The definition of wealth management has changed over the past several years, as has the number of investors who feel they are eligible for wealth management. Wealth management has previously been reserved for only ultra wealthy households, which is not the case any longer. What types of investors feel wealth management is suitable for themselves? Who feels they qualify for wealth management?

Familiarity with the term “wealth management” is fairly universal, with 89 percent of investors indicating they are familiar with wealth management, according to recent research from Spectrem Group. Investors at the highest levels of wealth, and male investors, are the most likely to be familiar with the term “wealth management”.

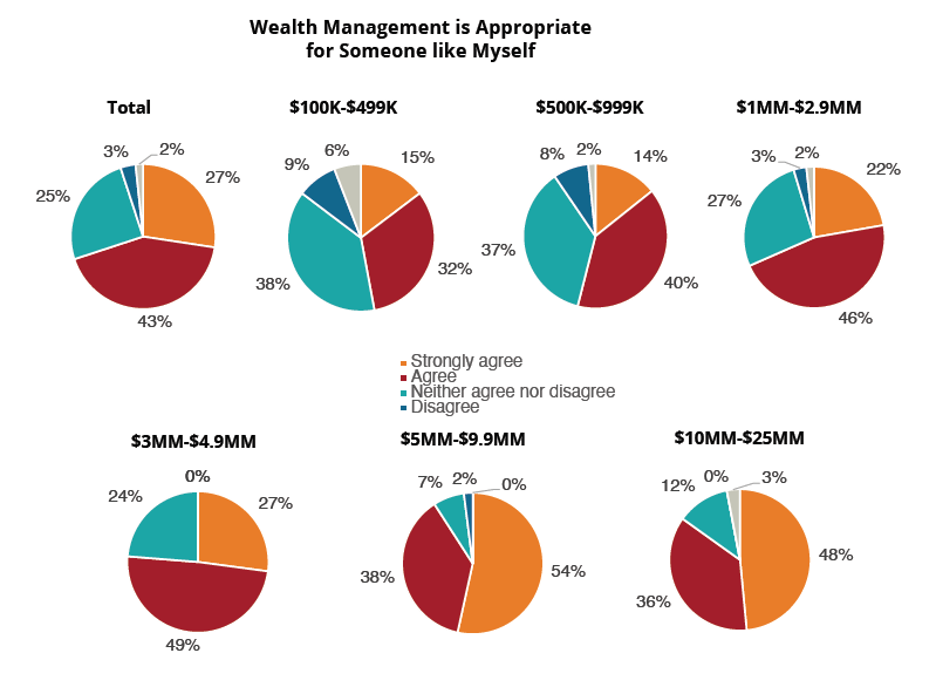

Seventy percent of investors feel that wealth management services are appropriate for someone like themselves. That percentage increases as wealth increases, with 47 percent of investors with a net worth between $100K-$499K feeling wealth management is suitable for someone like themselves, while 84 percent of those investors with a net worth between $10MM-$25MM feel the same way.

Regardless if investors feel wealth management services are appropriate for someone like themselves, there are still typically levels of net worth needed to quality for wealth management. Twenty-two percent of investors feel that at least $100,000 in net worth is needed to qualify for wealth management. A quarter of investors feel that an individual needs at least $1 million for wealth management, and a quarter feel at least $500,000 is needed to qualify for wealth management. Investors at higher levels of wealth are more likely to feel that at least $2,500,000 would be needed to qualify for wealth management, while those investors with a net worth under $1 million are more likely to feel that lower levels of wealth would qualify for wealth management.

Despite having high enough assets to qualify and feeling wealth management is suitable for someone like themselves, some investors feel that wealth management is too expensive for the services that they need. A quarter of investors feel that wealth management is too expensive for the services they need, and that percentage increases among younger investors and investors that are working.

Investors need to determine if the services that would be included in wealth management would be suitable for them. Most investors, regardless of wealth or age, would benefit from many components of wealth management, so it is important for wealthy investors to discuss wealth management with their financial providers and ensure they are receiving all of the various services they need and expect as part of their wealth management.

Related: The Most Important Variables in Hiring a Financial Advisor