Learning is a process that never stops. People are constantly learning throughout their lifetimes. How each person chooses to learn is as varied as the person itself. Some people love to learn through hearing an expert on a topic speak, while others learn through reading about things they would like to gain more information regarding. Other people also like to watch videos to gain information that they are looking for.

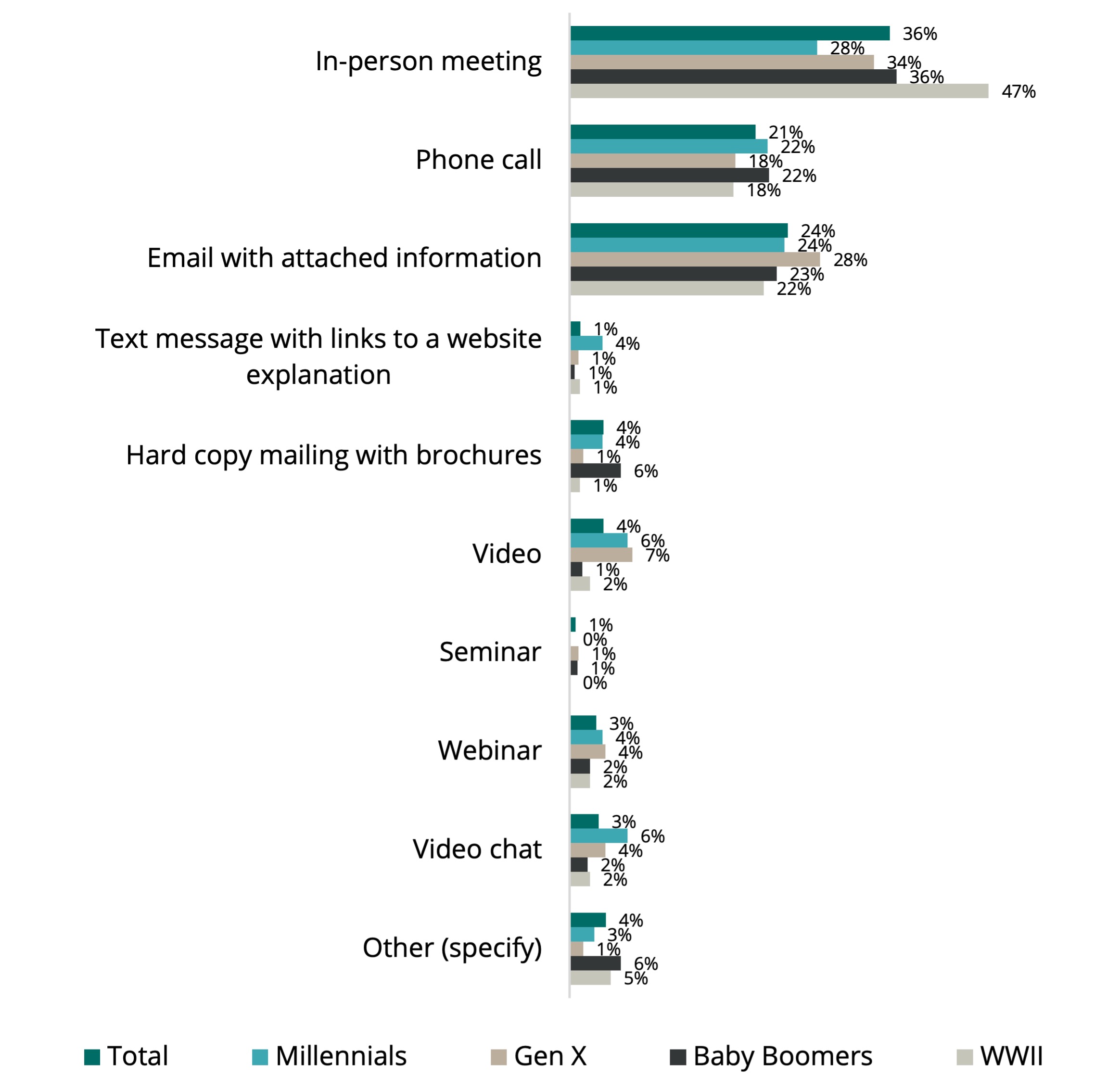

Regarding financial topics, investors prefer to be educated in a variety of ways, the most common of which is through an in-person meeting, according to recent research from Spectrem Group. Over a third of wealthy investors prefer to be educated on a new financial topic through an in-person meeting. Nearly a quarter of investors would like to be educated through receiving an email with information attached to it regarding the new product or service. Just over 20 percent of investors prefer phone calls to educate themselves regarding new financial information.

