Written by: Shiv Patel | Advisor Asset Management

As companies continue to grapple with higher costs associated with commodities and transportation, there is certainly chatter in the boardrooms around cost-saving strategies in order to preserve sales and margins. Despite their efforts, we believe there will ultimately be a share of their cost burden passed along to you, the consumer, by way of higher prices. From your grocery bill to the cost of that next vacation, corporations will continue to charge more for their goods and services in order to offset their increasing costs. In other words, the buck stops with you!

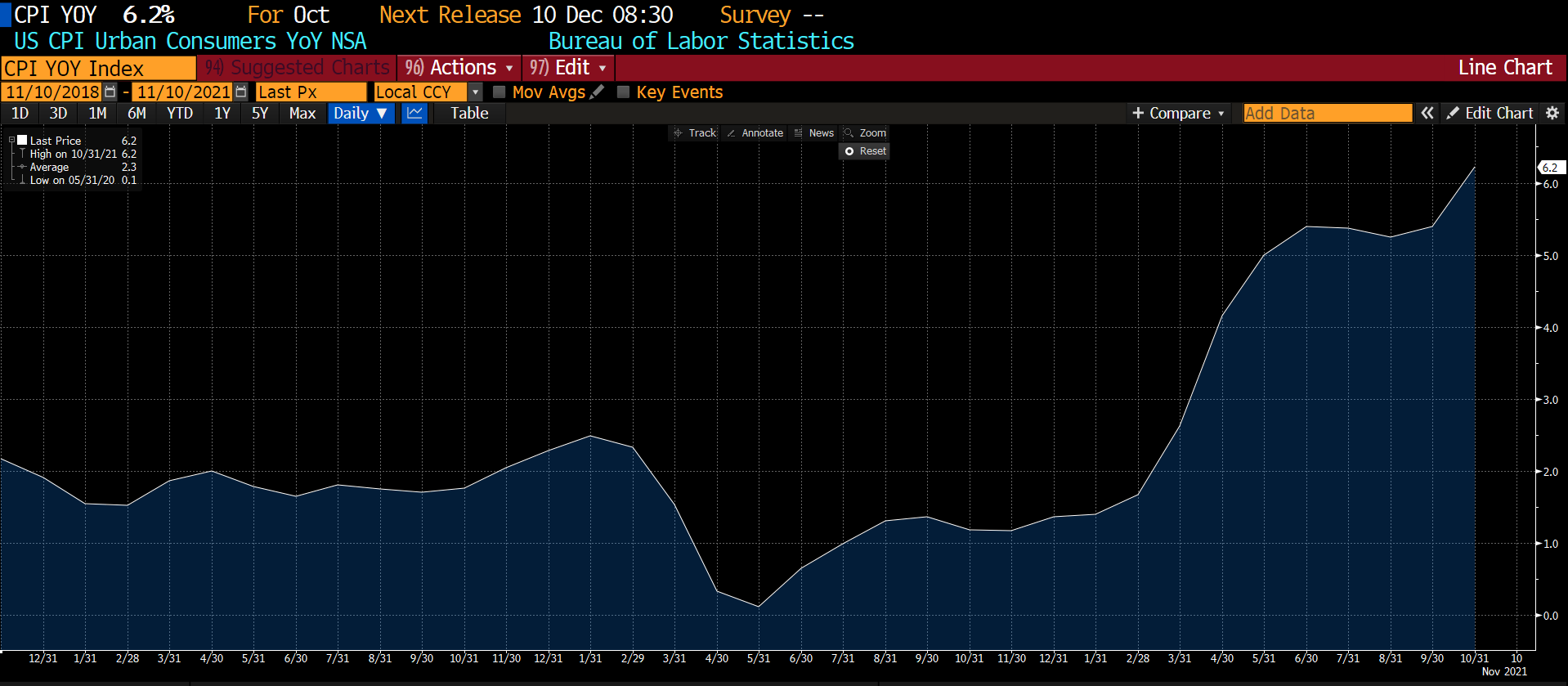

Although the Federal Reserve had largely maintained the stance that inflation will be transitory, their tone has shifted as of late. In recent meetings, they have acknowledged that inflationary pressures will be around longer than they had previously thought, specifically from supply-side disruptions. Moreover, the Labor Department reported last month that nonfarm payrolls rose by 531,000, more than expected, and the latest consumer price index reading (CPI) showed a 6.2% increase year over year, the fastest annual pace since 1990.

