It is no secret that men and women think differently. There is an entire industry dedicated to helping understand how these differences impact decision-making, relationships, and daily life. It is not surprising that men and women approach their financial lives and their investments differently as well. Understanding these differences can help many couples navigate conflicting attitudes towards their financial lives.

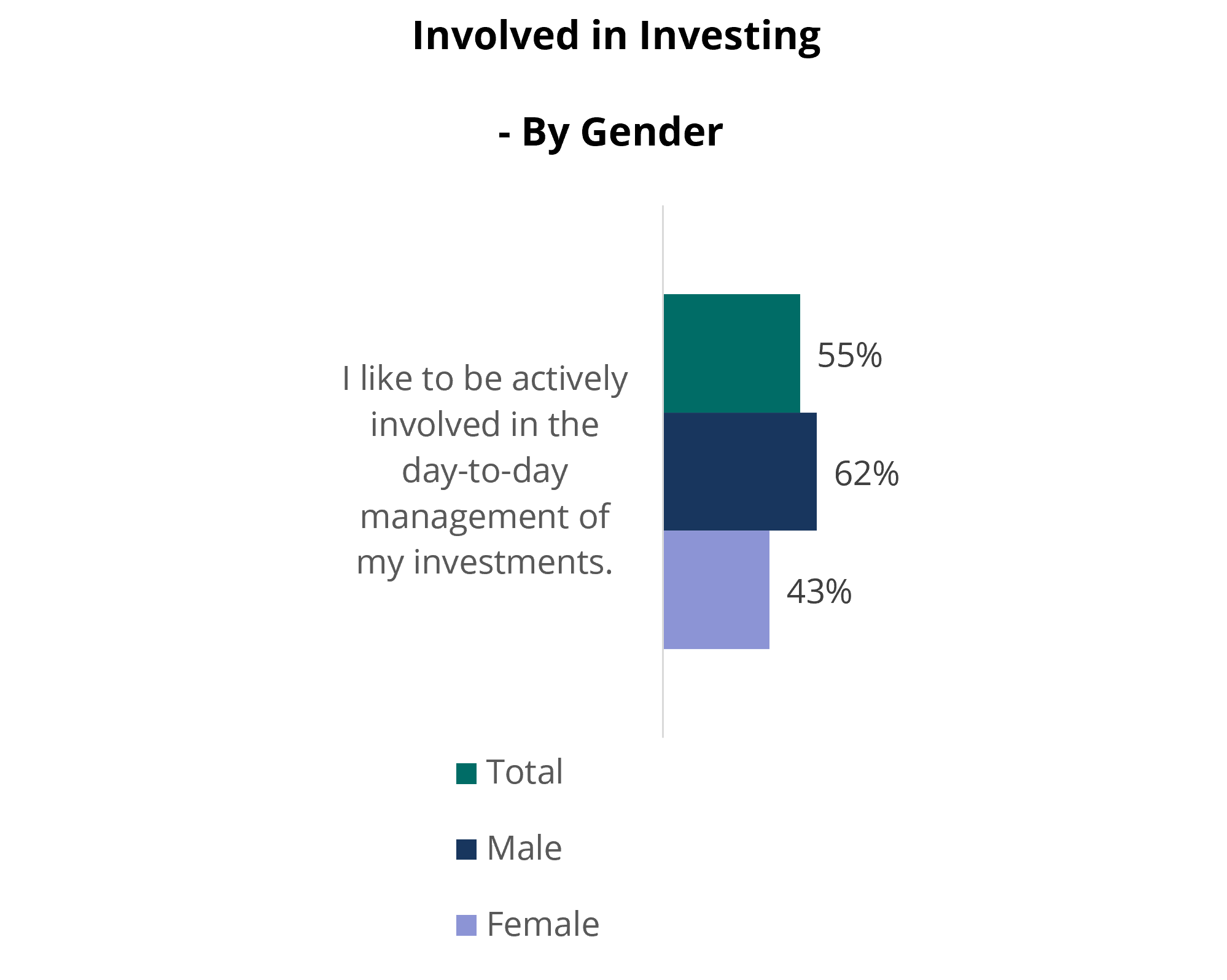

According to recent Spectrem Group research with investors who had between $100,000 and $25 million of net worth, the differences in investment preferences between men and women are noticeable. When asked about being actively involved in the day-to-day management of their investment’s men are far more likely to want to be involved, with 62 percent of men indicating they like being actively involved. This is in stark contrast to only 43 percent of women who enjoy being involved in the day-to-day management of their investments. This makes it less surprising that women are slightly more likely to utilize the services of a financial advisor than men, likely because women do not want to be managing their portfolio on their own.

Women are also slightly more conservative in their tolerance for investment risk, with over a quarter of women identifying themselves as conservative investors, compared to 16 percent of men who share that risk tolerance. Some of this conservative approach to investments could be due to the fact that women are not as confident in their investment knowledge as men. Thirty-eight percent of women consider themselves to be not very or not at all knowledgeable about financial topics, while only 17 percent of men feel similarly. This conservative approach is evident in the desire for investments that provide a guaranteed rate of return. Fifty-nine percent of women would prefer the majority of their investments have a guaranteed rate of return, compared to 46 percent of men who feel that way.

Another area of difference is where men and women think the markets will be at the end of 2022. When asked where they believe the DJIA will be at the end of 2022 the most common answer was between 34,000-37,999 for both men and women. However, over half of women indicate that they do not know where they think the DJIA will end up at the end of 2022, which is a significant difference from the 27 percent of men who do not know where they think the market will end 2022.

With women having a more conservative approach to their investments, it is important for couples to discuss risk tolerance and investment objectives to ensure that the risk tolerance of one person is not overshadowing the lack of risk tolerance for the other individual. Women also need to make their preferences known to their financial professional and not take a backseat to their spouse in discussions regarding financial topics. This will allow the opportunity for increased discussions and communications both between the advisor and client, as well as among the couple. Reconciling these differences does not have to be challenging, or something that creates conflict.

Related: Millionaire Real Estate Ownership