Behavioral Variability With Couples

Understanding who is driving financial decisions in a relationship can reduce stress and tension between couples. The emotional gravitational pull of money tends to accelerate behaviors that need to be known and where they are a de-railer, checked, and managed.

We all develop different values, attitudes, and habits around money management; some of us were taught from a young age how to save, while others might not know the first thing about budgeting but have great ideas on spending.

It's important to understand that the stronger behavioral style is not necessarily the decision-maker. Often it's the homemaker driving financial decisions for the family.

Suppose conversations haven't taken place around how each feels and approaches decisions about the money. In that case, when more significant financial life decisions need to be made, the wage earner could well blow past the homemaker, failing to involve them.

This behavior, especially in front of a financial adviser, will put significant strain on the relationship.

The emotional pull of money affects relationships. It's at the center of all our lives, given it is a fundamental currency for most things.

A person's behavioral style drives how they will deal with money. The energy of money then drives behavior.

Put relationships into the mix and failure to have 'the money conversation' results in a lack of understanding, acceptance, and respect for each other's attitude towards money. So, when there is a communication blockage, it will often manifest in poor money behavior, and hence money is blamed for the relationship breakdown.

Navigating Behavioral Differences In Every Relationship Interaction

Don't let money become the elephant in the room.

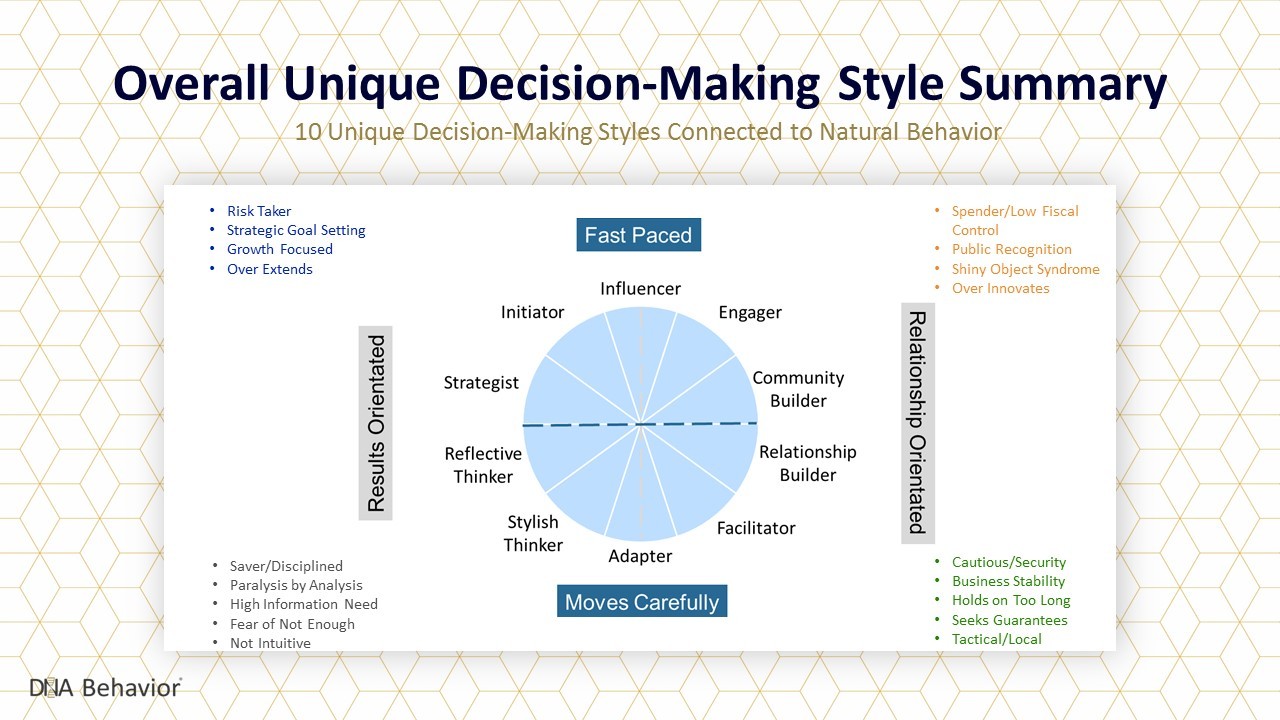

Based on many years of research and 1.5m participants per year completing Financial DNA, our guiding principle is that behavioral styles drive money decisions, and the energy of money drives money.

We see that most couples who partner for the first time when they are younger will have opposite styles. This means they will also be opposites in terms of making financial decisions, e.g., one will be a saver and the other a spender; one will take risks and the other cautious; one will be goal-oriented, and the other will be lifestyle and desire-driven.

It's important to mention at this stage that the behavior and financial decision-making style is gender-neutral.

The earlier in a relationship that money conversations take place, the better. Revealing finances can be a taboo subject for some couples.