These preferences change with age and wealth levels. Younger investors are less likely to want to be educated on new financial topics through an in-person meeting, and more likely to look to videos and video chats or webinars. Older investors have a strong preference to meeting with a knowledgeable individual, such as a financial advisor, to be educated on a new financial product or topic.

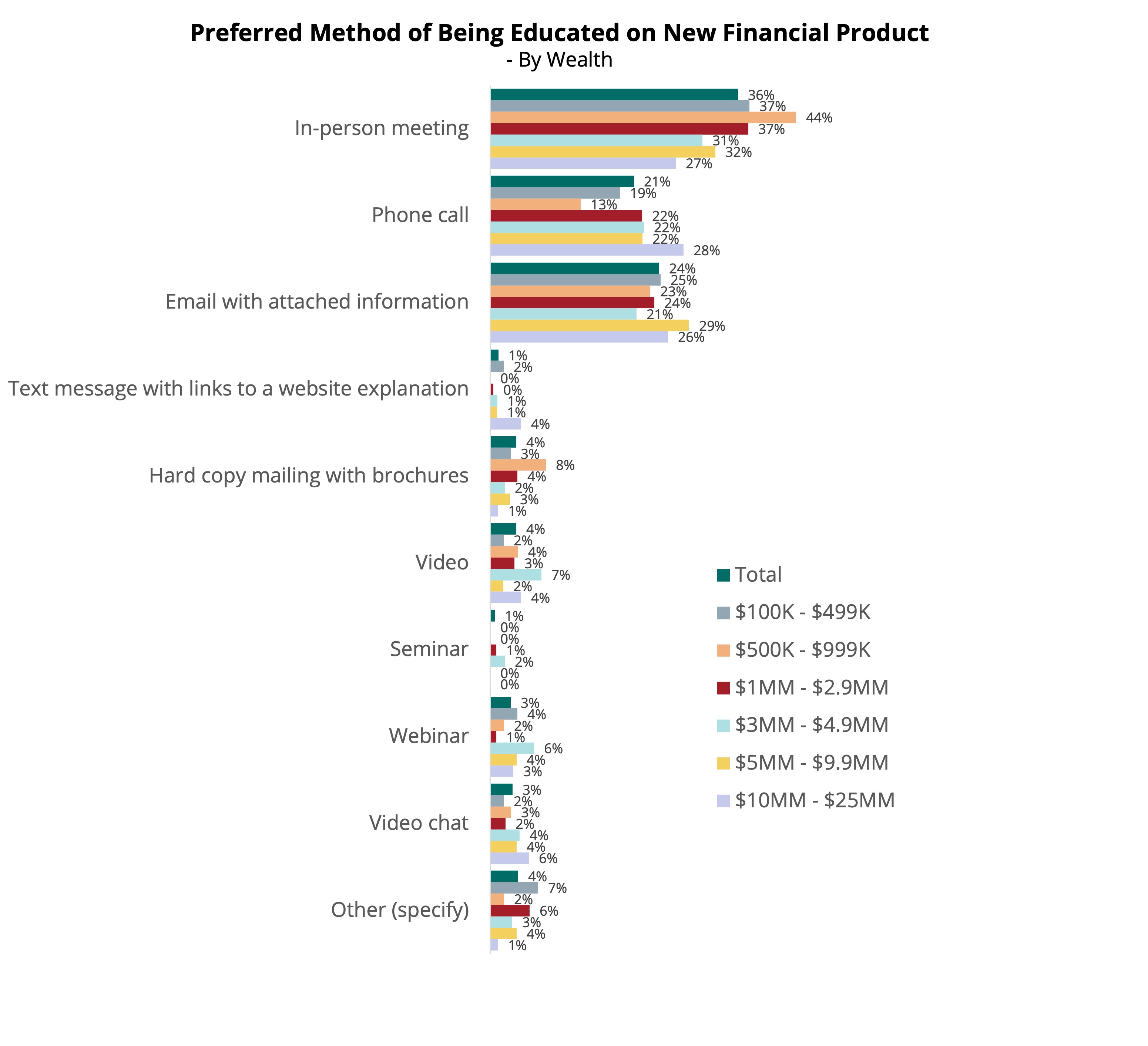

Wealth impacts how investors would like to be educated as well. Investors at lower levels of wealth would prefer to be educated on new financial products or services through in-person meetings. Investors with a net worth between $3-$4.9 million are far more likely to prefer to be educated through videos and webinars. Investors with a net worth of $10-$25 million are more likely to prefer a phone call or video chat as their preferred method of educating themselves on new products or services.

Regardless of how investors are choosing to educating themselves about new topics, they must continue to educate themselves regarding a variety of financial topics. This will allow them to stay aware of what is going on in the economy and stock market, and will allow for new knowledge pertaining to products and services that could provide them with additional benefits.

Related: Investors: What To Do With $100,000?