Digital payments continue to grow, but cards still are the leading payment method used by Americans. In our Logica® Future of Money Study, we have been looking at the payment habits and preferences of Americans to understand both current preferences and what the future holds.

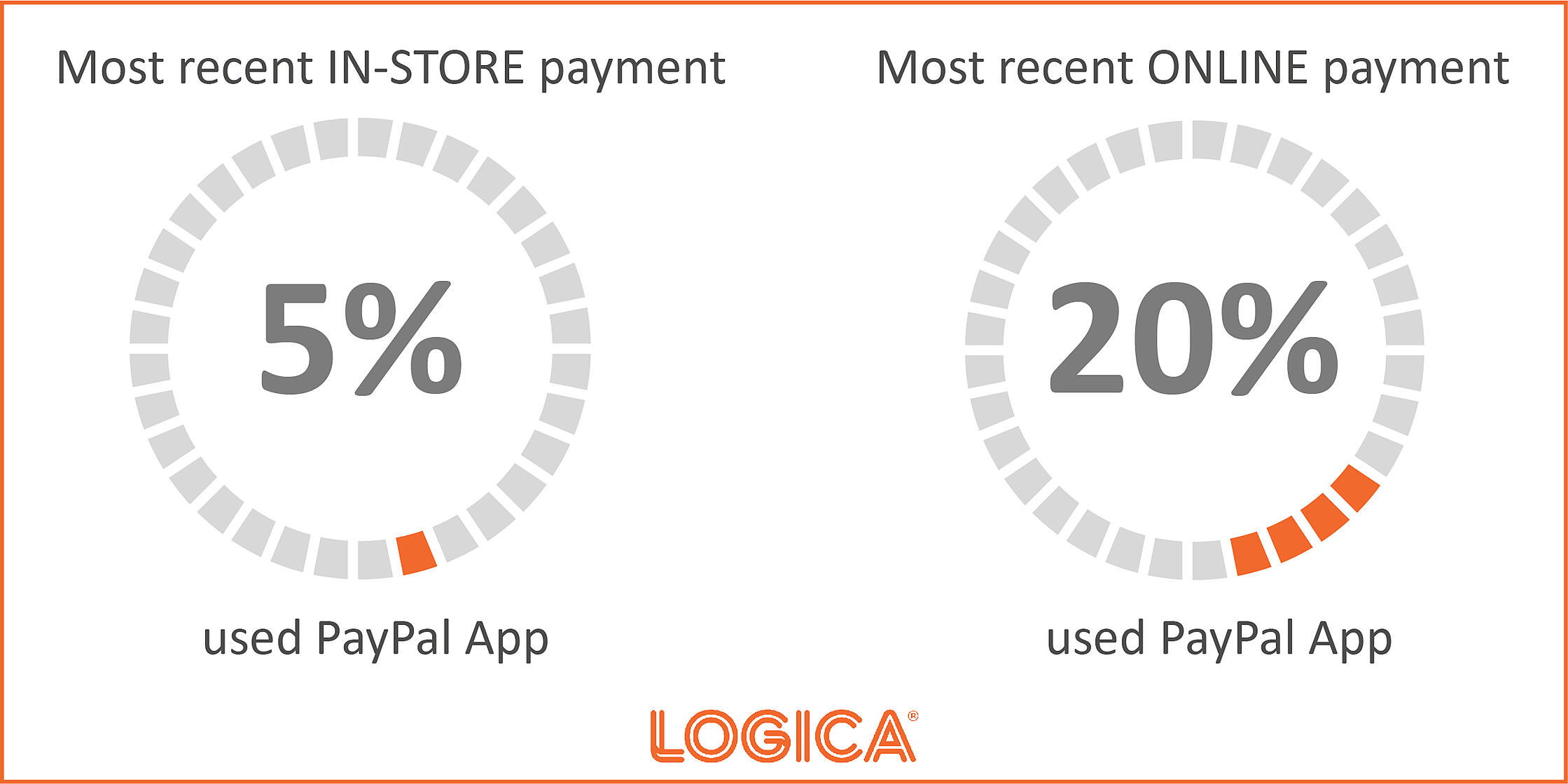

Even though cards are still most prevalent, Americans are definitely using digital payment apps with PayPal leading by a large margin—68% of Americans report using PayPal. Other digital payment apps have a long way to go to catch up with PayPal. 20% of Americans report using or having GooglePay or Venmo on their phone, whereas 19% use or have a bank’s digital wallet system or ApplePay, while 23% use a specific store’s digital app to pay.