Specific practical groundwork to facilitate these early conversations ensures that each partner can confidently approach the other with transparency?

Let's Make it Practical

Here are a few suggestions that each person needs to start working on:

Determining who they are as a person. A practical approach to this is focusing on identity: their self-awareness, knowing their talents, passions, values, and life purpose.

When identity is known, they can have a more precise, confident, and committed vision of the role of money in their life. – again, money follows who the person is and should not be dictated by money – it is only then that the person will have a healthy relationship with money.

Both partners need to get on top of their own identities. They should have clear easy to articulate life goals. Once known, this is a significant step forward in the relationship to ensure they build an inter-dependent life and not a co-dependent life. This approach forms the basis for making healthier financial decisions and safeguards money, and discussions about finances don't compromise the relationship.

So, the takeaway is, work on personal identity first. Then work on the meaning of money in your life.

We often get asked how to advise couples with differing approaches to the spend versus save scenario. Of course, our response would be to get the personal work done first.

The best starting point is a relationship built on healthy open conversations about anything, especially money, that has an emotional pull. So much about behaviors can now be discovered. Gone are the days when behavioral variability in decision-making could not be revealed and measured.

As an example, DNA Behavior can produce in-depth insights into how people relate to money. This enables partners to dig into their relationship to have healthy, open conversations about finances.

It makes agreeing and setting boundaries as a unit so much easier. For example, if spending is revealed as a potential problem, then putting it across as a spending plan is more helpful rather than saying a budget or savings plan.

The more that there is "hidden money," there will be problems, mainly if it is money they have jointly earned through the "breadwinning" process. If it is inherited money, the conversation may differ, but they still need to be a conversation.

Problems always come when one of the partners is dis-empowered through lack of information or being shut out entirely. Hence the importance of having the money conversation early in a relationship.

On occasion, the partners will have come together from quite different socioeconomic backgrounds.

For example, one of the partners grew up in a more frugal household, while the other may not have needed to worry as much about money.

The big thing is having an understanding of each other and where they have come from. They must make each different feel valued and not define each other and their relationship by money.

The danger is that entitlement creeps in, and that can manifest in many ways. Regardless of who brings the money to the table, they must share it and not create buckets based on where it came from.

Communicate, Communicate, Communicate

No legal or banking structure is necessarily going to work if the couple does not engage in a healthy discussion about potential power and control issues when one party has more income and assets than the other. That is to say, legal and financial structures never prevail when there is emotional unrest in the partnership.

So, if control and power imbalance issues creep in, this is because of the partner's behavioral styles and mindsets.

That is, the problems will come because there are unresolved issues emotionally between them. It all gets back to having a shared purpose and set of values for the relationship.

Nevertheless, having a shared bank account is essential, and it must have enough to meet the family's core needs. There must also be appropriate retirement planning for the couple. Ultimately, it will get to the estate planning as well as becoming more open.

This goes to the next issue often raised when one party earns or has more money than the other. But, again, the costs must be shared in a healthy, transparent relationship, and splitting them proportional to what is earned is a logical starting point.

Life is not always that simple, especially in the context of the broader financial situation. For example, consider inherited money or financial windfalls; maybe one partner will leave the workforce to be a homemaker. So, if there is a division of assets and funds, it needs to be done with some vision to future needs.

Ultimately, building an interdependent relationship is preferred where the partners can live with some independent freedom while still connected emotionally to each other. Therefore, the financial orchestrating of the relationship needs to work towards this end.

As a footnote to this, sharing/splitting refers not just to assets but also debt.

Both have to take equal responsibility for the debt if they evenly share the benefits and contribute the income.

The problem comes when one of the partners has a bigger ambition that needs to be funded with debt. Then both must address it and set boundaries. One of the partners cannot be disabled because of the actions of the other if they are not informed and bought into what the situation is. Hence the importance of revealing individual inherent behaviors early on. This makes navigating life and money potential dramas much easier when you have a behavioral life map.

Suppose relationships survive the emotional roller-coaster of money. In that case, there is no advantage in getting into a blame game if one runs up more debt through overspending or, conversely, losing income through job loss. Instead, healthy money conversations and behavioral insight will always signpost couples back to the purpose of their relationship.

That's why having established agreed goals and dreams should be regularly discussed. See them as the money compass to the relationship.

Life will take turns, and these situations will happen. Supporting each other through the unforeseen challenges must be foundational to the relationship.

However, a more difficult occurrence is if the partner who caused the problem hid it in the first place and has behaved badly in some way. This can get the relationship into a downward spiral, hence the importance of groundwork as set out earlier in this article.

We're Here To Help

If this article has stirred any thoughts for you and your partner, then I encourage you both to visit www.financialdna.com and complete your Financial DNA Discovery. This will provide an insight into your financial behavior and be a useful starting point to a conversation with your financial advisor or life coach.

Related: Financial Advisors + Emotional Intelligence + Identity = Better Finances