The last few years have provided one reminder after another that volatility can return suddenly and dramatically to the markets. The banking crisis is just the latest of many that have included a worldwide pandemic, Russia’s invasion of Ukraine, and the return of near double-digit inflation.

It’s not possible for investors to anticipate everything that can go wrong, but it is possible to prepare. One way is by diversifying your portfolio using liquid alternatives, a strategy that has demonstrated the ability to dampen volatility during periods of market stress. To see how this has worked, we recently took a look at the performance of three core alternative strategies across four different stress-related market scenarios.

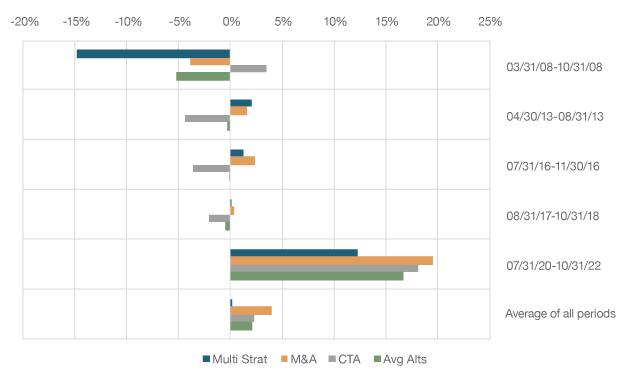

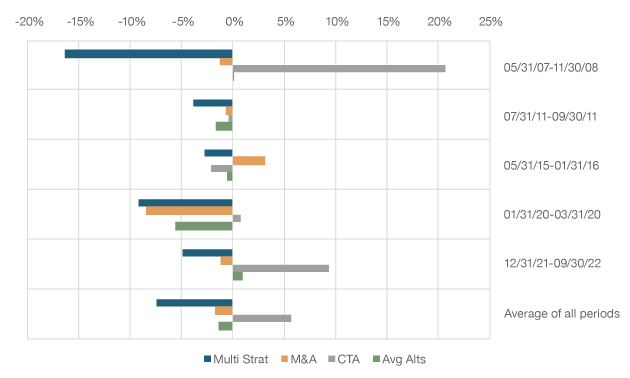

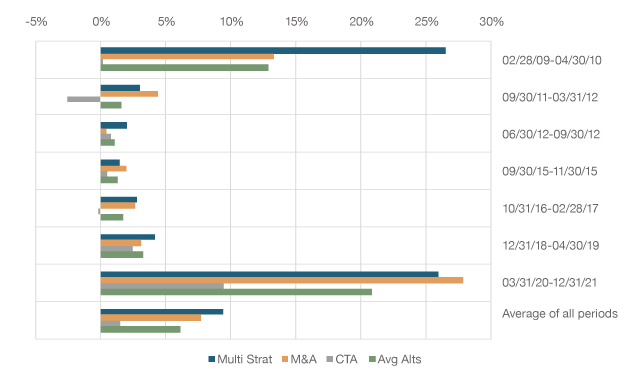

The categories were Multi-Strategy (as represented by BarclayHedge Multi Strategy Index), M&A (as represented by BarclayHedge Merger Arbitrage Index), and CTA (as represented by BarclayHedge CTA Index; Commodity Trading Advisor); the market conditions were Equity Stress (defined by the five largest declines in the S&P 500 Index since December 31, 2006), Rate Stress (defined by the five largest upward changes in the 10 year U.S. Treasury Bond interest rate since December 31, 2006), Credit Stress (defined by the five largest increases in credit spreads since December 31, 2006), and Equity Melt-up (defined as seven large, rapid moves up in the S&P 500 Index since December 31, 2006)*.

What we found was this: collectively these strategies provided an effective diversification tool across every period of market stress we examined, but no single strategy solved for every scenario.

In three of the four scenarios CTA was the top performer, sometimes by a lot. In times of credit stress, for example, CTA funds returned an average of 5.63% while credit broadly, as represented by the iBoxx USD Liquid Investment Grade Index Total Return (IBOXIG), was down -6.87%. In one period, May 31, 2007, through November 30, 2008, CTA funds returned 20.67% compared to a loss of --6.45%for IBOXIG. The differences were even bigger with Equity Stress, and slightly smaller with Rate Stress, but still positive.

Equity Stress Periods

Rising Rate Stress Periods

Rising Credit Spreads Stress Periods

So why not just own CTA funds? Take a look at our fourth scenario: Equity Melt Up. CTA funds lost money in two of the seven periods examined and posted an average return of just 1.52% compared to 32.33% for our benchmark, the S&P 500 Index (SPX).

Equity Market “Melt-Ups” Stress Periods

Keep in mind that melt ups, like melt downs often come out of nowhere. Based on historical returns, an investor with all his or her money in a CTA fund would quickly come to regret that decision when the markets moved higher, and over time they have moved higher more frequently than they have gone lower.

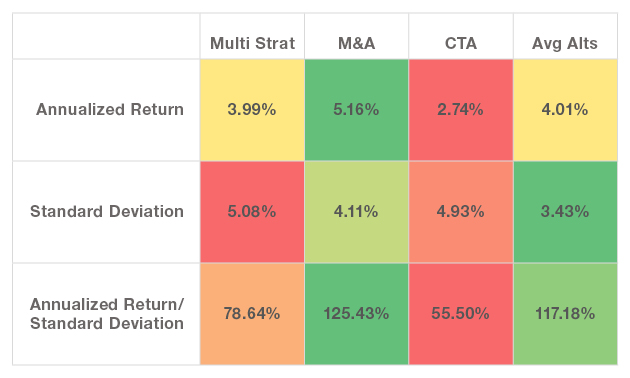

Strategy returns for Dec. 31, 2006 – March 31, 2023

Differences are the result of rounding.

Looking over a longer time period, we see that CTA would have been the worst performing strategy (2.74% annualized) with the second highest standard deviation (4.93%) and the lowest returns on a risk-adjusted basis.

While CTA may be very beneficial as a diversifier during periods of stress, other alternative strategies may also warrant consideration in the portfolio as longer-term diversifiers both to traditional asset classes and to CTA. In fact, employing a simple average of Multi-Strategy, M&A and CTA would have provided a strong hedge during the stress periods and would have had competitive returns with lower risk than any of the three individual strategies over the longer time period.

While CTAs performed very well in 2022 when there were sharp and meaningful negative trends across both stocks and bonds, in the present bank-driven turmoil – which we define as primarily equity stress – multi-strategy and merger arb funds have done well while CTA has struggled to deal with sharp trend reversals.

The bottom line: there is a clear benefit in diversifying with alternatives, especially during periods of market stress, and there is a further benefit from diversifying the diversifiers. Different alternative strategies performed differently in different scenarios, but collectively, the alternatives we examined have historically provided diversification benefits vs. traditional asset class benchmarks.

Related: Investors Struggle To Come to Grips With Competing Economic Scenarios