The Doomsday Clock warns we’re close to total annihilation... I’m far more optimistic... Plus, my take on “the Google killer”...

Stock market bulls claimed a big victory on Tuesday…

Inflation has been the chief concern for markets over the past year. Our healthcare bills shot up. It costs more to fill your gas tank. We’re paying more for a dozen eggs.

If you’re worried 2023 will bring more inflation pain, I have great news for you.

This last year showed beyond any doubt that rapidly rising inflation crushes stocks... But as I’ve written over and over again, the direction of inflation is what matters most to investors. In other words, is the inflation rate rising or falling?

That’s the dividing line for stock market returns.

Since 1928, the S&P 500 posted average annual gains of 6.7% when inflation rose. But when inflation fell, stocks posted annual gains of 16.5%, on average. That’s a Grand Canyon-sized gap.

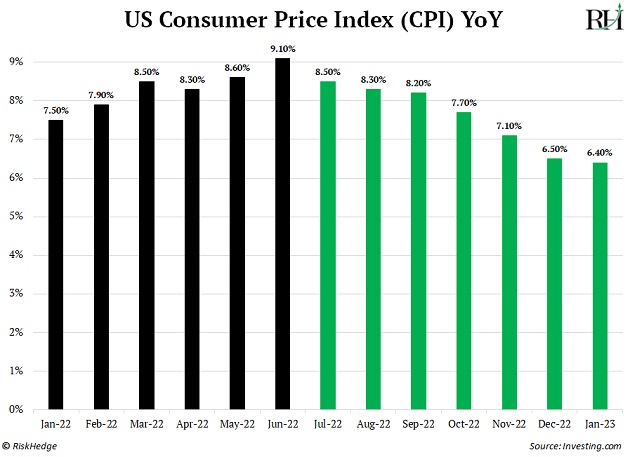

The latest US inflation numbers hit the wire Tuesday. Prices rose 6.3% over the past year. That sounds bad. After all, besides the past few months, that’s still the highest level since 1990!

But here’s what matters: Inflation has now fallen seven months in a row. And it’s a GREAT sign for stocks.

Inflation has peaked seven times over the past 70 years. Each time, the S&P 500 jumped an average of 16% over the next 12 months.

The year-over-year inflation rate topped out seven months ago, in June. The S&P 500 has jumped roughly 10% since then.

My friends, inflation has peaked. I’m even more sure of this today than when I first made the call last September.

That means it’s time to be bold and load up on your favorite stocks.

We’re in a “time of unprecedented danger…”

In 1947, the Bulletin of the Atomic Scientists unveiled the Doomsday Clock.

It’s a symbol “to convey how close humanity is to destroying itself.” And today, we’re closer than ever to total annihilation.

A few weeks back, the clock was moved to 90 seconds before midnight. This is the closest it’s ever been to midnight (the end of civilization).

Here’s the dramatic moment this cheery bunch revealed the bad news…

Source: Bulletin of the Atomic Scientists

How stupid. These folks look like scared third-graders unveiling a science project.

If you ask me, it’s just a big publicity stunt.

Every January, “experts” meet to decide whether to change the Doomsday Clock’s time. It was left unchanged for the past two years… and nobody batted an eyelid.

Today, these experts say we’re closer than we’ve ever been to total annihilation. Why? A couple reasons, the main one being the Russia-Ukraine conflict escalating into an all-out nuclear war.

When the Doomsday Clock debuted in 1947, schoolchildren were hiding under their desks seeking protection from Soviet nuclear bombs. The clock sat at seven minutes to midnight.

And you’re telling me we’re closer to global catastrophe today? Gimme a break. This is nothing more than fearmongering.

3. Investors should ignore this doom and gloom…

Pandemics… wars… earthquakes: There’s always something bad happening in the world.

When it comes to investing, it pays to be an optimist.

Stocks don’t go up 100% of the time, as we saw in 2022. But they do rise most of the time.

US stocks have risen roughly three out of every four years since 1945. Folks who invested $30,000 in the S&P 500 in 2010 have over $100,000 today. And despite many crashes, the odds of making money in US stocks is 100% over any 20-year period in history.

How could you not be a stock market optimist?

I’ll echo something Ron Baron of Baron Capital (among the best-performing funds over the past 30 years) said in a recent CNBC interview:

I started Baron Capital in 1982 and since then, there's been one year when the news was good: 1989. That was the year they took down the wall between East and West Berlin. All the other years, we had pandemics and wars and inflation and panics. And what happened? The stock market is up 41X since we started in the face of all this terrible news.

As the saying goes: Pessimists sound smart. Optimists make money.

4. Did you see The Economist’s latest cover?

On February 10, I detailed The Economist’s uncanny ability to nail market tops and bottoms… but not in a good way.

It usually pays to do the exact opposite of what its cover stories suggest.

The Economist’s new cover is bearish on Google.

Source: The Economist

Google dominates the internet search market. It’s essentially the homepage of the web. And advertisers will pay good money to appear on the homepage.

Google raked in $225 billion from search advertising in 2022.

Its stock dipped 12% the first two weeks of February. Investors are concerned OpenAI’s ChatGPT is set to dismantle its search monopoly.

ChatGPT can answer pretty much any question in a conversational way. It’s like you’re talking to a real human. (It’s free to use; you should check it out.)

The concern is ChatGPT is more precise than Google’s search engine, so advertisers will choose to spend their ad dollars there instead.

Right now, it seems the whole world is betting against Google. But I’ll leave you with this:

As I shared on February 10, by the time The Economist features an investing story on its front cover… the story is just about over.

You’re usually better off doing the exact opposite of what it suggests!

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.

Related: A Perfect Stock Market Indicator?