Source: Bloomberg

Thus, we believe investors would be prudent to more seriously consider what the impact of sustained inflation would have on consumer spending, and consequently corporate sales and earnings. This dynamic is central to concept of “price elasticity of demand” — or more colloquially, “price sensitivity.”

A high price sensitivity would indicate a consumer is more sensitive to price increases; such a consumer may reduce their spending meaningfully when faced with higher prices for goods and services. By contrast, a low price sensitivity would indicate a consumer is less sensitive to price increases; such a consumer may only reduce their spending slightly, if at all. Understanding this reaction to higher prices can be an effective tool in navigating the framework of growth vs value investing during inflationary periods.

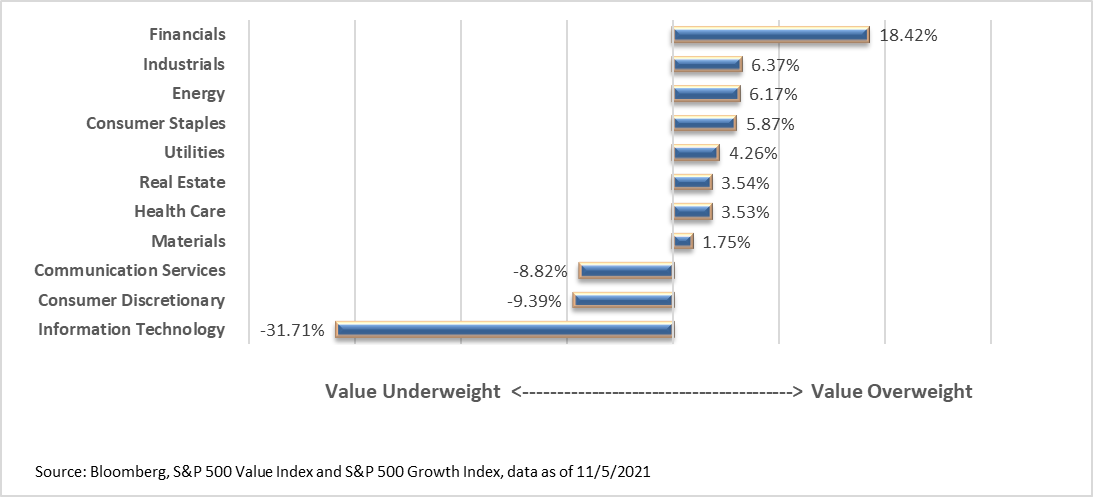

Value stocks, which tend to overweight toward sectors such as energy and consumer staples, are better positioned to pass on higher prices to consumers without jeopardizing a material decline in sales. Currently, the S&P 500 Value Index overweights the energy and consumer staples sectors by 6.17% and 5.87% respectively compared to the S&P 500 Growth Index. Companies within these sectors largely provide essential goods and services, whose demand is less sensitive to price increases. If prices continue to rise, we think consumers are less likely to curb spending on essential goods such as gasoline, food, or household products.

By contrast, growth stocks tend to overweight toward sectors such as information technology and consumer discretionary, which do not exhibit the same price sensitivity characteristics. Currently, the S&P 500 Value Index underweights the information technology and consumer discretionary sectors by 31.71% and 9.39% respectively compared to the S&P 500 Growth Index. Companies within these sectors largely provide non-essential goods and services, whose consumer demand is more sensitive to price increases. Categories such as entertainment, luxury goods, or leisure products are considered non-essential, and areas where consumers are more willing and able to reduce their spending when faced with higher prices. As a result, future sales and earnings of growth stocks may be more vulnerable to declines if prices continue to rise, and potentially lead to lower intrinsic equity valuations.

Although widely spoken upon, the growth and value designations can be rather vague and may not be the most ideal way to make portfolio positioning decisions. We believe it can be helpful to view the growth vs value debate from the lens of essential and non-essential goods and services. This can help more precisely distinguish the underlying sectors of outperformance, especially in an environment of sustained higher prices passed on to consumers.

Related: Opportunity in Equity Income