Written by: Shiv Patel | Advisor Asset Management

At less than two months into 2022, the market has reached levels of volatility not seen in over a year. Although there are several contributing factors, there are certainly some eyed with higher anxiety than others, with the most obvious being expectations of increasing interest rates. Moreover, as recent inflation numbers from both the producer and consumer sides solidly exceeded expectations, it seems the Fed speak of “not yet” is quickly turning into “perhaps not soon enough.” In our view, this should hasten investors’ rotation into more quality-tilting solutions for their portfolios, such as dividend-paying stocks.

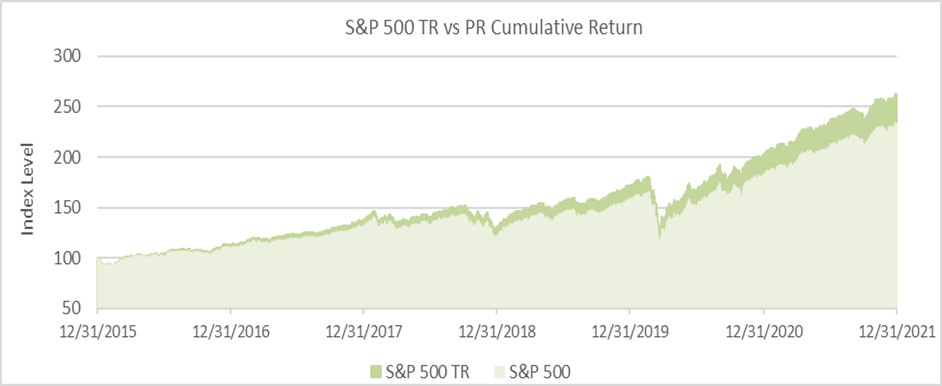

When remaining invested over longer horizons, the share of total return driven by dividends and dividend reinvestment increases meaningfully, as can be seen in the chart below of the S&P 500 Total Return (TR) Index relative to the price return S&P 500 Index. The S&P 500 TR Index, where dividend income earned is reinvested, posted an annualized return of 17.36% over the six-year period, compared to 15.16% for the price return of the S&P 500 Index.

Source: Bloomberg, 12/31/2015 to 12/31/2021 | Past performance is not indicative of future results.

Though many investors have long employed dividend strategies to take advantage of the reinvestment potential from the income they generate, we feel it is increasingly important to incorporate in the coming market environment.

As interest rates continue to rise, investors are forced to re-evaluate equity valuations, particularly those leaning heavily on sales and cash flow forecasts far into the future and these tend to be associated with high-growth stocks such as large-cap tech stocks. And while growth can still be a part of one’s portfolio, we believe investors will need to be far more selective going forward as rising interest rates weigh down on valuations of these stocks. Their distant cash flows become worth less when brought back in today’s terms by adjusting for the new, higher interest rates. As a result, price performance may be muted going forward, and why price appreciation alone cannot be relied on as the driver of portfolio returns.

By contrast, stocks known to pay dividends are generally producing strong sales and cash flow today. These tend to be quality companies with stable current earnings and therefore less vulnerable to eroding valuations.

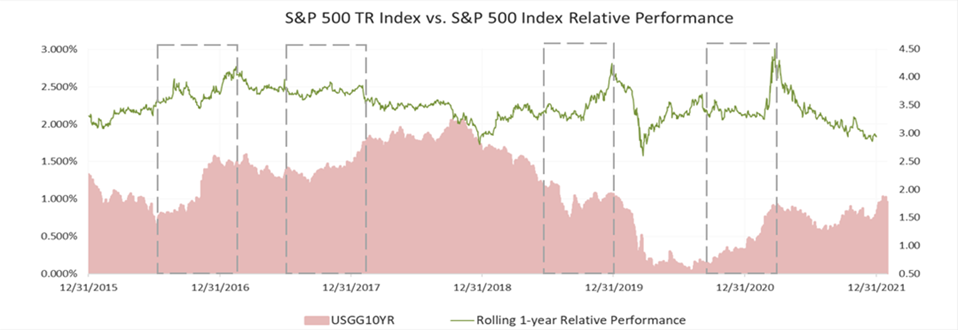

As can be seen in the chart below, following spans of increasing interest rates, relative outperformance between the S&P 500 TR Index and the S&P 500 Index tends to widen.

Source: Bloomberg, 12/31/2015 to 12/31/2021. Rolling 1-year relative performance calculated as the difference between the rolling 1-year return of the S&P 500 Index and the S&P 500 TR Index |Past performance is not indicative of future results.

Specifically focusing in on the movements in the first quarter (Q1) of 2021, when the 10-year yield increased by 83 basis points in just three months, relative outperformance reached its widest point in the six-year time period, with S&P 500 TR Index outperforming its price return counterpart by 3.02% in the trailing year ending 3/24/2021.

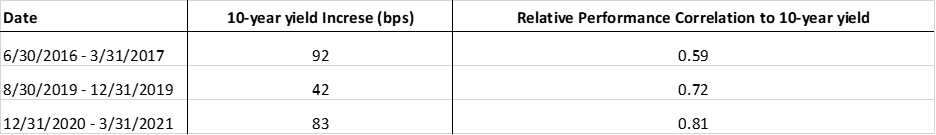

Furthermore, the correlation between relative performance and the 10-year yield reached 0.81 in Q1 2021 compared to only a 0.24 correlation over the same six-year period. Elevated correlations also held true during other spans of increasing 10-year yields:

Source: Bloomberg | Past performance is not indicative of future results.

If interest rates continue their current trajectory, we could see similar increases in correlations and stretches of relative outperformance as income from dividend-paying stocks increasingly become the main drivers of total return. Should this dynamic unfold, we believe investors would be prudent to seek out income-focused solutions for their portfolios in the coming year and beyond.

Related: Investing During a Tightening Cycle