Written by: Vinay Thapar and John Fogarty

After several years of exceptional returns, fear of rising interest rates has recently shaken confidence in high-growth stocks. But US companies offer innovative businesses and excellent growth prospects and are not all created equal. By striking a better balance between growth and profitability, investors can find promising portfolio candidates with more attractive risk and reward profiles.

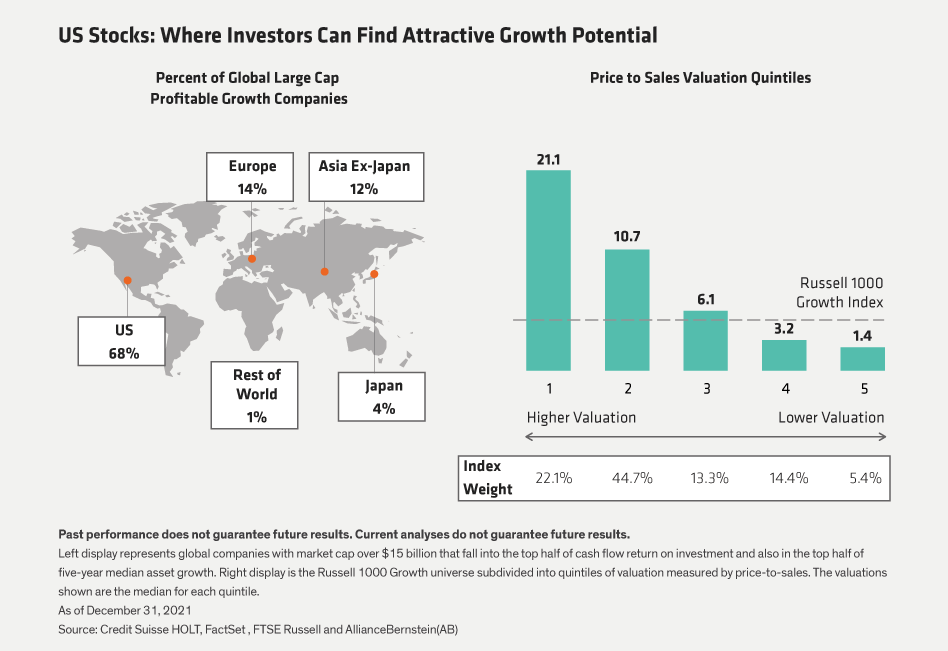

US equity markets are home to over two-thirds of the world’s large-cap companies with profitable growth characteristics (Display, left). These businesses rank in the top half of their global peers in terms of both cash flow return on investment and five-year median asset growth.

Companies with the highest future growth potential have been very popular among investors in recent years, boosting their valuations. In fact, the most expensive growth stocks were trading at a hefty median price/sales ratio of 21.1x at the end of 2021 (Display, right).

A Better Balance

In our view, investors who seek companies with both growth and profitability can better balance risk and reward. If we exclude the five largest companies in the Russell 1000 Growth Index, the remaining companies generated an annualized 11.7% return on assets over the past five years. Within this group, investors can find companies with more reasonable valuations, strong growth potential and solid profitability.

Corporate profitability measured by return on assets indicates sustainability and stability. Highly profitable companies get to decide how they deploy the capital gained through growth. And companies with strategic vision can reinvest profits back into the business to support future growth.

The opposite is true for expensive companies which expect the bulk of their cash flow and earnings to come many years from now. Inflation driven by supply chain and labor challenges can threaten operating profits. Higher interest rates mean a higher cost of capital. Investors then apply a heavier discount to future cash flows, making them worth less today, which puts downward pressure on stock prices and valuations.

Maintaining Discipline on Valuation

Rising rates could shake up the familiar market landscape of the last few years. Indeed, as the yield on the 10-year US Treasury jumped in January, high-growth technology stocks sold off sharply. Additionally, the popularity of the five largest stocks has led to an extreme concentration in the US market—the market capitalization of those five largest stocks totaled 38% of the Russell 1000 Growth Index as of year-end. If valuations are rerated, investors with heavy exposure to mega caps and high-flyers could get burned.

While the next few years are certainly unlikely to look like the last few, we believe that investors should still retain US equity market exposure given the concentration of profitable growth companies in the US. However, maintaining pricing discipline by avoiding the most overpriced growth stocks and building portfolios of companies with solid profitability and growth potential is a strategic necessity in today’s rapidly changing market conditions.

Related: Why High-Yield Investors Are Rooting for Rates to Rise