Written by: Meera Pandit

Last week's, the Inflation Reduction Act (IRA), a legislative package that includes climate spending, prescription drug pricing reform, and tax reform, was signed into law. The IRA represents a meaningful commitment to climate goals and should reduce the deficit over the next decade but is unlikely to reduce inflation and will weigh on 2023 profits.

The Inflation Reduction Act seeks to raise approximately $737 billion in revenue over ten years through a 15% corporate minimum tax on companies earning over $1 billion in profits, a 1% tax on stock buybacks, greater IRS enforcement, and allowing Medicare officials to negotiate directly on prescription drug costs. The IRA would spend $437 billion on climate investment and extended health care subsidies.

From an economic standpoint, the Inflation Reduction Act should have the following impacts:

- Inflation – Despite the name, it may not have a measurable impact on reducing inflation, which is being driven higher by energy and food prices, rents, and consumer goods and services spending.

- Deficit – However, it should reduce the deficit by about $300 billion over the next decade, improving federal finances and leaving enough fiscal space to avoid reaching the debt ceiling until 2024.

- Growth – Although it should help federal finances, substantially less fiscal stimulus ahead compared to 2020 and 2021 represents a fiscal drag to economic growth.

- Profits – Together, we estimate the 1% tax on share buybacks and the 15% corporate minimum tax would subtract 3% from S&P 500 earnings growth in 2023, with the corporate minimum tax accounting for 2.6 percentage points of the total 3% reduction.

- Fiscal policy outlook – With the passage of the Inflation Reduction Act and the bi-partisan CHIPS and Science Act, a $280 billion spending package for semiconductors and science and technology research and development, the legislative agenda should be light until after the midterms. If the midterms result in divided government, political gridlock is unlikely to yield more spending or additional tax reform on capital gains, estates, or the top marginal tax rates for individuals or corporations.

- Climate goals – This is the largest federal climate investment in history, which includes tax credits for clean energy and electric vehicles and targeted investment towards clean energy technology and projects. However, it should be considered an initial down payment towards the U.S.’s net zero carbon emissions goals, not comprehensive funding to achieve future climate targets.

The Inflation Reduction Act advances key climate goals on the Administration’s agenda while reducing the deficit over the next decade. However, investors should be mindful of the continuing fiscal drag on economic growth and the headwind for corporate profits from tax reform.

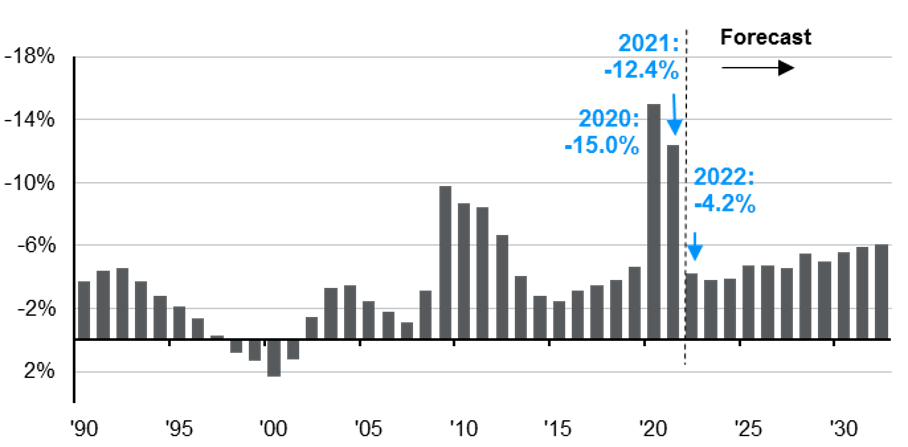

Federal budget surplus/deficit

% of GDP, 1990 – 2032, CBO Baseline Forecast

Source: BEA, CBO, U.S. Treasury Department, J.P. Morgan Asset Management.

Estimates are based on the Congressional Budget Office (CBO) May 2022 Update to the Budget and Economic Outlook and do not include recent legislation. Years shown are fiscal years. Text includes estimates from the U.S. Senate on the Inflation Reduction Act. Data are as of August 16, 2022.

Related: Will Global Central Banks’ Fight Against Inflation Lead to a Global Recession?