Did you see what happened to Facebook’s stock?

Last week, the social media giant—now Meta Platforms—plunged 26% after reporting bad earnings.

And get this: The company lost $232 billion in shareholder wealth overnight. It was the largest one-day drop in value of any stock ever.

Of course, if you’ve been following along, you know it’s not just large stocks struggling. Roughly half of the stocks in the tech-heavy Nasdaq have been cut in half.

Investors are panicking and wondering what to do.

So today, I’m giving you my game plan for the rest of 2022. I’ll tell you how I’m approaching this sell-off, and the one kind of stock you should be buying.

But first… what the heck is going on with the stock market?

I mentioned a few weeks ago that investors are worried about rising interest rates.

As superinvestor Warren Buffett says, interest rates are like “gravity” for stock valuations. When interest rates are low, stock valuations can go to the moon. But rising rates pull prices back down to earth.

This explains why expensive tech companies have performed so poorly over the past few months.

One of my favorite “screens” to watch is the best-performing stocks, year to date. It highlights where investors are putting their money. Seeing a bunch of similar names on the list helps you spot investment trends early.

I ran the screen recently… and there was just one tech stock inside the top 100.

Bloomberg data shows tech valuations collapsed 35% during this sell-off. Did you know tech stocks are at their cheapest levels since late 2018?

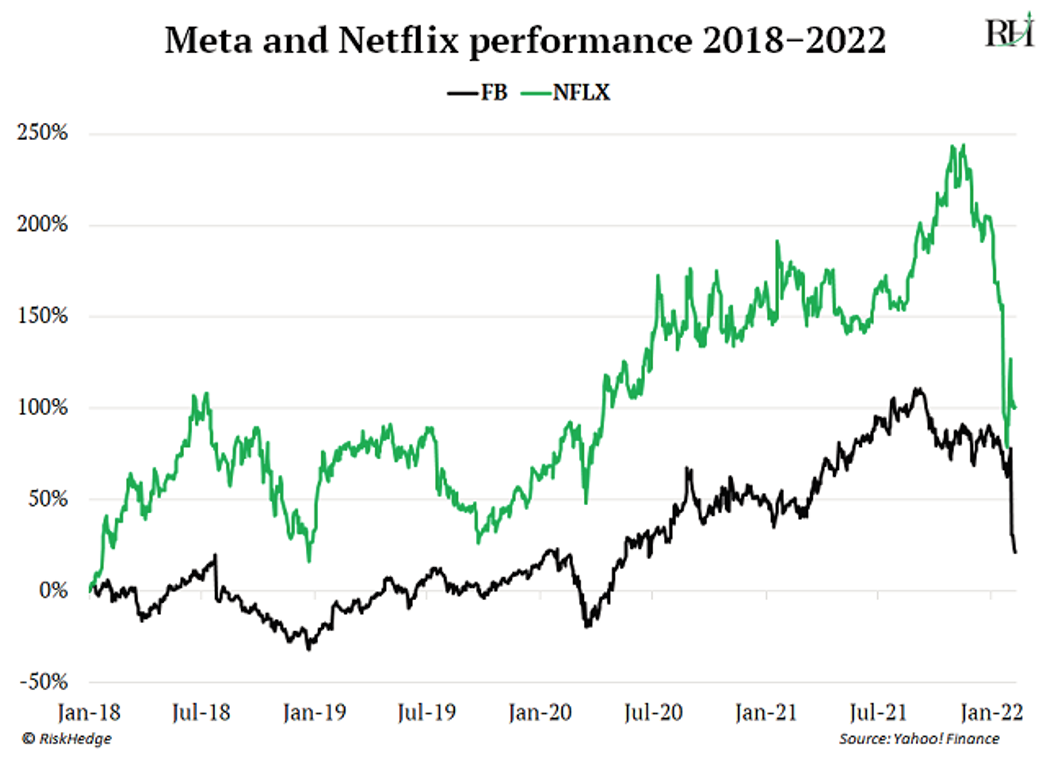

In fact, Netflix and Meta are now trading at the same levels they were three years ago!

Over the past 12 months, a special type of tech stock has sailed through this storm.

On the surface, you might assume all richly valued tech stocks have gotten slammed. But it pays to dig deeper into what’s really happening with individual companies.

