely bonds will instead deliver losses.

A Better Option

At Swan Global Investments, we believe there is another option. We believe the traditional 60% equity/40% fixed income portfolio is fundamentally broken and needs help.

Investors are caught between a rock and a hard place, as both equity markets and fixed income markets are trading at all-time highs. We believe that the Defined Risk Strategy is a better solution and helps fix the problems with traditional balanced portfolios.

Launched in 1997, the Defined Risk Strategy is a hedged equity approach that combines long exposure to the equity market via ETFs, effective hedging techniques, and volatility capture in a single strategy designed to provide consistent rolling returns throughout rising, declining, or flat markets without any dependency on fixed income or interest rates.

Related: What is Risk Budgeting?