Despite the more than 50% increase in fuel prices in recent years, most wealthy households have not changed their fuel consumption practices. According to research recently conducted by Spectrem Group with investors with $100,000 to $25,000,000 of net worth, 84% of investors indicated that they have not changed their consumption of fuel despite rising prices.

While those with less wealth are more likely to acknowledge that they have cut back on shorter trips and errands than others, there are relatively small differences based upon wealth.

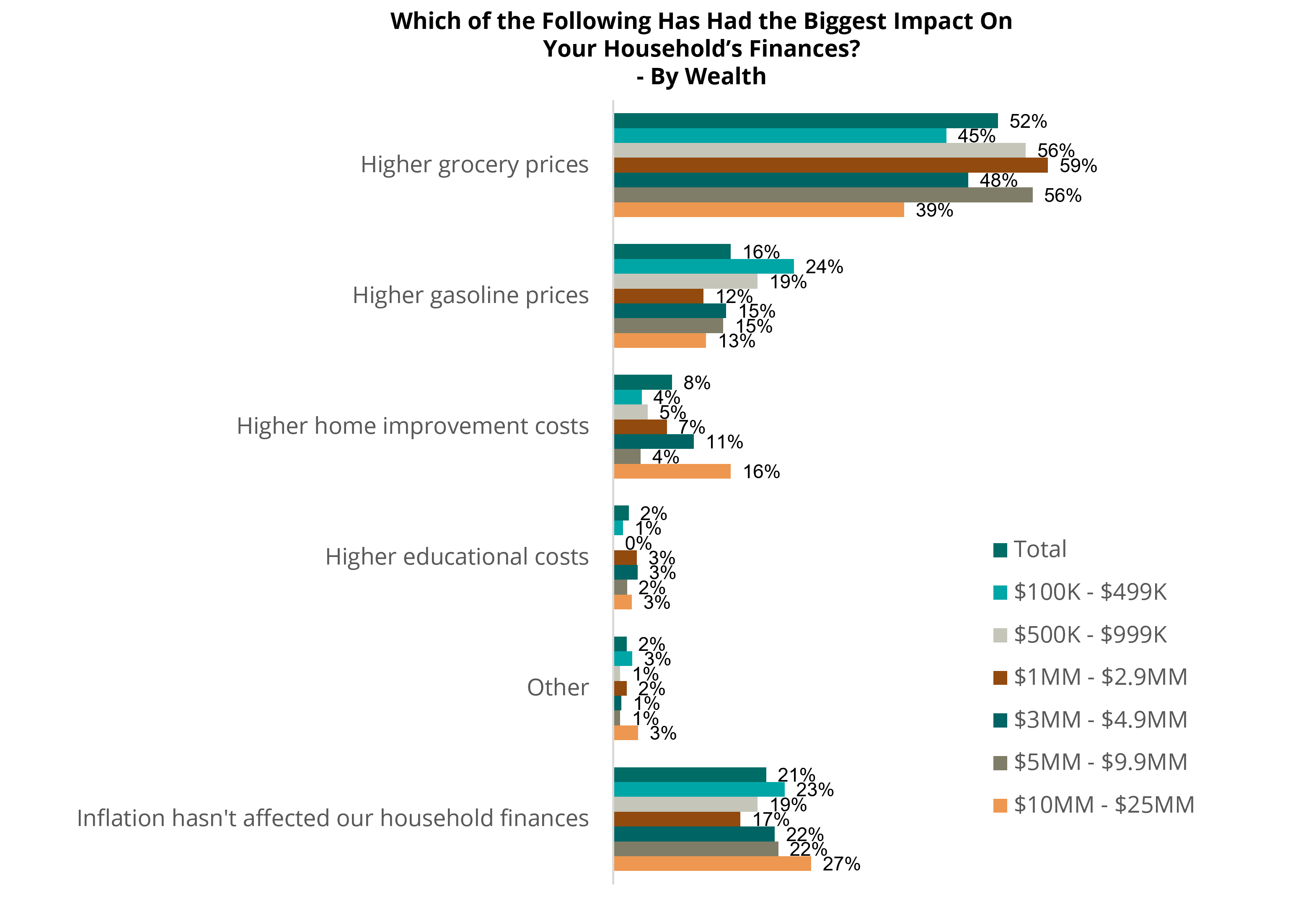

It’s interesting to note, however, that investors of all wealth levels have felt the impact of higher grocery prices with 52% of investors indicating that these prices have had an impact on their household finances with those in the $1-2.9 million category having the greatest concern (59%). The cost of groceries has had a greater impact than fuel costs for all of these households.