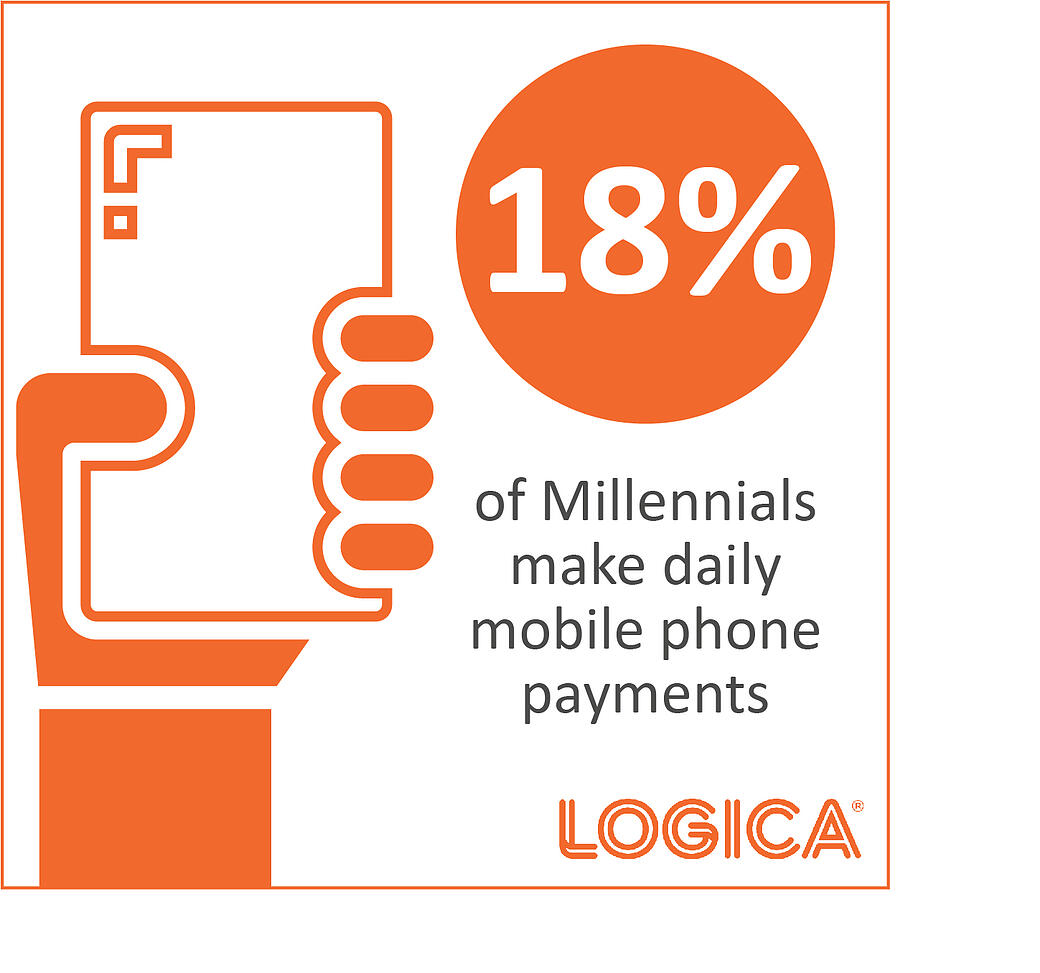

And payment choice may be influenced by generation. Eighteen percent (18%) of Millennials are likely to make daily mobile phone payments, which is no surprise as many Millennials own an average of six connected devices. When we look beyond the Millennial, 68% of Americans as a whole are making mobile phone payments at varying levels of frequency: daily (10%), weekly (24%) and monthly (23%).

In-person payments with debit cards (31%), credit cards (29%) and cash (25%) are most prevalent, with a long way to go for apps. 20% of online payments are made with the PayPal app, with other apps like Amazon Pay at 3% and Visa Checkout at 2%.

New, and constantly evolving, technologies are anticipated to have a large impact on the ways we pay in the future. With facial recognition and artificial intelligence making digital payment platforms more efficient, Americans expect technologies not even invented yet to rise in usage over the next five years. This means there is a good chance of the coming-of-age Gen Zers using ways to pay we aren’t even using yet.

With improvements and innovations in technology, Americans predict the way they pay will change over the next five years. In fact, 27% of Americans expect to pay in-person with apps 5 years from now, whereas only 6% currently use this method in-person.

Are you ready for the future of payments? Let us help you get the insights you need to improve your customers’ financial lives.

Related: Gen Z is the Newest Generation of Investors Leaning Toward Automated Investing Advice