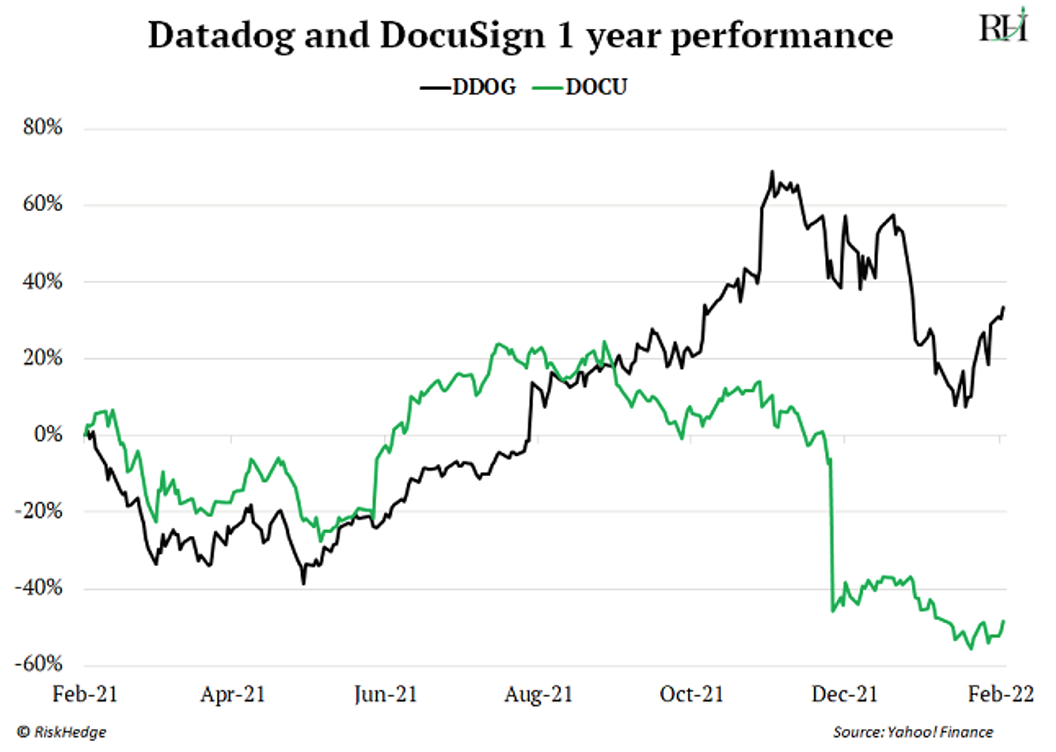

Consider how one of my favorite businesses—data disruptor Datadog (DDOG)—stacks up against overhyped e-signature company DocuSign (DOCU).

They’re both lofty-valued tech stocks that have been hit hard. But the market is telling us they’re nothing alike.

Last February, Datadog traded for 50X sales. Last week it was trading for under 34X sales. In other words, its valuation got slashed by one-third.

You’d expect Datadog’s stock to have collapsed too, right? Yet, even investors who bought at “peak valuation” are sitting on a 30% gain.

Datadog’s business is growing so fast it more than made up for its valuation getting cut in half.

DocuSign is the opposite. Its valuation plunged by 70% over the past 12 months. And unlike Datadog, its stock collapsed right along with it—by 54%.

What explains the big performance gap between these two stocks?

Both companies are growing sales fast… but only Datadog turns a profit.

When we’re in a raging bull market and investors are willing to gamble on “trendy” companies, both companies might have made it out.

We’re not in that type of market anymore. This is the kind of environment where companies with poor businesses or no profits get punished.

But what never goes out of fashion? Great companies with strong sales growth and lots of profits. These companies have the ability to grow fast enough to offset a sustained drop in valuations.

Fast growing and profitable: You want to be buying stocks with these traits.

It sounds simple, but these are the kind of stocks that can make you money even when most other tech stocks are falling apart.

We’ve seen this play out many times in the past.

This isn’t the first time tech stocks have experienced rising rates.

I dug into which tech firms performed best during the last few rising rate periods. It was the same then as it is now: Fast-growing, profitable businesses sail through the storm.