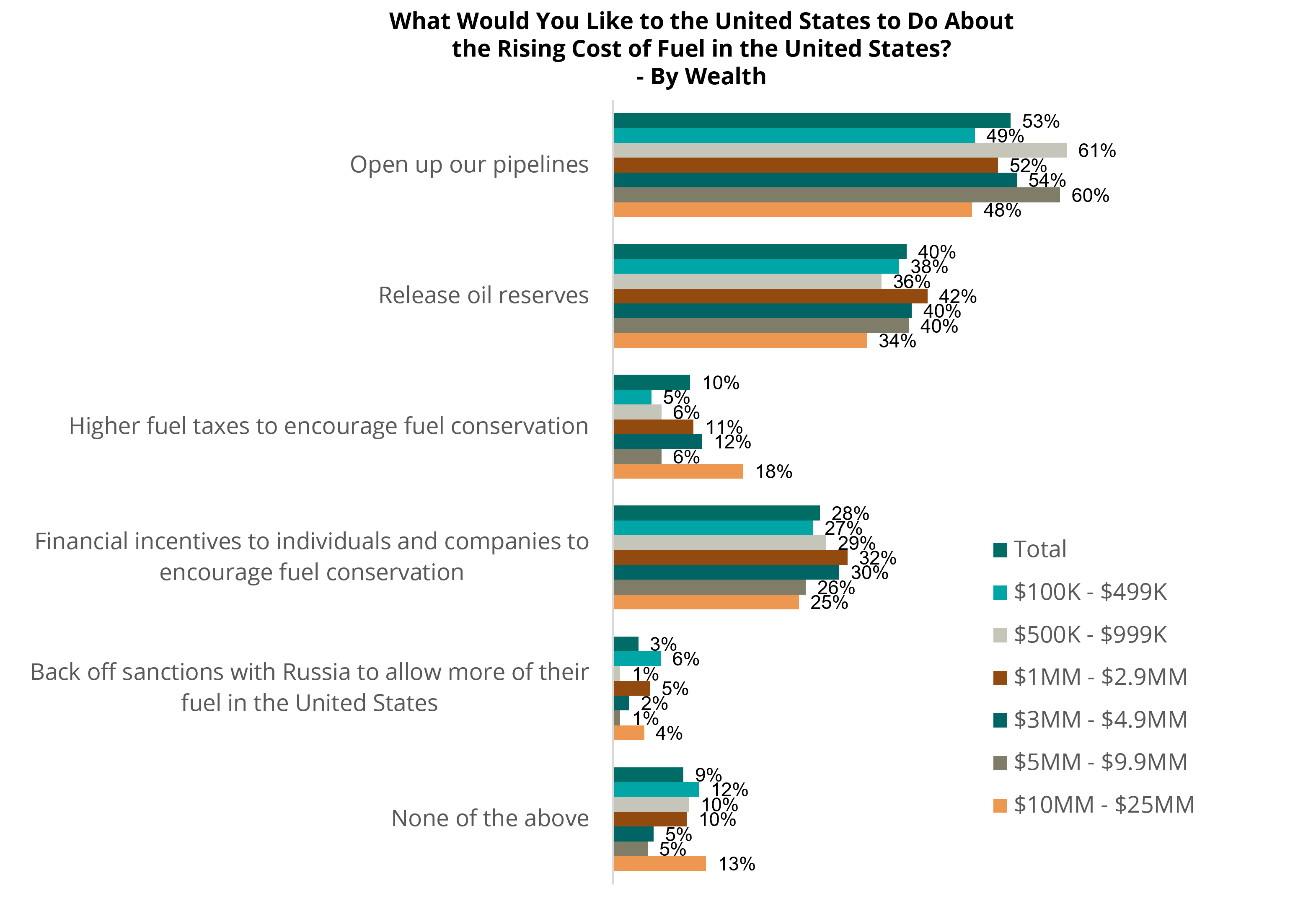

When asked what should happen to reduce rising fuel costs, 53% of investors felt that the government should open up the U.S. pipelines while 40% believe the government should release oil from strategic reserves. Twenty-eight percent believe in incentives to make people and corporations reduce fuel consumption while 10% support higher taxes. Only 3% want to back of the sanctions on Russia.

While wealthy investors may not personally feel the impact of rising fuel costs, the increase is actually impacting them via the increased cost of their groceries. Stay tuned to see if these attitudes change as the higher cost endure.

Related: Investors Don’t Really Understand Social/ESG Investing