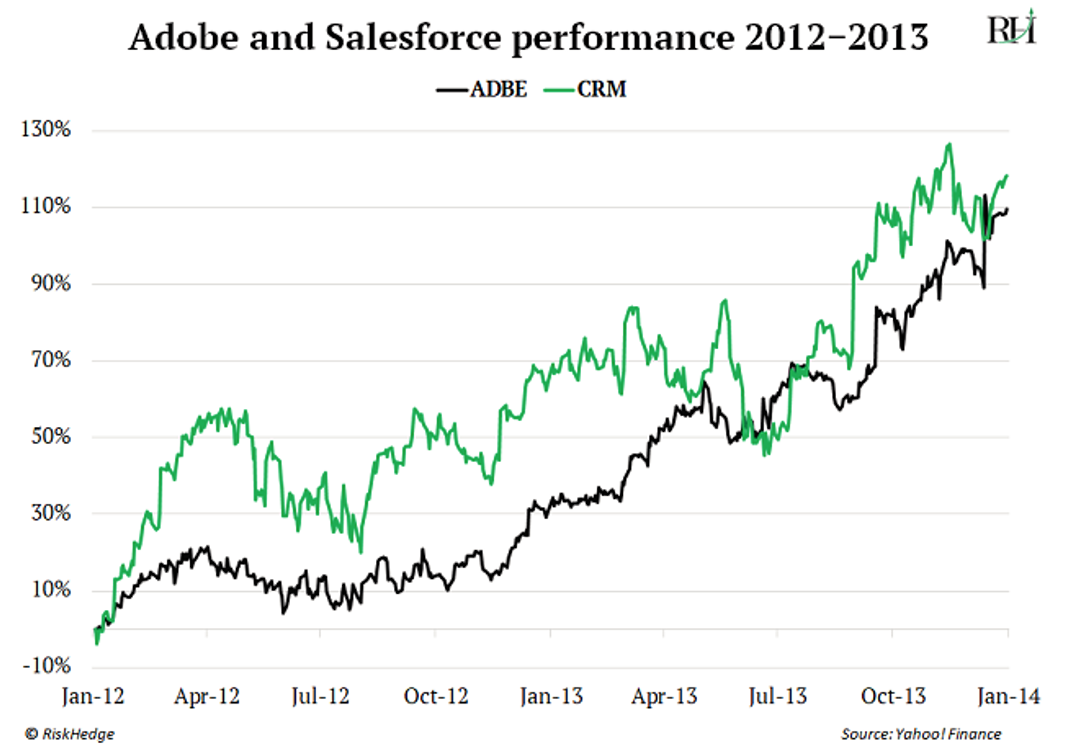

For example, during 2012 and 2013, US interest rates spiked to multi-year highs. But that didn’t derail Adobe and Salesforce:

Both Adobe and Salesforce’s valuations fell during this period. But sales and profits grew so fast, both stocks chugged higher.

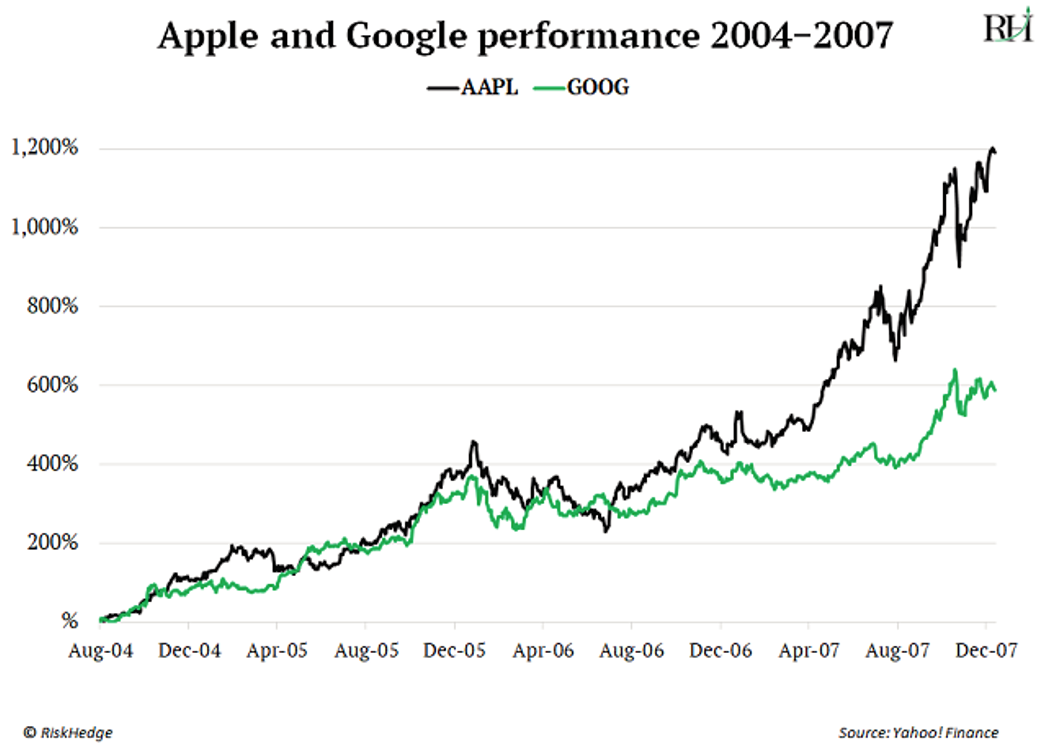

Go back to 2004–2007 when US interest rates almost doubled. That didn’t halt future juggernauts like Apple and Google:

Back then, Apple and Google weren’t the giants they are today. But they were growing profitably, which allowed them to hand out big gains to investors.

This shouldn’t come as a surprise.

Morgan Stanley dug into the biggest drivers of stock returns since 1990 and came up with some great insights. Over any five-year period, 78% of a stock’s performance is driven by profit and sales growth. This jumps to 90% when you zoom out a decade.

In other words, profitable growth is by far the most important driver of a stock’s returns.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

Related: Crypto Will Devour the Stock Market